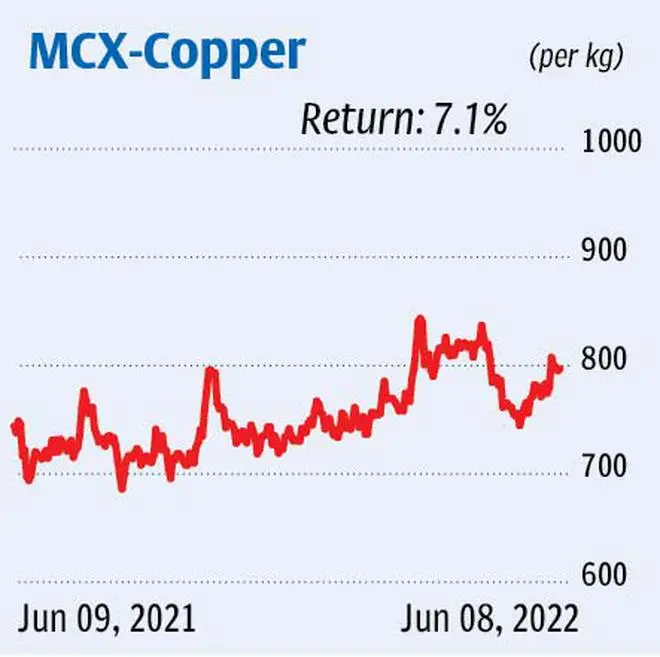

Last week, in our MCX copper futures price projection, we had forecasted the contract would reverse lower post the corrective rally. That is, we expected it to resume decline in the price band of ₹785-790. But contrary to that, it extended the rally to hit a six-week high of ₹814.6 on May 3.

However, the contract could not sustain above the ₹800-mark where it dropped and is currently trading around ₹785. So, the rally overshot but the trend did not turn bullish. Going ahead, we expect the contract to decline from the current level.

While ₹770 can be a minor support, the contract will most likely slip below this price point and drop to ₹760. A breach of this level can result in the contract declining to ₹738 — its previous low.

Given the above conditions, one can consider initiating fresh short positions at the current level of ₹785. Add more shorts if there is a rally to ₹800. Keep initial stop-loss at ₹815. When the contract drops below ₹770, revise the stop-loss down to ₹785. Likewise, when it falls below ₹760, tighten the stop-loss further to ₹775. Exit all the shorts when the contract touches ₹738 because there can be a bounce off this level since this is a strong support.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.