In Calendar 2023, the BSE Capital Goods index gained nearly 66 per cent beating the broad benchmark Sensex by more than 40 per cent with stocks such as Suzlon, RVNL and BHEL among the top performers. Last year, this was the best performing sectoral index after BSE Auto.

The stock performance in this segment was driven by factors such as increased government capex, moderating raw material prices and robust order inflows. Will the rally sustain in 2024, is the question on investors’ minds.

While the increased government spending in areas such as power transmission, clean energy, railways, and defence indigenisation has revived the capex cycle, private capex is yet to pick up. With the general elections round the corner, we might see a moderation in inflows and revenue growth till the first quarter of FY25, per a Motilal Oswal report. In such a case, it becomes imminent for private capex to chip in to sustain the rally for the sector.

Private capex

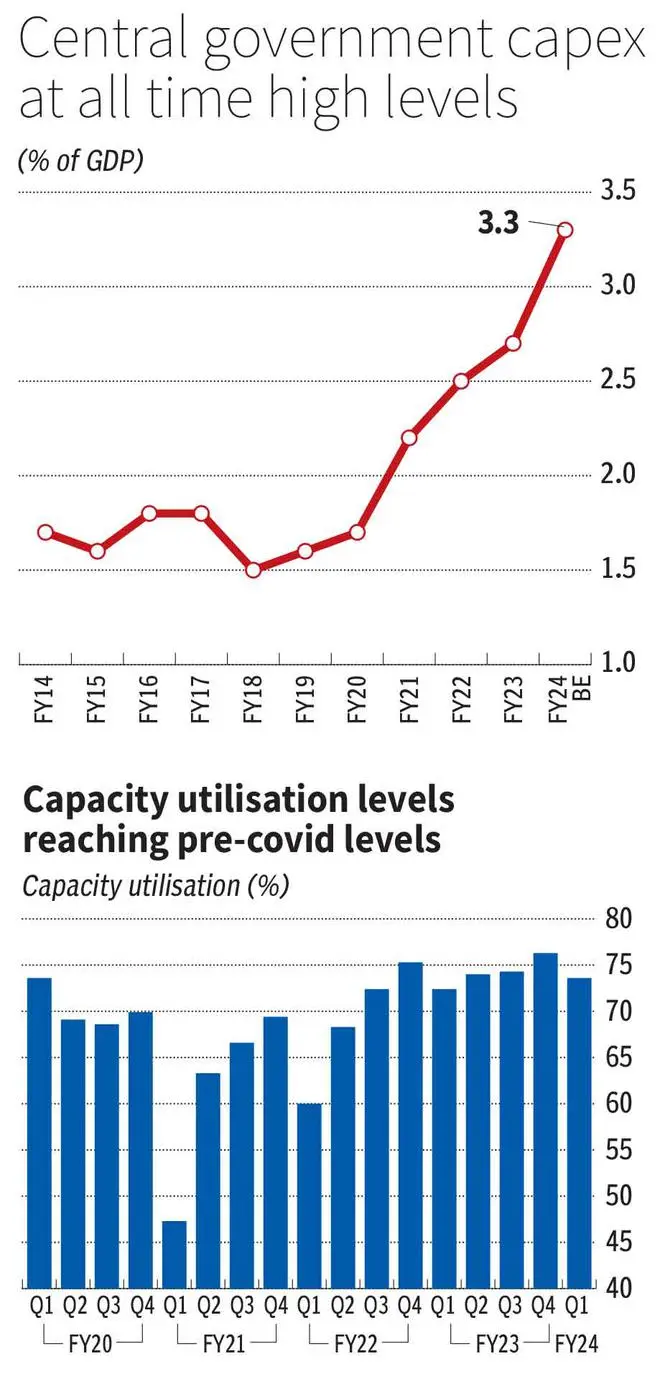

Contrary to the capex cycles of 2003-07 and 2011-19, the current one is driven by the government. While the capital expenditure by the Centre, as a percentage of GDP, was seen ranging at 1.5-1.8 per cent during 2011-19, the same has been 2.2-3.3 per cent in the post-Covid period. Further, the government capex remained strong in the first half of FY24 with the Centre’s capex growing nearly 29 per cent YoY reaching ₹4,90,628 crore.

While the government has been doing the heavy lifting with an expectation of its capex acting as a catalyst for investments by the private sector, per Careedge Foresights Report (November 2023), while there has been a recovery in private capex, it is yet to accelerate.

Post-Covid, capex by private non-financial corporations has just been able to match the capex of pre-Covid levels at around ₹8.6-lakh crore in FY23 (based on Careedge analysis of 1299 non-financial companies). Investments are also are happening in select sectors such as power, steel, cement and renewables.

Valuations up

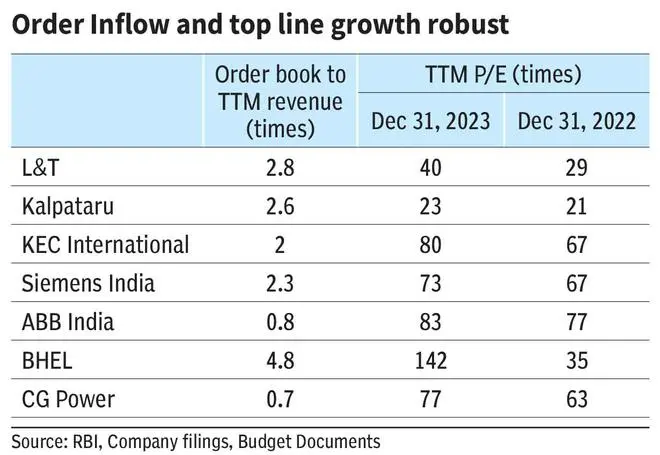

Riding on the pick-up in government capex, the BSE Capital Goods index has seen a re-rating during 2021-23 with the P/E moving up from 33 times to 53 times. Product-based companies such as Siemens, ABB India and CG Power, for instance, reported YoY growth in order inflows of around 9 per cent, 12 per cent and 34 per cent, respectively, during H1FY24. The revenue growth for the companies remained robust at 17-20 per cent backed by strong execution across segments such as T&D and railways. But valuations have moved up for these companies, too (see table).

Thus, tailwinds such as strong order flows, robust revenue growth and revival of capex cycle appear to have already factored in the valuation of the stocks in capital goods space. Now, what remains to be monitored for the rally to sustain is the momentum in order flows in the pre-election period and the private capex.

There is hope for a more broad-based spending. Per RBI’s Order Books, Inventories and Capacity Utilisation Survey, the capacity utilisation in the manufacturing space has gone back to pre-pandemic levels starting from Q4FY22. During Q4FY22-Q1FY24, the capacity utilisation has been around 75 per cent, similar to the level seen in Q1FY20, after bottoming out at 47 per cent in Q1FY21.

Further, compared to previous capex cycles, corporate balance-sheets have deleveraged. Thus, lower leverage and higher capacity utilisation can help accelerate private capex in the upcoming quarters.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.