The IPO of Aeroflex Industries, a flexible steel hose manufacturer, is open till August 24. It was subscribed 6.7 times on the first day. The IPO will raise fresh proceeds of ₹162 crore and OFS of ₹189 crore at the upper end of the price band of ₹102-₹108 per share. At that price, the company is valued at 46 times FY23 earnings, for a market capitalisation of ₹1,396 crore.

Long-term investors can wait for better entry points post listing, as the safety margin at the current valuation is minimal. The growth outlook without business expansion will be normal and all the positives seem to be factored in for now.

End markets

The company manufactures stainless steel corrugated flexible hoses that find industrial application in controlled flow of all forms, including air, liquid and solid. The hoses are used across steel production (22 per cent of FY23 revenues), oil & gas (19 per cent), fire sprinklers, metal and mining, and also in HVAC solutions. Exports accounted for 81 per cent of revenues in FY23, including from the US (28 per cent), the UAE (7 per cent), and the UK, Spain, Italy, Belgium and Brazil (3-4 per cent). The remaining 19 per cent was accounted for by the domestic market.

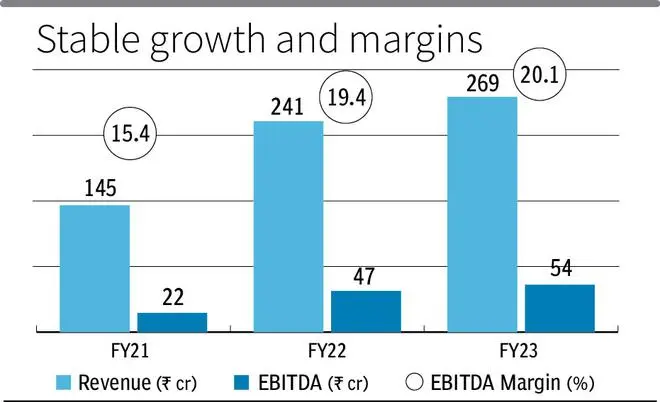

The company reported revenue/ earnings growth of 36/ 124 per cent CAGR in FY21-23. But this may be attributed to a low base in FY21, under the impact of the pandemic. The company reported 12/10 per cent growth in FY22-23, which indicates a normalised growth pattern for the company.

Exports and domestic operations

The export focus of the company can possibly weigh down revenue growth due to the expected high interest rate environment over the next two years for developed economies. With slowing economic growth in many countries that Aeroflex exports to, industrial activity could be dampened in end-user markets, impacting the company. This is a risk to watch out for.

The domestic markets may drive strong growth, albeit on a lower base. The strong pace of industrial activity, growth in city gas distribution, natural gas pipelines and increased demand from automobiles, residential and commercial HVAC solutions, should provide strong domestic demand in the next two years. The RHP document also mentions flexible hose applications in new-age energy storage solutions, including solar power and lithium ion batteries, thereby, finding a place in EV automobiles, as well. But as the end market in new age solutions is yet to take off, potential growth can only be a longer term opportunity.

Financials and valuation

The company reported revenues of ₹270 crore in FY23, with an EBITDA margin of 20 per cent and a PAT margin of 11.2 per cent (similar margins in FY22 as well). The company has a comfortable leverage profile, with net debt to EBITDA of 0.77 times in FY23. The company intends to use the IPO proceeds for clearing debt (₹32 crores), improving working capital investments (₹84 crore) and inorganic expansion with the remaining ₹46 crore. The IPO proceeds have not been earmarked for capital expansion, even as the company operates at 80 per cent capacity utilisation as of FY23, from its only plant in Taloja, Maharashtra.

While clearing debt will reduce the interest expense, it does not add significantly to earnings. Assuming no interest expense in FY23, the PE valuation improves to around 42 times FY23 earnings, which is still expensive, instead of the current 46 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.