The development on the Russia-Ukraine front dragged the Indian benchmark indices lower at the beginning of the week in line with our expectation. Both the Sensex and Nifty 50 opened with a wide gap-down as expected and tumbled over 3 per cent intraday on Monday. The news on Russia calling back some of its troops to its base provided some relief and aided the benchmark indices to bounce-back sharply and recover the loss. But thereafter the Sensex and Nifty failed to get a strong follow-through rise and have come-off gradually in the second half of the week and close marginally lower. The fear of Russia attacking Ukraine for an invasion any time will continue to weigh on the market and keep the risky assets such as the equities under pressure.

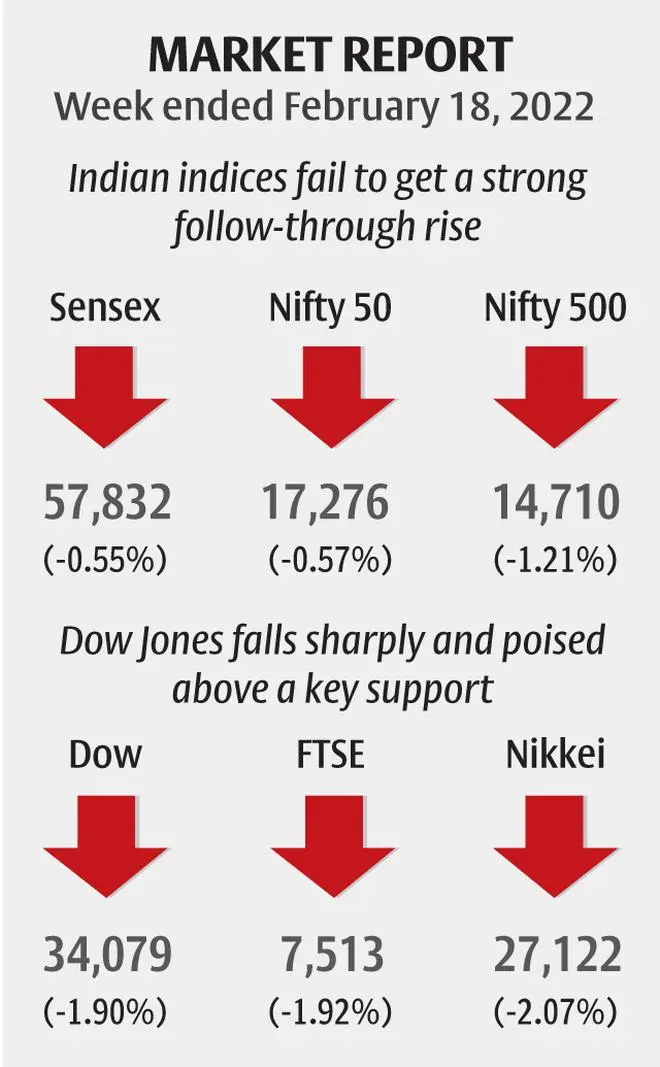

Sensex and Nifty 50 were down 0.55 and 0.57 per cent respectively for the week. The fall was indeed steeper in the midcap and small cap segment. The BSE MidCap and BSE SmallCap indices fell 1.98 and 3.29 per cent respectively. All the sectoral indices barring the BSE Consumer Durables (up 0.63 per cent) closed in the red last week. The BSE Metal index (down 4.23 per cent) was beaten down the most. The BSE Bankex, Health Care, Realty and PSU indices fell over 2 per cent each.

The Foreign Portfolio Investors (FPIs) continue to sell Indian equities. The FPIs pulled out about $697 million from the equity segment. In February, the FPIs have sold over $2 billion in this segment. Though the pace of selling seems to have come down over the last couple of weeks, unless the FPIs turn as net buyers the Sensex and Nifty are not likely to get support for a sustained rise.

Nifty 50 (17,276.3)

Nifty 50 opened the week on a weak note and tumbled 3.25 per cent intraday in Monday to make a low of 16,809.65. However, it managed to rise back sharply recovering all the loss and made a high of 17,490.6 on Wednesday. But thereafter the index fell gradually for the rest of the week. Nifty has closed the week at 17,276.3, down 0.57 per cent.

The week ahead: The 21-Week Moving Average (WMA) at 17,589 is an important resistance to watch this week. Nifty will have to rise past this hurdle to become bullish. Such a break above 17,589 can take the index up to 18,100-18,200 in the short-term.

On the other hand, if Nifty fails to break above the 21-WMA resistance and sustains below it, a fall to 16,850-16,800 can be seen again. A strong break below 16,800 can drag the index further down to the next support level of 16,450-16,400.

The bias is bearish. As such we expect Nifty to fall to 16.850-16,800 from here and then to 16,450-16,400 eventually in the short-term.

Medium-term outlook: The bigger picture remains bearish as long as the Nifty sustains below the broader 18,000-18,500 resistance zone. Important supports to watch on the downside are 16,450-16,400 and then 16,350. We see high chances for the Nifty to break below 16,350 and fall to 15,500 initially. A further break below 15,500 can drag the index down to 15,000-14,500 eventually. Nifty will have to rise past 18,500 decisively to negate the bearish view and turn the outlook bullish.

Trading Strategy: High risk appetite traders can go short now and also accumulate on a rise at 17,380. Stop-loss can be placed at 17,640. Trail the stop-loss down to 17,020 as soon as the index falls to 16,880. Move the stop-loss further down to 16,720 when the index touches 16,610. Exit the short positions at 16,480.

Sensex (57,832.97)

Sensex tumbled 3.2 per cent intraday on Monday and made a low of 56,295.7. The sharp bounce thereafter that aided to recover all the loss but failed to get a strong follow-through rise. Sensex made a high of 58,569.22 and had come-off from there to close the week 0.55 per cent lower at 57,832.97.

The week ahead: Important resistances are at 58,750 and 59,000. Sensex must rise past 59,000 decisively to ease the downside pressure and become bullish to see 60,000-61,000 levels on the upside in the short-term. But while below 59,000 the bias is bearish, and the chances are high for the Sensex to dip towards 56,400-56,300 and even 56,100 in the near-term. A break below 56,100 can take the index down to 54,850 – the next short-term support.

Medium-term outlook: The broader picture continues to remain weak. We reiterate that 61,000-62,000 region will continue to remain as a strong resistance. Sensex has to rise past 62,000 decisively to turn the outlook bullish and negate a strong fall.

The level of 54,850 mentioned above 54,850 is an important support. A strong break below it will drag the Sensex down to 52,500-52,000 in the coming months. The chances of the fall extending beyond 52,000 is also a possibility if the global equity sell-off intensifies on the back of the on-going geo-political tensions and if the US Federal Reserve decides to increase rates more than forecasted earlier.

Nifty Bank (37,599.15)

The Nifty Bank index opened with a wide gap-down and tumbled 4.8 per cent to make a low of 36,651.85 on Tuesday. Though the index witnessed a sharp bounce from the low, it failed to sustain higher and get strong follow-through rise above 38,000. It made a high of 38,461.7 and fell-back to close the week at 37,599.15, down 2.38 per cent.

Broadly the index has been trading in a sideways range of 36,375-38,425 since mid-January. Within this range, the 200-Day Moving Average (DMA) support is at 36,555. The bias is bearish to break below this support which in turn will increase the chances of the index falling below 36,375. Such a break can then drag the Nifty Bank index down to 35,100-35,000 in the short-term.

On the other hand, if the index manages to sustain above 36,555 (200-DMA), it can bounce-back to 38,000-38,500 again. In that case the broader 36,375-38,425 range will continue to remain intact and the index can oscillate within it for some more weeks.

Trading Strategy: Traders with high-risk appetite can go short at current levels and also accumulate on a rise at 38,120. Stop-loss can be placed at 38,850. Trail the stop-loss down to 37,150 as soon as the index moves down to 36,300. Move the stop-loss further down to 36,400 when the index touches 35,700. Book profits at 35,550.

Global Cues

After failing to breach 35,500 for two consecutive weeks, the Dow Jones Industrial Average (34,079.18) struggled to rise past 35,000 itself in the past week. The bounce from Monday’s low if 34,304 faced resistances near 35,050 – the 200-Day Moving Average (DMA). The Dow made a high of 35,047 and fell back sharply to close at 34,079.18, down 1.9 per cent for the week.

The price action on the chart leaves the near-term outlook bearish. The chances are high for the Dow to break below 34,000 and fall to 33,000 in the coming days. Inability to bounce from 33,000 can drag the Dow further down to 32,500-32,000 eventually. From a long-term perspective the region between 32,500 and 32,000 is a strong support from where a fresh rally can begin.

The US markets are closed on Monday on account of a public holiday.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.