You would remember the iconic episode, ”The vacation solution” of The Big Bang Theory where Sheldon is mandated by his university to take his accumulated vacation leave. Similarly, in India too, employees are eligible for earned leave. In case this is not utilised, the employee can encash the earned leave — and, as always, wherever there is inflow of money in our pockets, the taxman shows up, demanding his cut.

On May 25, 2023, the CBDT (Central Board of Direct Taxes) notified that the increased limit for tax exemption on leave encashment on retirement, of non-government salaried employees, is ₹25 lakh, effective from April 1, 2023.

Leave encashment and its tax treatment

The employer offers different types of leave — such as casual leave, earned/privilege leave, sick leave, etc.. Out of these, only earned leave can be carried forward while other types of leave lapse in the year if not used. The employer may cap the accumulation of earned leave as per the policies of the company and the employee has to then avail it or encash it. Some employers may therefore show this entitlement to encash earned leave as a part of CTC. Since the earned leave is eligible for encashment, it is taxable.

The taxability of amount received as leave encashment varies on the type of employment and the time when the leave is being encashed. The amount received by government employees (both State and Central) with respect to leave encashment is exempt from tax during retirement; and if encashed during service it is fully taxable at slab rate for both Government and non-government employee, but relief under section 89 can be availed. The employees of public sector undertakings, including public sector banks, are not treated as government employees and the proceeds received by them as leave encashment are treated at par with private sector employees.

The employees other than government employees will therefore have to deal with the taxman whenever they encash their paid leave. The leave encashed during retirement or resignation gets taxed after deducting the allowed exemption.

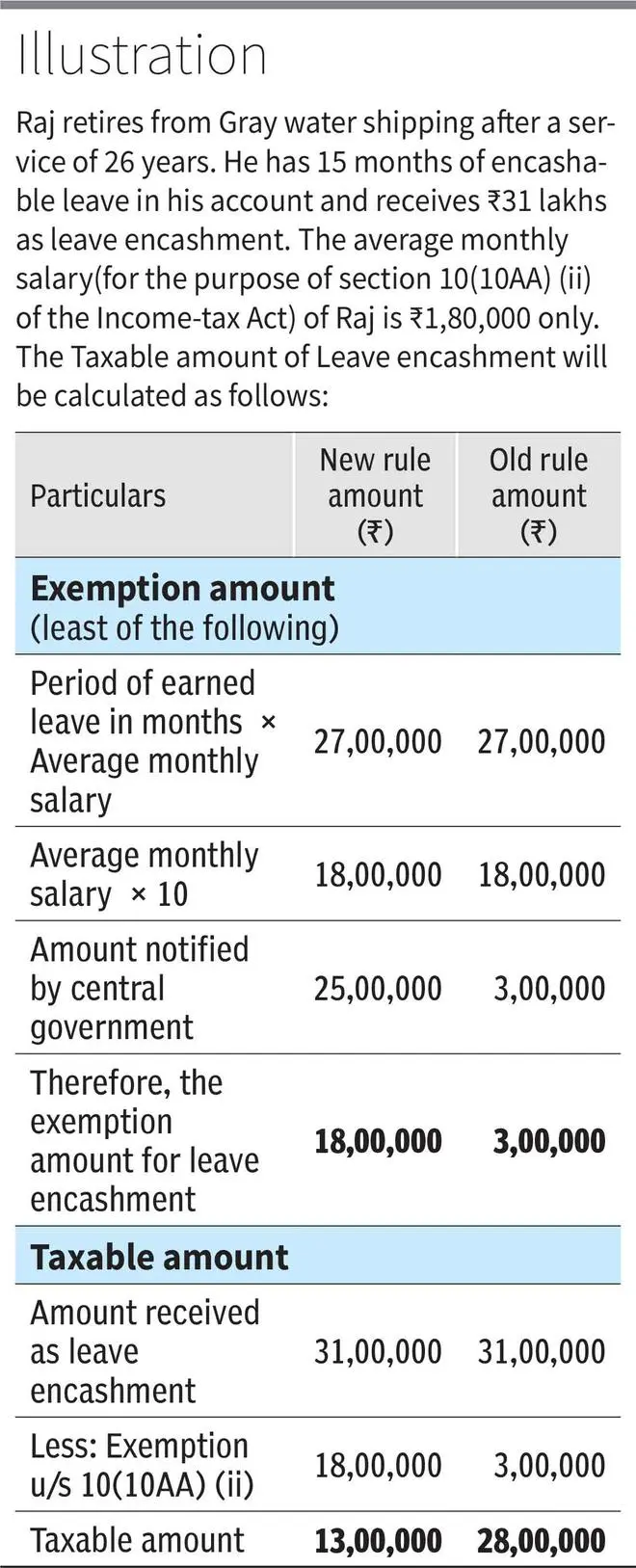

Section 10(10AA) (ii) of the Income-tax Act, 1961, deals with leave encashment and defines the exemption allowed. The section allows the least of the following as exemption from the amount received as leave encashment. One, Period of earned leave in months × Average monthly salary, second Average monthly salary × 10 and third maximum amount as specified by the Central Government i.e., ₹25 lakh. The average monthly salary to be considered is Basic salary, Dearness allowance and commission based on fixed percentage of turnover achieved by the employee.

It must be noted that the ₹25 lakh limit notified by the government is for the whole career of the assessee. Here’s an illustration. Rajeev used to work for Bluewater Shipping and while leaving that job he got an exemption of ₹5 lakh on leave encashment. Rajeev then joins JS Shipping and while retiring from there, the maximum exemption available to him would be ₹20 lakh (₹25 lakh-₹5 lakh).

The new notification

Previously, till FY23, the amount specified by the Central government in Section 10(10AA) (ii) of the Income-Tax Act was ₹3 lakh. However, with the new notification on May 25, 2023, this limit has been raised to ₹25 lakh. This is in line with the Finance Minister’s Budget speech. The limit of ₹3 lakh was introduced in 1998, in accordance with salaries of that period. However, post that period there has been significant rise in people’s salaries and the exemption limit of ₹3 lakh on leave encashment resulted in higher tax bill in most cases.

Taking the illustration above, if the notified amount by Central government was still ₹3 lakh, then under section 10(10AA) (ii) ₹3 lakh would be the exemption amount, which would lead to taxable leave encashment of ₹28 lakh — which is almost 115 per cent higher than ₹13 lakh.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.