Hariharan (35) is married to Swapna (32). They want to build a portfolio using financial assets. Both are from Andhra Pradesh and the family has more than adequate exposure to real estate assets for their requirements, in their opinion.

Both did not foresee any need for goal-oriented expenses in the near future. Their daughter Akshara is aged 7. The parents of the couple are in a comfortable position financially and in good health too.

Swapna is more inclined to have a better lifestyle. She wants good education for her daughter. . They plan to stay in Bengaluru, their workplace, till retirement. Upon retirement, they intend to shif back to their native place. Hence the need to purchase a house in the city did not arise.

They were risk-seeking with respect to their investments. Both understood the risks associated with stock market-related investments. They showed keen interest in building a portfolio for wealth creation over the long term. Though their experience was very limited, considering they participated in the dream run of the stock market after March 2020, they were quite aware of the downsides.

Their limited experience of investing in stocks during 20-21 had earned them good profits. Since both are employed and returning to work from office mode, they wanted to move their investments to mutual funds. They were ready to do systematic investments considering the volatile nature of the market. They seemed to have had the conviction in the potential of equity to generate wealth over the long term.

We assessed their risk profile as ‘Aggressive’ and recommended them to opt for an asset allocation of 70:30 in Equity: Debt.

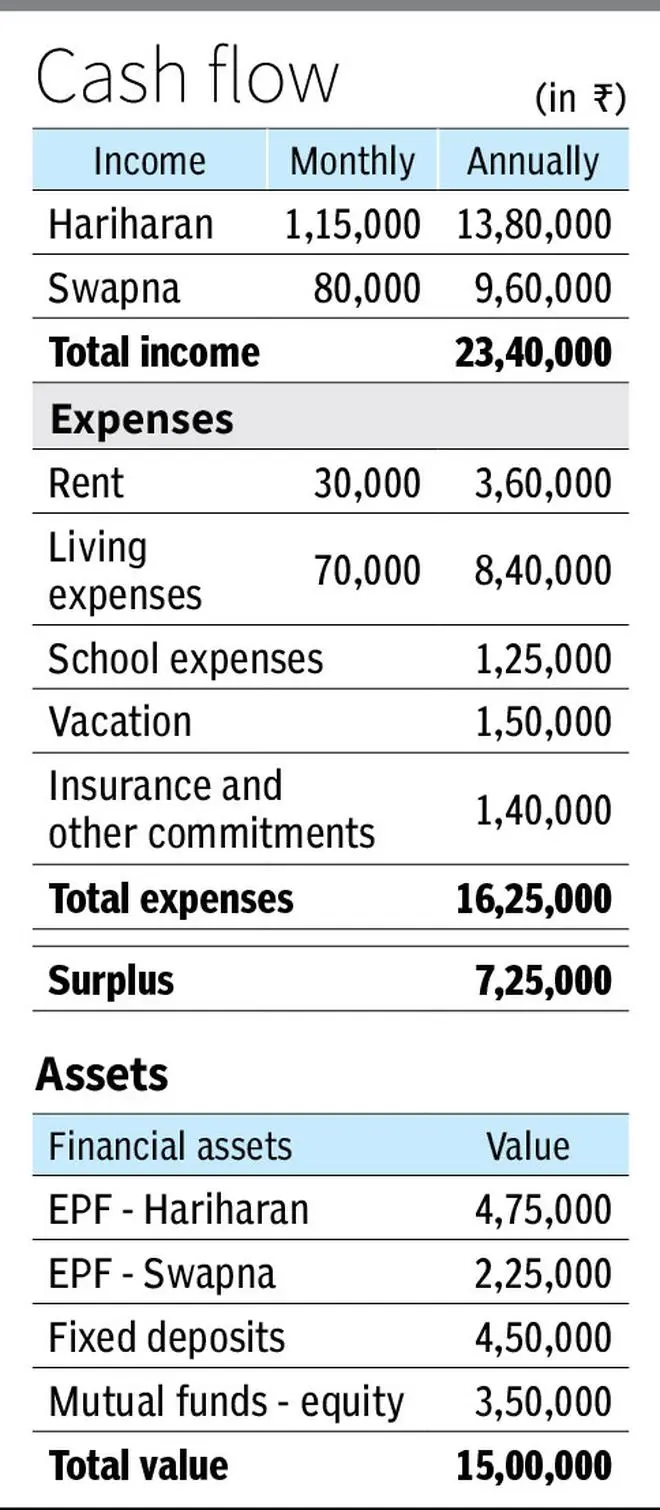

The equity exposure is less than 25 per cent of the total financial assets . With regular contributions to employer provident funds, ₹1.56 lakh per annum for Hariharan and ₹86,400 for Swapna, they will not be reaching the desired allocation immediately. With surplus of ₹7.25 lakh per annum, it may take around 10 years to reach this goal. Hence, we suggested that they invest the entire surplus in equity for the next 10 years. Any increase in salary income will result in increase in PF contribution too. Asset allocation has to be monitored for desired proportion during market ups, downs, and also every year with salary increase.

Coming to the next point of when to exit, we advised them to bring in goals where they can have some clarity of exiting any or all of the investments. If they plan for current cost of college education of ₹25 lakh for Akshara when she turns 18, they need to withdraw ₹71.32 lakh approximately at 10 per cent inflation from the corpus. This goal can be reached by investing ₹25,000 per month along with mapping of ₹1 lakh from current MF investments. We advised them to invest this amount in a flexi-cap category fund.

The balance ₹35,000/- was split into a mix of two aggressive mid-cap funds and tactical portfolio with 3 sector funds.

If they continue to invest the same amount for the next 11 years, they will have ₹1.69 crore in mutual funds at the end of 11 years at an expected return of 12 per cent per CAGR. They have the option to withdraw for Akshara’s college education if they are not able to liquidate the real estate. By continuing to invest for the next 25 years, Hariharan, at age 60, will have ₹12.85 crore at 12 per cent CAGR and have the potential to build ₹19.2 crore at an expected return of 15 per cent CAGR. This is without accounting for any increase in income or increase in contribution in mutual funds and EPF.

Wealth-building looks easier on paper. There could be many challenges… a) A longer than usual bear market would diminish the returns which could be lower than fixed income at times. This is unavoidable while investing for long term, b) Relatives and friends provide unsolicited advice, especially throwing real estate offers by providing absolute numbers that could be very tempting and very tough to avoid. At such times, the couple should stick to their asset allocation strategy and keep a cool head; c) Understanding that systematically investing to create wealth is easier said than done, as during the course of the journey, a lot of noise that presents itself as information would derail the investing journey.

There are a few mutual funds with track record of 20-25 years which can show past return of 12-15 per cent. But how many investors have reaped the benefits with patience and discipline is the question to ponder over. While taking such efforts to build wealth over the long term, the journey alone is not important but every step counts!

The writer, Co-founder of Chamomile Investment Consultants in Chennai, is an investment advisor registered with SEBI

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.