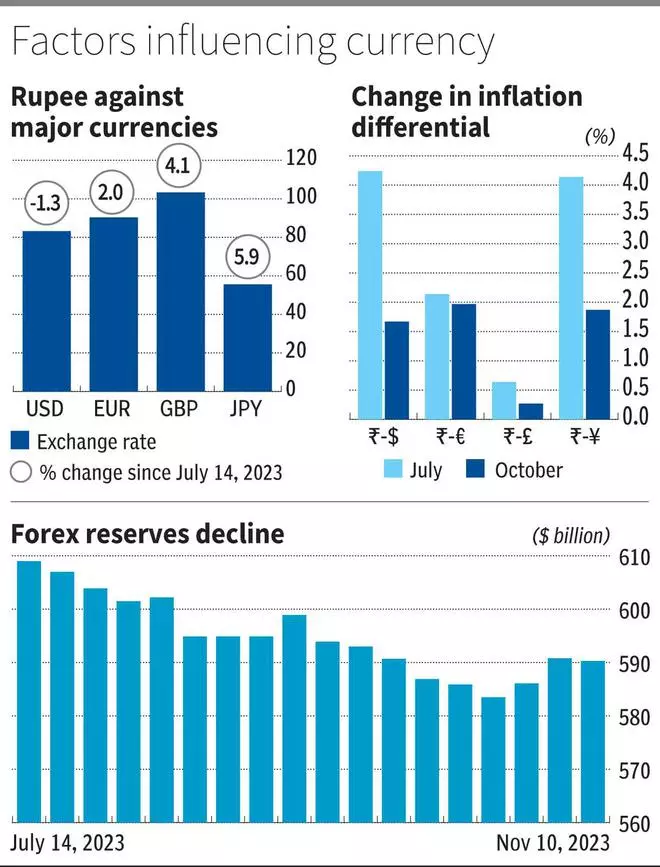

The rupee (INR) has appreciated against major currencies such as the euro (EUR), the pound (GBP) and the yen (JPY) in the recent months (see chart) and has held stable against the dollar. Possible RBI intervention, FPI inflows and a narrowing of the inflation differential have all played a role.

Dollar rally

Halfway through July, the dollar began its latest leg of uptrend. “The Fed’s FOMC continued to maintain a restrictive policy stance on the back of persistent ‘above-the-target’ inflation numbers and strong labour market. Fed speakers remained hawkish in terms of their rates trajectory and were not eyeing any rate cut soon. Risk off sentiments and haven demand due to the crisis in the Middle East, which started in October, also helped the dollar surge,” reasons Kunal Sodhani, Vice-President, Global Trading Center, Shinhan Bank.

The dollar index (a measure of the value of dollar against a basket of six currencies – the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc) is up 4 per cent since mid-July. Resultantly, the currencies of most big economies depreciated against the dollar. Weakening of other major currencies and the rupee simultaneously staying flat led to the Indian unit appreciating against the EUR, the GBP and the JPY.

The primary reason for this seems to be the Reserve Bank of India involvement in the currency market.

RBI action, fund flows

Experts believe that an active RBI has managed to keep the Indian currency stable against the dollar so far. “The RBI has been selling dollars to keep the rupee stable. It has defended 83.30 well so far. The RBI has been capping the upside, too, by buying dollars when the rupee appreciated, essentially keeping the rupee in the 83-83.30 range” says Anindya Banerjee, Kotak Securities’ Vice-President of research in currency and interest rates.

Supporting this argument is the drop in the forex (FX) reserves. According to RBI data, FX reserves shrank from $609 billion on July 14 to $590.3 billion on November 10, down nearly $19 billion. The drop could be an indication that the RBI provided a buffer by selling dollars and buying rupee whenever the latter faced downside pressure. “If not for the intervention by the RBI, the rupee could have depreciated to 85 versus the dollar by now,” adds Banerjee.

Another supporting factor is the foreign inflows. According to NSDL (National Securities Depository Limited) data, the net inflows since July totals $6.1 billion, much of it going to the equity market. Besides, a drop in the inflation differential between India and the major economies also helped the rupee stay afloat (see charts).

The Road ahead

Despite events such as the Israel-Hamas war and equity market sell-offs in September and October, the rupee has remained stable. Even if it appreciates, the RBI may act to keep the rupee within a specific range.

“The rupee is likely to remain flat going ahead. I expect the rupee to remain within 82.50 and 84 until the end of this financial year,” predicts Kotak Securities’ Banerjee.

Shinhan Bank’s Sodhani sees the USD-INR pair remaining in the 82.70-83.80 range in the medium term. Similarly, against other majors such as the EUR, the GBP and the JPY, he expects the rupee to remain in the 89.20-91.80, 102.25-104.40 and 54.60-56.65 range, respectively.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.