The year 2021-22 marked a major milestone for the Ombudsman mechanism of RBI as it witnessed the integration of the three erstwhile Ombudsman Schemes viz., Banking Ombudsman Scheme (BOS) 2006, Ombudsman Scheme for Non-Banking Financial Companies (OSNBFC) 2018, and Ombudsman Scheme for Digital Transactions (OSDT) 2019 into the Reserve Bank - Integrated Ombudsman Scheme (RB-IOS), 2021. Here are 4 charts on the on the nature of plaints against banks and NBFCs, how complaints are addressed and why sometimes they are not considered.

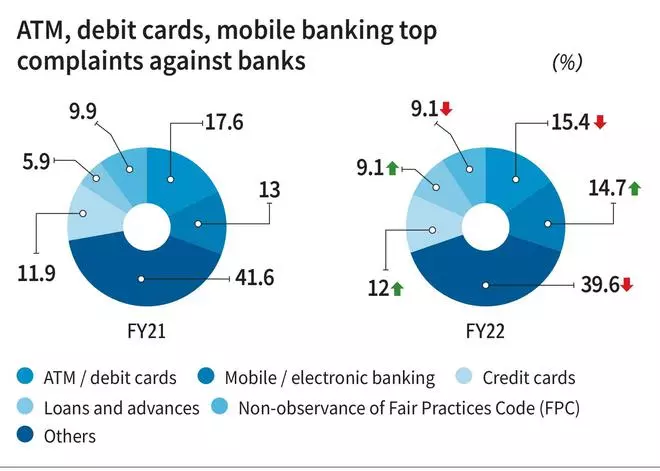

What angers bank customers

Complaints against banks formed the largest portion, accounting for 88.04% of complaints. Customer complaints against ATM, debit cards, mobile/internet banking accounted for highest share.

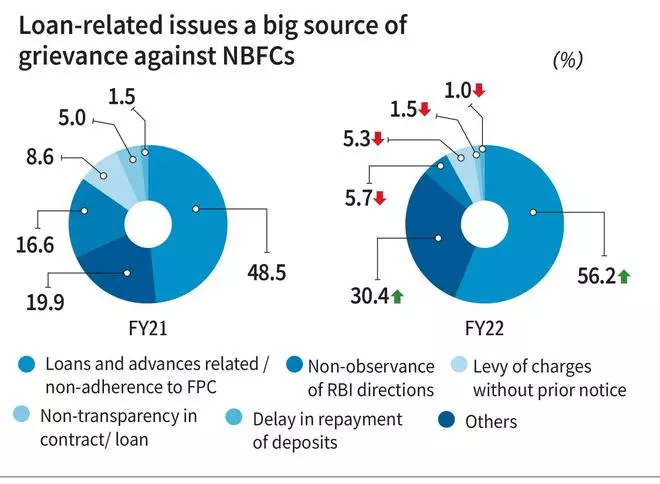

What makes NBFC customers unhappy

Loans and Advances contribute to majority of complaints against NBFCs, followed by non-adherence to Fair Practices Code (FPC), which is also indirectly related to loans and advances.

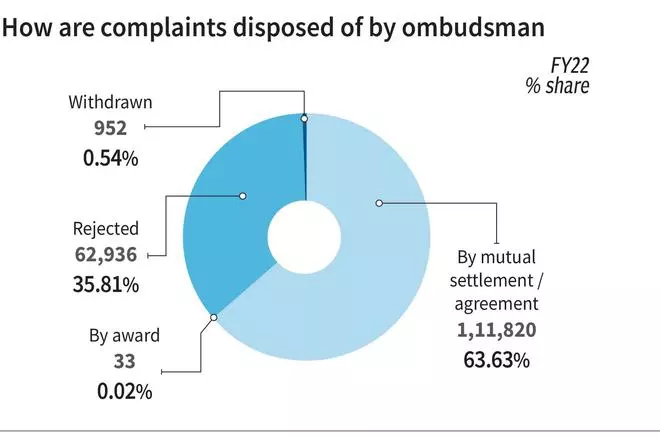

Usual ways of dealing with complaints

Under the Ombudsman Schemes, the majority of complaints are settled through conciliation and mediation efforts.

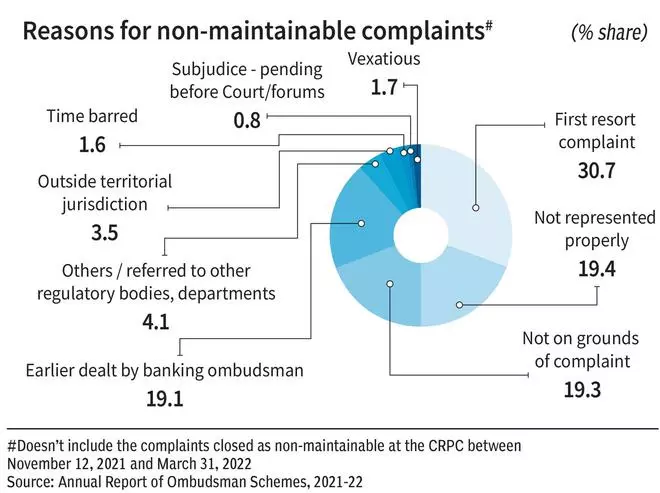

Why complaints are not considered

A total of 1,35,326 (42.62%) of the total handled complaints at ORBIOs were closed as non-maintainable during the year.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.