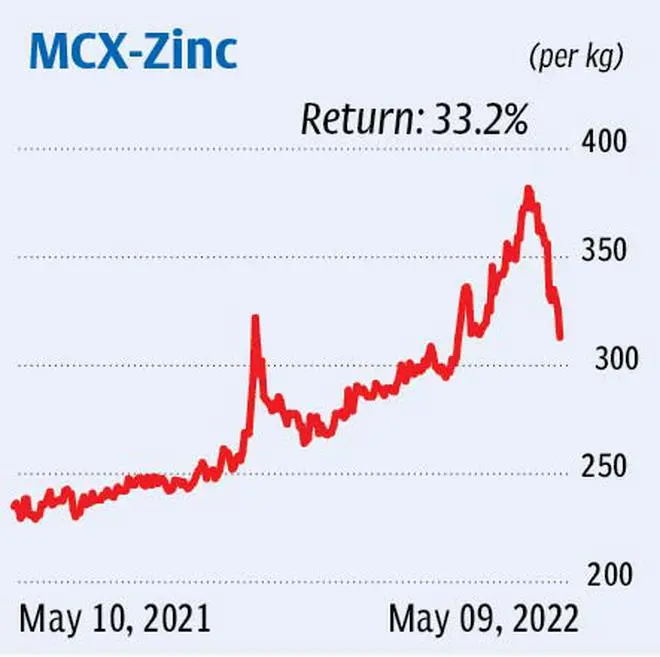

For almost a month now, the zinc futures on the Multi Commodity Exchange (MCX) have declined . It started falling after marking a high of ₹383.4. That said, when the contract was hovering around ₹320 last week, we expected it to see a bounce towards ₹360 and then resume the downtrend, breaking below the support at ₹320.

However, the contract breached the support at ₹320 on Monday. This is crucial as trendline support and 50 per cent Fibonacci retracement of the prior rally coincide at this level. Thus, slipping below ₹320, the contract has turned bearish.

Going forward, the zinc futures is likely to decline further. It could drop to the support band of ₹286-292. A breach of this level can result in the contract falling to ₹260. But before that, as with any breakout and breakdown, there could be a retracement. In this case, the contract might inch up to ₹330. It is advised to accommodate this possibility in the trade plan. A rally above ₹330 is less likely, though.

Our trade recommendation would be to execute shorts in two legs. Initiate shorts worth three-fourths of the intended amount at the current level of ₹316 and add shorts for the remaining when it moves up to ₹330. Place the stop-loss at ₹340 and revise it to ₹325 when the price falls below ₹305. Liquidate all the shorts at ₹290.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.