The US Federal Reserve has maintained a hawkish stance on interest rates even as it paused on hikes in its recent policy announcement. Consumer inflation rose a wee bit in the US. As crude prices rise to $93 a barrel levels due to production cuts, there are fears that it may end up pushing inflation higher even for India, even as food prices settle down. Domestically, while the 10-year and 5-year yields are relatively stable and range-bound, short-term yields (182-day and 364-day treasury securities) have risen beyond 7.05 per cent levels. A slowing global economy is hurting exports and current account deficit could rise in the months ahead.

Interest rates are thus expected to remain at present levels for the foreseeable future. Any cuts are seen only in the middle of the next calendar year. At peak or near-peak levels, it may be a good idea to lock into quality fixed-income instruments that offer attractive coupons and yields.

Such being the case, fixed income instruments, especially those that offer reasonable rates in the 3-5-year band, have become more attractive.

In this regard, Aditya Birla Finance is coming out with an offer of non-convertible debentures (NCDs) for investors, across tenors. The offer opens on September 27. Here’s more on the NCD offer for you to take an informed investment call.

High ratings, reasonable coupons

Aditya Birla Finance is an NBFC (non-banking finance company) that carries the highest credit rating. It is rated AAA with stable outlook by both ICRA and India Ratings. This rating indicates that there is the highest degree of safety in servicing principal and interest payments, and very low credit risk.

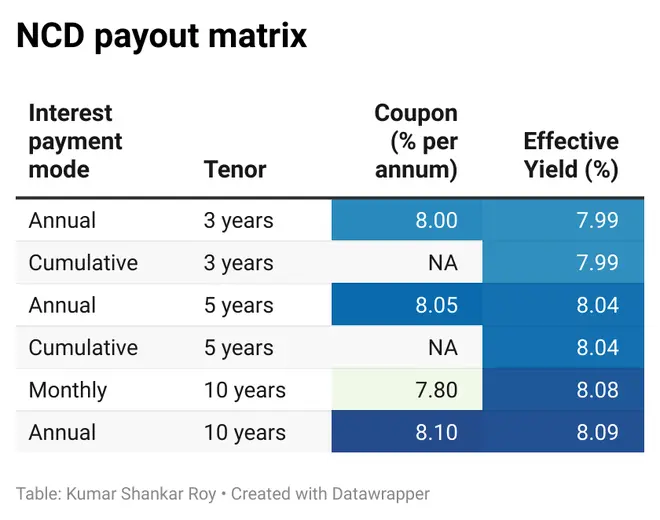

The NBFC is offering NCDs for tenors of three, five and 10 years. The three and five-year tenors have annual and cumulative interest payment options. The 10-year NCD series has only monthly and annual modes of interest payment.

For those taking the annual interest payment option, the 3, 6 and 10-year tenors offer coupons of 8 per cent, 8.05 per cent and 8.1 per cent. The effective yields across all tenors (and interest payment modes) ranges from 7.99 per cent to 8.09 per cent.

Data from ICRA Analytics compiled by Axis Bank indicates that 3, 5 and 10-year corporate bonds that are rated AAA, trade at yields of 7.67 per cent, 7.68 per cent and 7.93 per cent, respectively, in the secondary markets.

Thus, Aditya Birla Finance’s NCDs offer 16-37 basis points higher yield over secondary market bonds with similar credit ratings.

Most investors can consider the five-year tenor and annual payout option as that option offers the best returns from the choices available. Those willing to wait for long periods in lieu of steady coupon payouts at 8.08 per cent yield that are much higher than 10-year g-sec yields (7.15 per cent) can consider the tenor as well. Of course, they must have other fixed-income instruments in their portfolio for diversification and cash flows.

Interest is added to your income and taxed at the applicable slab. Tax is also deducted at source on the interest payout. The minimum investment amount is ₹10,000.

Investors can consider parking reasonable amounts in these NCDs. The exposure should be less than 5 per cent of the overall debt portfolio.

Steady metrics

Aditya Birla Finance is a subsidiary of Aditya Birla Capital. It has the conglomerate’s backing.

The company has been classified as an upper-layer NBFC and, among other RBI regulatory obligations, must fulfil the requirement of listing by FY26.

Aditya Birla Finance provides loans to the following segments: personal & consumer (19 per cent of total AUM), unsecured business (10 per cent), secured business (40 per cent), and corporate/mid-market (31 per cent). These figures are as of March 2023. The company thrives in generating leads and disbursing loans mostly via the digital modes.

The AUM of the company stood at ₹80,556 crore as of FY23, a 46 per cent increase over FY22. It grew further to ₹85,891 crore as of June 2023. Net interest margin improved from 6.24 per cent in FY22 to 6.84 per cent in FY23. This has moved up to 6.98 per cent, as of June 2023.

Return on assets stood at 2.45 per cent in FY23, up from 2.3 per cent in FY22. This has further inched up to 2.54 per cent as of June 2023. Capital adequacy stood at a healthy 16.38 per cent as of March 2023.

Gross non-performing assets stood at 3.1 per cent as of March 2023, compared to 3.6 per cent in March 2022. The net NPA fell to 1.7 per cent as of March 2023 from 2.2 per cent in March 2022. Gross NPA has come down further to 2.8 per cent as of June 2023.

The key performance metrics thus appear reasonably healthy.

Aditya Birla Finance’s NCD offer is open till October 12. But it would be better to invest early to get subscription.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.