Indian equities finally managed to reverse their three-month-long losing streak, with bellwether Nifty50 breaking 18,000 levels for the second time this year. Its attempt to scale beyond 18000 levels since October 2021, when it scaled this milestone the first time, did not meet much success except for the second half of 2022. Since the beginning of 2023, the index has been on a slippery path.

While the rally’s sustainability remains to be seen, the Nifty 50 has recovered by over 7 per cent from its March 2023 low level of 16,950. Interestingly every time the market has tried to move past 18,000 levels, it has been quite a struggle for the market, given the global recessionary concerns, inflation worries, rate hikes and other adverse geopolitical developments.

But what has changed between October 2021, when Nifty first breached 18,000? Which stocks have aided the rally this time and then?

The October 2021 rally was largely led by banking stocks such as HDFC Bank, HDFC, ICICI Bank and Reliance Industries, ruling at new highs then. Banking stocks got a boost from the hopes of economic recovery and credit growth improvement, post easing of covid related curbs.

Stocks such as ITC and auto majors such as Maruti failed to participate in the 2021 rally, thanks to the post covid impact and high raw material prices as food and other industrial commodity prices hit the roof in 2021-22.

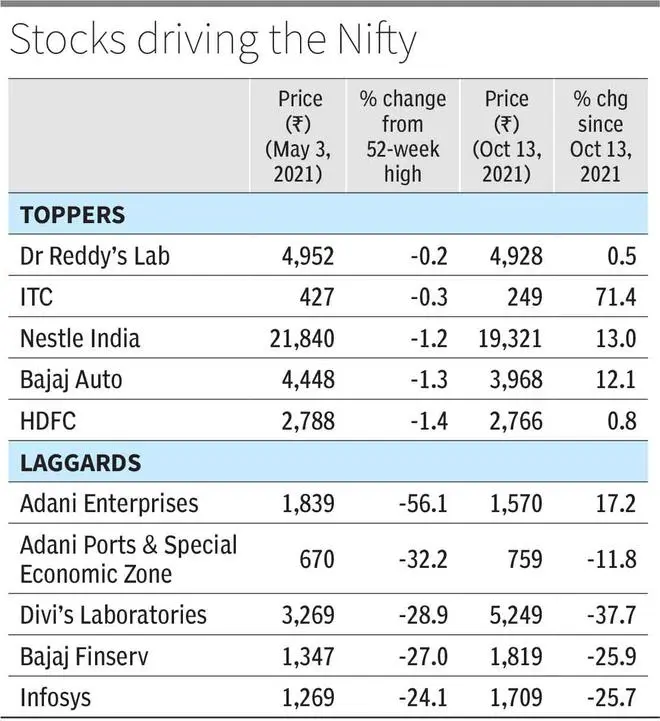

Interestingly, the Nifty’s journey this time has been driven by the stocks that did not participate in the 2021 rally. To understand the contributors to this rally, we have considered the prices of Nifty stocks now (as of 3May 2023), their 52-week high price and price as on 13 October 2021.

Our analysis reveals that of the 50 stocks that are part of the Nifty 50, 17 stocks, constituting about a third of the index, are trading close to their 52-week high price, with the deviation being under 5 per cent. Topping the list is the stock of drug maker Dr Reddy’s Laboratories and ITC Limited. Other stocks include Nestle India, Bajaj Auto, HDFC twins, and Tata Motors. PSU stocks have contributed to the rally this time, including ONGC, Bharat Petroleum Corporation, Power Grid Corporation and NTPC. In terms of themes that have led the rally this time, it is FMCG, Oil and Gas, PSU stocks and in other sectors such as pharmaceuticals and banking, it is specific stocks that have aided the rally, instead of a broad-based rally, covering all stocks in the sector. For instance, While Dr Reddy’s is trading close to its 52-week high price, Cipla is about 22 per cent off its one-year high price. Likewise, in banking while ICICI Bank and HDFC Bank have done well, Axis Bank is about 11 per cent off its year high. IT, a significant contributor to the Nifty rally in October 2021, has been a laggard this time. Infosys and Wipro are trading at a steep 24 per cent discount to their one-year high price, while TCS has managed to contain the downside relatively well trading 11 per cent lower than its 52-week high levels.

Adani Enterprise is at the bottom, trading 56 per cent below its year-high price. Others include Adani Ports (32 per cent lower), Divi’s Laboratories (29 per cent), Bajaj Finserv (27 per cent) and Infosys (24 per cent).

Rally not broad-based

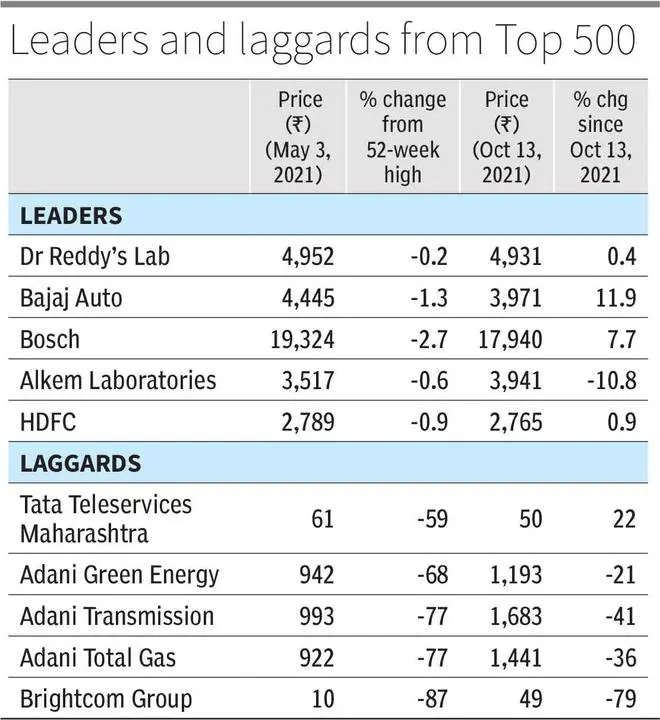

While Nifty is the key index the country tracks, what is the broad market trend? To understand this better, we have analysed the data of the top 500 listed stocks.

Of the top 500 stocks, about 88 of them are trading about 5 per cent off their year highs. Dr Reddy’s Laboratories, Bajaj Auto and Bosch Limited are topping this list. Others in the top 10 stocks close to their 52-week highs include, Alkem Laboratories, HDFC Ltd, Oracle Financial Services, ITC, and Power Finance Corporation. Besides PSUs, several oil and gas companies, including city gas distributors such as Indraprastha Gas, are featured in the list, with the current price close to about 5 per cent off its peak. Besides large banks, small finance banks – AU Small Finance Bank also features in the list. While large IT has underperformed market, mid and small IT companies have still managed to do well and buck the weakness, with several of them still trading close to their year highs, including names such as KPIT Technologies, Cyient Ltd and Sonata Software.

About 72 stocks are trading 5-10 per cent lower than their year-high prices, while 133 stocks are trading 10-20 per cent lower than their 52-week high prices. About 208 stocks are trading at a 20-88 per cent discount to their 52-week highs.

Among those trading off their year highs, top on the list is Brightcom Group (88 per cent), Adani Total Gas (76 per cent), Adani Transmission (76 per cent), Adani Green (67 per cent), Tata Tele services (59 per cent) and Gland Pharma (58 per cent) among others. About 13 stocks are trading at over half their October 2021 prices.

Of the 500 stocks, 17 stocks were listed after October 2021. Out of the balance 483 stocks, 213 stocks are trading at prices higher than the October 2021 levels; of these, about 19 stocks have doubled since October 2021. Stocks that have delivered the most since October 2021 include RVNL, Lloyds Metals, Raymond, and several defence stocks such as Mazagon Dock, Bharat Dynamics, and Hindustan Aeronautics. About 20 stocks are trading at half the prices seen in October 2021. About 270 stocks are trading at levels below the October 2021 levels. This points to the fact that the market rally is not broad-based but driven by select themes such as PSU, Oil and gas and FMCG.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.