The Indian benchmark indices began the week on a dull note. Sensex was struggling to breach 61,500 and the Nifty was not getting a strong follow-through rise above 18,200. Both the indices fell sharply on Thursday following the surprise fall in the Dow Jones Industrial Average overnight on Wednesday.

Inflation cools down

However, the US inflation data release on Thursday came as a saviour for the equity market. The US Headline and the Core Consumer Price Index (CPI) numbers showed signs of cooling down. That increased the speculation in the market that the US Federal Reserve will slow down their pace of rate hikes in the futures. As a result, the US Treasury yields, and the dollar index got beaten down badly. In turn, the risky assets such as the equities and non-dollar currencies surged on Thursday on high-risk appetite.

This aided the Indian benchmark indices, the Sensex and Nifty to open with a wide gap-up on Friday and also close on a strong note. For the week, both the Sensex and Nifty have closed over a per cent.

Sectors mixed

The performance of the sectoral indices was mixed last week. The BSE IT index outperformed by closing 3.02 per cent higher for the week. The BSE Health Care index fell the most by 2.5 per cent, followed by the BSE Auto index, down 1.98 per cent.

FPI flows

The Foreign Portfolio Investors (FPIs) continue to buy the Indian equities. The FPIs bought $449.57 million in the equity segment last week. So far, the Indian equities have seen an inflow of about $2.3 billion this month. Continuing foreign money inflows can help the Indian benchmark indices to scale new highs in the coming weeks.

Nifty 50 (18,349.70)

After struggling to get a strong follow-through rise above 18,200 initially, Nifty fell sharply on Thursday. The index made a log of 17,969.40. However, Nifty opened with a wide gap-up on Friday recovering all the loss and closed on a strong note at 18,349.70, up 1.28 per cent.

The week ahead: The outlook is bullish. But there is limited room on the upside from a near-term perspective. A strong resistance is at 18,480-18,500. Inability to break above 18,500 can trigger a corrective fall to 18,200 and 18,100.

Strong support is in the 18,100-18,000 region. As such a fall below 18,000 is less likely. A fresh rise from 18,200-18,000 support zone can take the Nifty back up to 18,500 again.

An eventual break above 18,500 will take the Nifty up to new highs going forward.

Chart Source: MetaStock

Medium-term outlook: The overall trend is up. The medium-term outlook continues to remain bullish. Nifty can rally to 19,300-19,500 initially. From a big picture perspective, Nifty has the potential to target 20,500 on the upside in the coming months.

Below 18,000, there is a strong support at 17,600-17,500 and then at 17,200 and 17,000. So, any fall below 18,000 will increase the chances of fresh buyers coming into the market.

Trading strategy: Short-term traders with a time frame of minimum three months can go long now. Accumulate on dips at 18,150 and 18,050. Buy more at 17,700 if a steeper fall below 18,000 is seen. Keep a stop-loss at 17,200. Trail the stop-loss up to 18,600 as soon as the index moves up to 19,100. Move the stop-loss further up to 19,100 when the index rallies to 19,950. Book profits at 20,100.

Sensex (61,795.04)

The support at 60,450 mentioned last week has held very well. Sensex fell sharply to a low of 60,425.47, but then bounced back sharply recovering all the loss. The index has closed the week at 61,795.04, up 1.39 per cent.

The week ahead: The near-term outlook is bullish. Support is at 61,250 and then at 60,650-60,600. Sensex can rise to 62,500 in the near term. A corrective fall thereafter to 61,500-61,300 cannot be ruled out.

In case a strong break above 62,500 is seen immediately, then Sensex can see an extended rally to 63,800 in the short term.

Chart Source: MetaStock

Medium-term outlook: The bullish view of seeing 64,000 on the upside remains very well intact. From a big picture perspective, the current rally in the Sensex has the potential to target 65,500, also on the upside, in the coming months.

Strong supports will now be at 60,000 and 59,000. The bullish outlook will get negated only if the Sensex declines below 59,000. But such a fall looks unlikely at the moment.

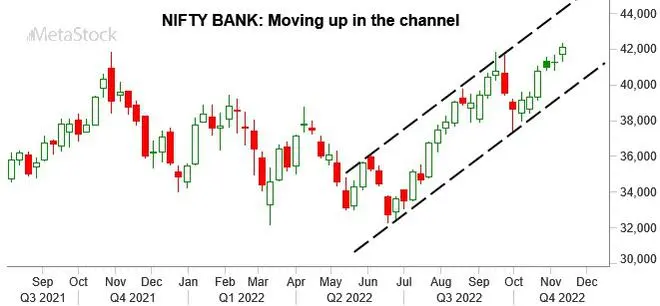

Nifty Bank (42,137.05)

As expected, the Nifty Bank index has broken its 40,820-41,860 on the upside. The rise above 42,000 has also happened in line with our expectation. Nifty Bank index made a high of 42,345.5 on Friday and has come off slightly from there. It has closed the week at 42,137.05, up 2.13 per cent.

Chart Source: MetaStock

On the weekly chart, the breakout after two weeks of consolidation strengthens the uptrend. The outlook is bullish. Immediate support is at 41,950. Resistance is at 42,500. A break above it will pave way for a rise to 43,400 in the coming weeks.

From a big picture perspective, strong supports are at 41,300 and then at 40,800-40,600. The Nifty Bank index can target 44,000 and 45,000 in the coming months as long as it sustains above these supports.

Global cues

The breakout above 33,400 on the Dow Jones Industrial Average (33,747.86) has happened in line with our expectation. Although the index saw a sharp fall on Wednesday, it managed to hold above the support at 32,400. The US inflation data release on Thursday showing signs of a slowdown triggered a strong reversal in the Dow Jones. That helped the index to breach 33,400 and close the week on a strong note at 33,737.86, up 4.15 per cent.

Chart Source: MetaStock

The outlook is bullish. Immediate supports are at 33,450-33,400 and then at 33,350-33,250. Below that 33,000 is a strong trendline as well as a psychological support. The Dow Jones now has potential to target 34,700 and 35,000 in the coming weeks. Thereafter, a corrective fall is possible.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.