In these times of elevated interest rates, bank fixed deposits have also become reasonably attractive. Small finance banks generally offer higher rates than traditional public and private sector banks. Jana Small Finance Bank’s deposit rates have been increased recently in the 500-days and ‘more than 2 years to 3 years’ tenors, making for an appealing investment case. For senior citizens, the rates are even higher.

Here’s what you must know before parking your money in the bank’s fixed deposits.

Locking into high rates

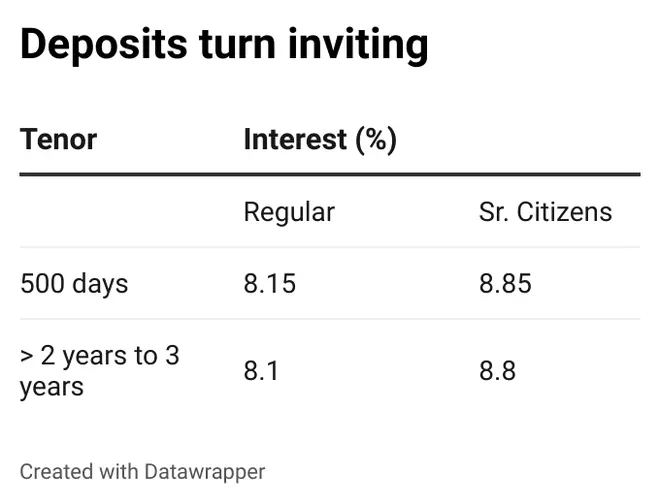

Jana Small Finance offers 8.15 per cent on its 500-day deposit. The rate applicable to senior citizens for the same tenor is 8.85 per cent. These are among the highest rates available and are especially inviting for senior citizens. In the ‘greater than 2 years to 3 years’ period, the deposit rate is 8.1 per cent and for senior citizens, it is 8.8 per cent. The post-tax returns are especially healthy for those in the lower slabs — 5, 10 and 20 per cent — and are higher than the prevailing inflation levels.

Investors can lock into either of the two tenors based on their requirements, as the rates are much higher than what even the best of NBFCs (non-banking finance companies) currently offer.

Ideally, investors must choose the cumulative option to benefit from the compounding of rates. However, for those needing regular cash flows, Jana Bank deposits offer monthly, quarterly, half-yearly and annual interest payouts.

You can open an account online, by carrying out a video know-your-customer (KYC) process and book your deposit. Alternatively, you can visit the branch and open an account. Aadhaar and PAN may be required for the process, apart from address proof.

As with all deposits of regular banks, Jana Small Finance’s FDs are insured by the RBI-managed Deposit Insurance and Credit Guarantee Corporation (DICGC), to the extent of ₹5 lakh.

You can park a portion of your debt portfolio in these deposits.

Reasonable financials

The bank has been gradually building its deposit base. Its cost of borrowing has declined steadily from 7.5 per cent in FY22 to 7 per cent in the nine months of FY23 (9MFY23). Since over 45 per cent of the bank’s book is microfinance loans, there is an element of risk. Net NPA (non-performing asset) ratio stood at 3.22 per cent in 9MFY23, marginally lower than the 3.43 per cent recorded in FY22. Recoveries in its stressed loan book represent a challenge the bank must deliver on.

However, Jana Small Finance Bank’s secured loan book stood at ₹9,876 crore, or 54.7 per cent of the total loan book. This is double the level achieved in March 2020.

The capital-to-risk weighted assets ratio (CRAR) stood at 15.84 per cent in December 2022, up from the level in March 2022. This level is higher than the regulatory requirement prescribed by the RBI.

Net interest margin is at a healthy 7.26 per cent as of December 2022, higher than the 7.08 per cent level achieved in March 2022.

On the whole, Jana Small Finance Bank’s financials are slowly on the mend. DICGC’s insurance is another safety enabler.

As indicated earlier, investors can park a portion of their deposit portfolio in the bank, perhaps coinciding with a medium-term goal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.