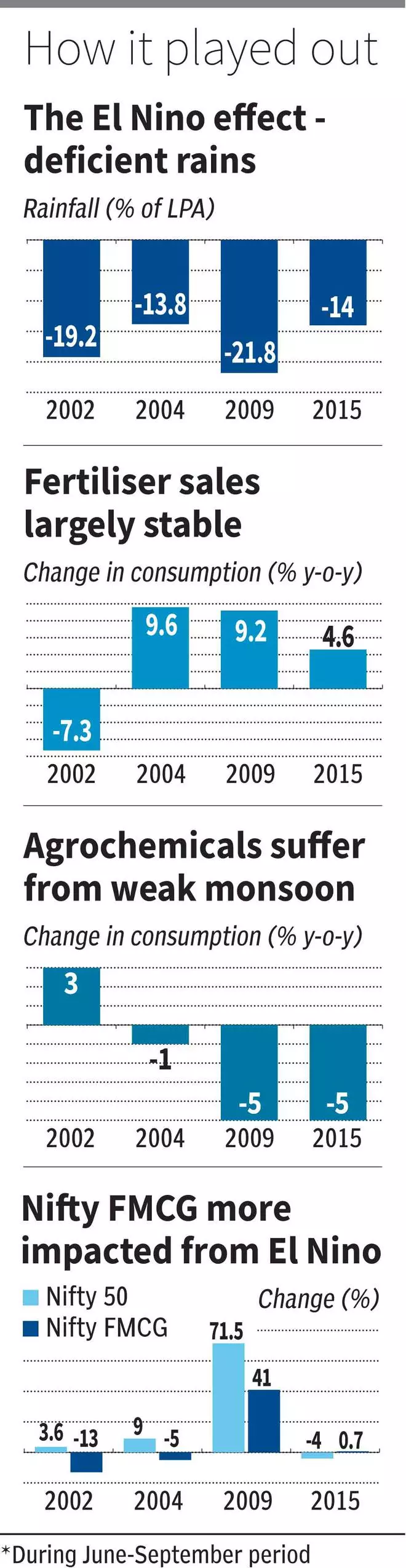

One Spanish word that has sent shivers down the spine of equity investors is El Nino and it is here to haunt them this year. In India, El Nino condition closer to the Southwest monsoon has typically resulted in widespread rainfall deficiency. Of the six El Nino periods since 2000 — 2002-03, 2004-05, 2006-07, 2009-10, 2014-16, and 201819 — the rainfall deficiency during the monsoon ranged between 9 and 22 per cent of the long period average (LPA). Of these, 2009 was a disaster year, as the Southwest monsoon rainfall was 21.8 per cent below the LPA; 2006 was an exception, with near-normal rainfall.

However, while El Nino certainly affects the country’s agricultural and economic prospects, the broad market performance, measured by the Nifty 50 Index, seems less impacted. Except for calendar 2015, when the Nifty 50 Index shed about 4 per cent, the benchmark delivered positive returns during the earlier El Nino years of 2002 (3.6 per cent), 2004 (nine per cent) and 2009 (71 per cent). In 2009, the recovery from the global financial crisis too aided the sharp rise.

But is El Nino a nonevent for India Inc? Not really. There are sectors that bear the brunt of deficient monsoon.

Sectors impacted

While one would intuitively consider all agri and related sectors, covering inputs and processing, to be the first casualty of El Nino, it is not always so, going by historical data compiled by the World Bank. For instance, fertilizer consumption was not impacted in three out of four times when India had deficient monsoon rainfall (see chart).

This is because fertilizer purchases happen ahead of the monsoon onset and hence sales may remain strong. Interestingly, there was no material impact on consumption in the following year, too. The reason for this is twofold.

First, fertilizers being the growth stimulant, basal application is critical and needs to be done even after a bad monsoon year, to maintain productivity.

Second, the subsidy on fertilizer helps buying decision — though this has changed for phosphatic fertilizers post the partial decontrol in 2010, urea continues to remain under price control and has not seen significant increase in the selling price. Agrochemicals sales, within the agri inputs pack, are highly correlated with the monsoon and are more susceptible to a decrease in farm incomes due to insufficient rainfall (see chart).

This is because preventive sprays are typically purchased before the monsoon, whereas a significant amount of purchases occur when there is a pest outbreak.

FMCG, auto sectors

Apart from agri inputs, consumption segments also see an impact due to below normal rainfall and consequent reduction in farm incomes, sometimes with a lag effect too.

For instance, Hindustan Unilever’s revenue and operating profit declined year-on-year (y-o-y) in 2010 by 13 per cent and 8 per cent, respectively, the year following El Nino in 2009, and a flat revenue growth and 4 per cent operating profit decline in 2016. The El Nino impact is also evident from the performance of the Nifty FMCG Index, which declined in 2002 and 2004 by 13 per cent and 5 per cent, respectively.

In 2015, the Index just managed to keep its head above water, gaining just 0.7 per cent. 2009 though, was an aberration with a 41 per cent gain, thanks to the recovery after the global meltdown in 2008. Besides, an increase in MSPs to support farmers during drought coupled with lower production also hurt the profitability of companies in the FMCG space due to high input costs. Auto is another sector that has faced some impact due to a deficient monsoon, particularly, those companies that derive significant revenues from the rural market or have a presence in tractors.

For instance, Mahindra & Mahindra’s farm equipment segment revenue and operating profits declined by 4 per cent and 20 per cent y-o-y, respectively, in FY15.

Sectors that gain

But some sectors also benefit from El Nino and below normal monsoon rainfall. Cement and construction material companies typically see lower sales during monsoon as construction activity is halted during rains. Absence or reduction in rainfall supports construction and thus is a positive for companies in this space. This is also evident from higher growth in cement dispatches during El Nino years. For instance, cement consumption grew 10.7 per cent y-o-y in 2009, versus 9.4 per cent in 2008.

Mining is also another beneficiary of below normal rainfall. While the overall impact of El Nino on stocks and markets is one side of the story, the impact on food inflation arising from reduction in agri produce and lower consumption due to a fall in rural incomes is another. The latter can have a snowballing effect on the overall economic growth.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.