Cash is king as far as company balance sheets are concerned. Firms with comfortably low or no debt and with solid cash balances tend to pay healthy dividends to shareholders. But one constant observation made in such dividend-yielding companies is that they may not provide too much capital appreciation (share price increase) or are too large now to register high growth rates. This point may hold in some cases. However, there are many exceptions too.

Dividends add 1.3-1.4 percentage points to the returns of indices of all hues – large-cap, mid-cap, small-cap, and broader market benchmark.

Companies that offer a mix of healthy dividends with reasonable growth prospects are what the new SBI Dividend Yield Fund will look to invest in. The new fund offer (NFO) closes on March 6.

Here’s what you must know about the dividend yield theme before investing in the NFO.

Payout and growth

Traditionally, the view is that dividends are paid by large firms that have reached peak growth rates. But we have even smaller public sector companies offering high dividend yields. Again, there is a perception that there is limited growth in dividend yield stocks. But we see many companies, even in the IT sector, grow in double digits despite their already large revenue base.

Also, dividend-yielding companies are not necessarily value buys. A whole host of FMCG and MNC companies trade at huge valuation multiples but offer reasonably high dividend yields as well.

Dividend payment by itself doesn’t make a company investible, though it does usually give added comfort in terms of lower volatility. A dividend yield strategy generally does very well in correcting markets as the fall is cushioned. During rallies, it may not always be able to capture the upside as beaten-down cyclical and value stocks outperform in such times.

Also read: Budget 2023: Portal balm for reclaiming ‘unclaimed’ stocks, dividends

For example, during the period of the global financial crisis in 2008-09, the Nifty Dividend Opportunities TRI fell 2-5 percentage points less than the Nifty 50 TRI and Nifty 500 TRI. But surprisingly, the dividend index outperformed the other two benchmarks by 19-24 percentage points in the 2009-10 rally. In the 2013-15 rally, however, the dividend index trailed the other two by 9-14 percentage points. Again, in the March 2020 fall, the Nifty Dividend Opportunities TRI fell 6-7 percentage points less than the Nifty 50 TRI and Nifty 500 TRI, and also rallied 1-4 percentage points more in the subsequent rally.

Thus, it is not necessary for the dividend index to be a defensive bet alone. For instance, the long-term (2008-23) average price earning (PE) multiple for the Nifty Dividend Opportunities TRI is just 13.8 times, cheaper than the Nifty TRI or Nifty 500 TRI.

The NFO and how other dividend yield funds delivered

SBI Dividend Yield fund will not fall into the value, growth, or any specific style of investing. And bottom-up stock picks will eventually decide sector preference and not vice versa. In addition to dividend yield, the fund will look at the growth in dividends over a period of time to zero-in on stocks. Also, stock selection can be based on macroeconomic factors, asset allocation, ESG forensic, and quantitative and multi-factor models, among others.

The idea is to achieve aggregate dividend yield that is at least 50 per cent higher than that of the Nifty 50.

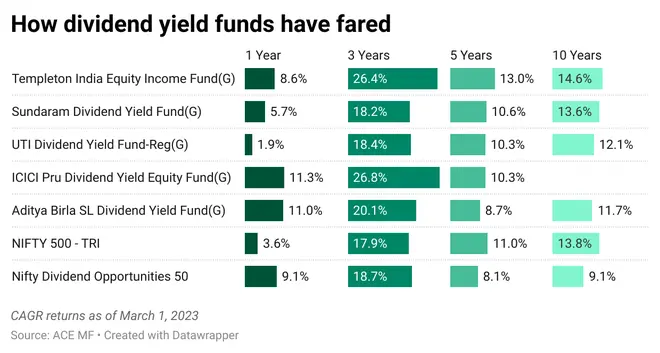

There are currently only eight dividend yield funds available. Only four have a 10-year track record, while five have been around for more than five years.t

Templeton India Equity Income, ICICI Pru Dividend Yield Equity, and Aditya Birla SL Dividend Yield have done well over the past one and three-year periods.

Also read: Birla MF raises ₹1,570 crore from multi-asset NFO

All dividend yield funds follow a multi-cap strategy. Data from ACE MF suggests that 25-45 per cent of their portfolio comprises mid and small-cap stocks.

Should you invest?

Returns from dividend yield funds over the years have been reasonable but not spectacular. By having slightly broader definitions and following an agnostic stock selection model, SBI Dividend Yield may be able to zero-in on potentially rewarding picks. However, will the offering differ significantly from what is available currently is a factor that remains to be seen. Investors with the ability to take risks can consider small SIPs in the fund as a diversifier if they already have a robust core portfolio of schemes. Others can wait for the fund to develop a track record before ploughing in money into the scheme.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.