In a significant milestone for the burgeoning Indian stocks, India is now host to over 500 companies with billion-dollar market capitalisation, reflecting the transformation of a market from its humble beginnings under a banyan tree to the fourth-largest position globally, now.

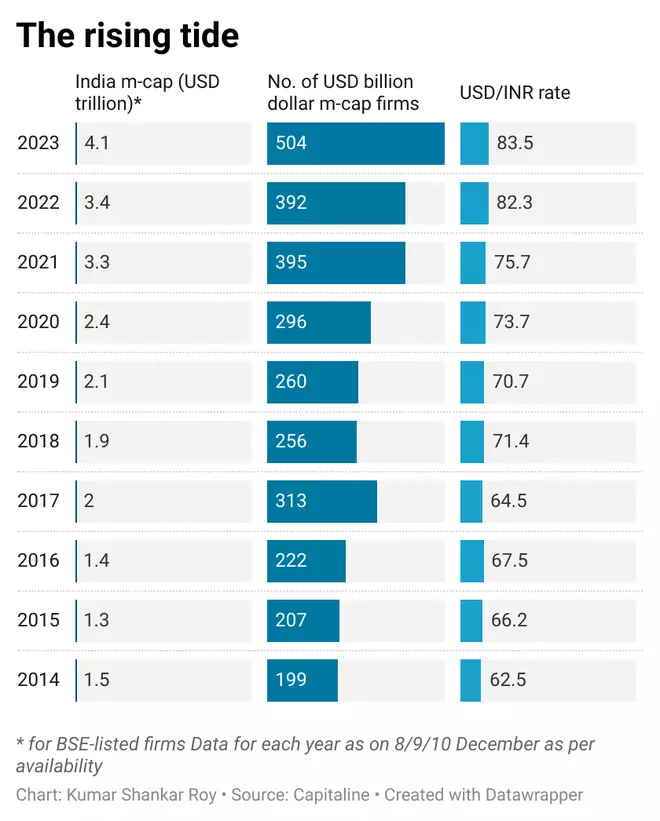

In just a year, the number of billion-dollar listed firms on the BSE has surged from 392 to 504, an impressive increase of 112. This marks the most substantial rise in the last decade.

Over the past ten years, the billion-dollar firm club has expanded 2.5 times in sync with the stock market’s wealth ascent.

Already, 2023 has been marked by milestones for Indian markets and the economy, with the market now ranked fourth in the world, boasting an equity market capitalisation exceeding $4 trillion. This positions it behind the US, China (including Hong Kong), and Japan.

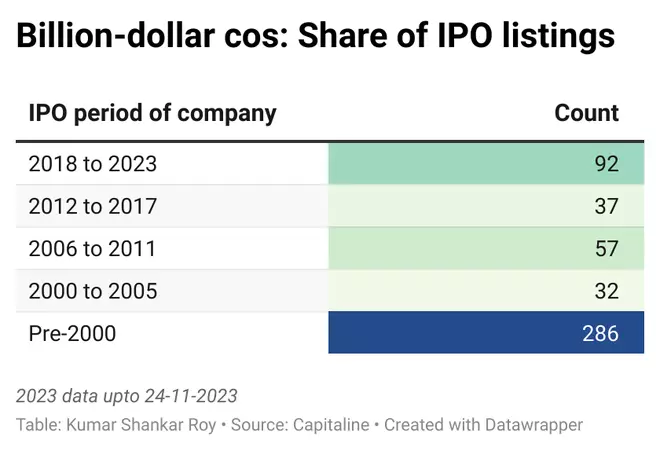

Topping the 500-mark for this thriving ecosystem of billion-dollar companies in India is an accomplishment driven by factors such as the robust equity rally during the Narendra Modi government’s tenure, high-value IPO listings, and increased wealth gains for mid- and small-cap stocks.

Deciphering drivers

The resounding long-term rally in Indian stocks, which commenced in late 2013, has played a crucial role in boosting the billion-dollar club from the usual RIL, TCS, HDFC Bank, etc., to the likes of Caplin Point, India Cements, KRBL, VIP Industries, ION Exchange, JK Tyres, and MedPlus. Starting just below 200 in December 2014, the count progressed to over 300 by December 2017 as markets rose by over 50 per cent during this period.

However, the correction in 2018 saw the billion-dollar club shrink to 256 in December 2018. The number remained almost stagnant at less than 400 for two successive years — 2021 and 2022 — but the rebound in domestic equities from late March 2023 helped the tally eventually cross the psychologically important 500-mark (see chart). Another contributing factor to the expansion of the billion-dollar company circle is the rising number of IPO listings, with many of them being high-value on the back of supportive policies and a vibrant entrepreneurial ecosystem.

Of the 180 companies that have listed in the last five years, over 90 such as Tata Tech., JSW Infra, Mankind Pharma, LIC, Latent View, Zomato, and CAMS, currently hold billion-dollar market capitalisation status.

The new listings account for nearly 20 per cent share of the overall 504-strong club. Private sector business groups (excluding the top ones) account for 36 per cent of the billion-dollar club today, compared to 17 per cent in 2014. Rising wealth gains for mid- and small-cap stocks have played a role in growing the billion-dollar fraternity.

Mid- & small-cap gains

For instance, in the last 12 months, BSE Largecap index market capitalisation has risen by around 12 per cent, but the same is much higher at 28 per cent for BSE Mid-cap and 37 per cent for BSE Small-cap. This trend extends over longer periods, such as 5 and 10 years, too.

Along the way, the billion-dollar club faced market corrections, but the most significant hurdle would possibly be the depreciating rupee. From around ₹62 to the dollar in 2014 to over ₹83 currently in 2023, the currency impact on the billion-dollar club is unmistakable. Hypothetically, if the US dollar was at 2014 levels today, the club would be much bigger, close to 600 today.

While the 504 billion-dollar companies in India come from numerous sectors, most of the elite members are predominantly from Finance (47), Capital Goods (33), IT and Pharma (30 each), Banks (29), Auto and Auto Ancillaries (25), Chemicals (23), Steel (16), FMCG (15), etc.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.