Raghunathan, aged 59, working in the private sector, is retiring in a few months. .He approached us as he wanted to plan his finances.

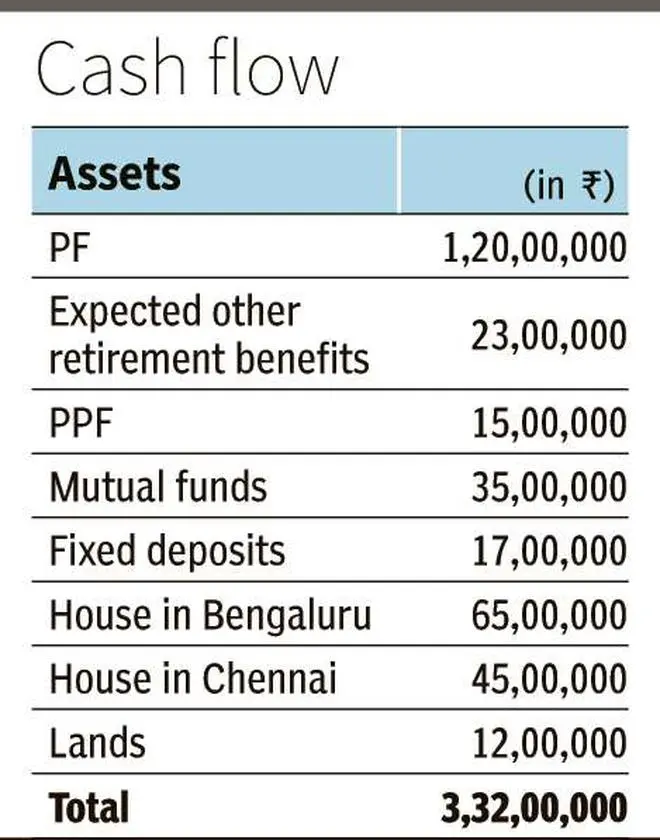

His current assets are listed as below:

He resides in Bengaluru. He gets a monthly rental income of ₹6,000 from his Chennai property. He is also eligible for a monthly fixed pension of ₹38,000. He wanted to check if he could buy a property in Chennai for a sum of ₹85 lakh in a gated community. He expects a rental income of ₹25,000 per month from the new property, which could be used to support his monthly expenses.

Identified constraints

Raghunathan faces the following limitations when it comes to financial planning.

1. He will be receiving a fixed pension and there will be no return of corpus to his nominees when he passes away.

2. Raghunathan has had health ailments for the last 15 years and his prescription costs have been increasing over the years, along with regular medical check-up needs. These expenses are not covered under any medical insurance. His spouse, Chandra, has had surgery in one knee, and is due for surgery on the other knee anytime now, for which the cost could be around ₹3 lakh.

3. Rental income from Chennai property has not increased significantly in the last 3-4 years and he is finding it difficult to get tenants. If he renovates the property at a cost of ₹5 lakh, he stands a better chance of getting a monthly rent of ₹7,500.

4. With the couple’s son and daughter settled abroad, moving to a retirement community or a larger community may help Raghunathan and Chandra to manage their lifestyle better. Hence, they wanted to buy a 2BHK property in Chennai with reasonable access to health facilities. He is not keen to get any financial support from his children to address this need.

5. The couple wanted to earmark ₹60,000 per month to manage their living expenses, health care and other needs. If they move to any other larger community, additional expenses have to be factored in at ₹10,000 per month.

6. Both are willing to set aside 20per cent of their financial assets in growth assets such as equity mutual funds for their long-term requirements.

Review and recommendations

This was the financial plan suggested for them after an assessment of their resources and needs.

1. Since both have health issues, it was recommended that the amount available in fixed deposits be retained towards medical and emergency needs.

2. They can also retain Public Provident Fund towards their additional health needs. This instrument provides flexibility for withdrawal and tax-free interest additions every year.

3. They were advised to sell the Chennai property and lands. With additional funds from retirement proceeds and PF, they can buy a 2BHK property in a larger community. This leaves them with ₹1.78 crore in financial assets.

4. They need to invest ₹1,65,50,000 in a 20:80 Equity:Debt asset allocation to generate 7.5 per cent post-tax income to support their lifestyle expenses of ₹70,000 per month from when Raghunathan turns 60, for the next 30 years, at an expected inflation of 7 per cent per year.

5. The property where they stay currently may yield better rental income and this can be let out to generate additional income to support other expenses and travel. The expected rent from this property is ₹10,000-12,000 per month. They need not bank on this rental income for the regular expenses. Depending on the certainty of rental income as expected, the property may be retained or sold at a later point of time.

6. In addition, they will have a surplus of ₹12.5 lakh. This, along with the retirement corpus of ₹1,65,50,000 needs to be invested judiciously, keeping in mind the safety of capital, liquidity needs, and growth needed to support inflation-adjusted expenses in the long term.

7. In the fixed income part of asset allocation, safety needs to be assigned high priority. Senior Citizen Savings Scheme, RBI Bonds, annuity products, and other safe avenues should be considered with the liquidity aspect in mind.

8. As they are comfortable with equity mutual funds, they could consider large-cap exposure through mutual funds for their long-term investments in the equity asset allocation.

Consolidating real estate investments at the earliest is better considering their children are likely to reside outside India. Though the previous generation felt pride and happiness about buying and transferring real assets, times are changing and every parent needs to analyse this with regard to their own situation, which cannot be generalised. What is good for your neighbour or a relative may sound illogical to you and your family. Transferring wealth to the next generation is a great idea but it should be done without binding them to a particular asset class. “Cash is King” is worth remembering here!

(The author is a SEBI Registered Investment Adviser)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.