At a time when flows are heavy in the small cap space even as valuations turn uncomfortable in the space that is characterized by relatively low liquidity and volatility, it may be advisable for retail investors to look at other segments to lower their portfolio risk.

The large & midcap funds category offers a good opportunity for investors looking for opportunities in a relatively attractive space. With market regulator SEBI’s mandate that requires such funds to invest at least 35 per cent each in large and midcap stocks – the balance portion is left to the fund manager’s discretion – a healthy blended portfolio becomes available to investors, with an above-average risk appetite. Most funds in the space tend to be heavy on large-caps in their portfolios.

In this regard, Quant Large & Midcap Fund (rated 5 stars by bl.portfolio) has been a top-notch and consistent performer over the years and can be considered by investors for their long-term goals. The fund can be a part of their core portfolio and the SIP route can used to for take exposure.

Strong outperformer

Quant Large & Midcap has been a top-quartile performer in its category over the past several years.

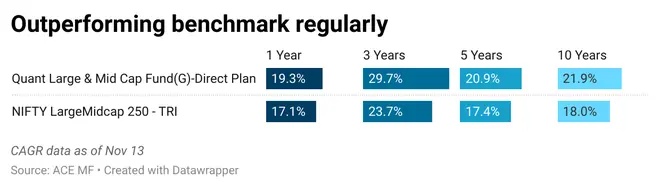

On a point-to-point returns basis over the past one, three, five and 10-year period, the fund has outperformed its benchmark, Nifty Large Midcap 250 TRI, by 2-6 percentage points.

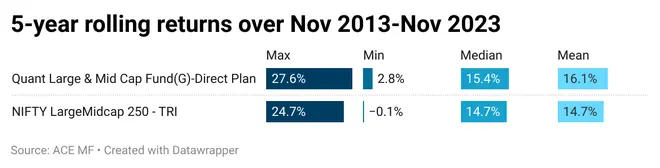

When 5-year rolling returns over the period November 2013-November 2023 are taken, the fund has outperformed its benchmark over 77 per cent of the time, among the best in its category.

Further, Quant Large & Midcap fund has delivered more than 20 per cent returns nearly 23 per cent of the time on a 5-year rolling basis over 2013-2023. It has given more than 12 per cent nearly 82 per cent of the time and more than 15 per cent over 57 per cent of the time in this timeframe.

The mean returns on a five-year rolling basis over Nov 2013-Nov 2023 is a healthy 16.1 per cent. The Nifty Large Midcap 250 TRI managed about 14.7 per cent over the same period.

When SIP returns over the past 10 years are taken, the fund has managed an XIRR of 19.2 per cent, according to Valueresearch data, placing it among the top couple of funds in the category.

The fund has an upside capture ratio of 105.3, indicating that it rises much more than the benchmark Nifty Large Midcap 250 TRI during rallies. Its downside capture ratio is 84.4, suggesting that the fund’s NAV falls a lot less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark.

Timed portfolio moves

In general, it may not be easy to pinpoint which style of investing Quant Mutual Fund’s schemes follow. Of course, the fund house follows a VLRT framework for its investment decisions. This incorporates valuation, liquidity and risk appetite analytics, apart from the time factor.

Thus, the fund house and the Quant Large & Midcap scheme follow a combination of fundamental and technical factors to enter and exit stocks and sectors.

There is considerable churn in the portfolio. Some likely winners are spotted early. They are also exited on time. Underperformers or those that are under the effect of adverse news flow are quickly exited.

For example, Quant Large & Midcap was early to latch on the likes of ITC and Larsen & Toubro from late 2020 and early 2021, and had these stocks among its top holdings. But as these stocks rallied massively, it either pared stakes or exited them completely. Banks figured prominently in 2021 and 2022, but in its recent portfolio, only finance stocks prevail and there are no banks. Interestingly the fund has never had a serious exposure to IT stocks despite their high index weightage. It was early to spot pharma and telecom stocks in the immediate aftermath of COVID-19. It held stakes in the more fundamentally strong Adani group stocks of ports & SEZ and power businesses.

The fund runs a relatively concentrated portfolio. Its October holdings show only 18 stocks in Quant Large & Midcap fund.

Even in the March 2020 fall, the fund’s NAV fell only a little over 30 per cent, much lower than the broader markets or benchmarks.

Investing for the long-term may be rewarding for investors, especially when done via the systematic route.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.