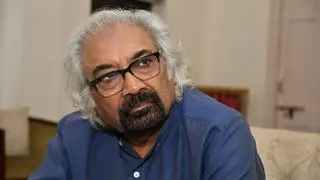

Sumit Bose’s elevation as Finance Secretary comes at a time when challenges abound on the fiscal policy front.

While foreign investors continue to repose faith in the India growth story, many of them privately rue that the Indian tax system remains complex, discretionary and sometimes unfair.

As Finance Secretary, Bose, who has spent nearly four years in the Finance Ministry in various roles, is well placed to help improve the tax environment.

Tax regime In India, tax controversies abound especially in international taxation as authorities are still perceived to be “very aggressive” and sometimes irrational.

Bose has a four-month window (he retires in March) to help clear the air on retrospective taxation (under the income tax law) and set the stage for ushering in the much awaited Goods and Services Tax (GST) system.

Of course, in the Government’s scheme of things it is not entirely in his hands to clean up the system and take major tax policy decisions.

But the usually reticent Bose could use his over 30 years experience in the Indian administrative framework to bring to the table some urgency and fresh perspective to the tax policy changes.

Pending Bills Uppermost in the priority list of Finance Minister P. Chidambaram for the ongoing session will be to pick some low hanging fruits such as the SEBI Bill (to replace the ordinance) or get the long-pending insurance Bill passed.

This, however, hinges on whether the main opposition party BJP playing ball, especially after the recent Assembly election results in five States.

But the critical issue is whether the Finance Minister will in the next couple of days (only seven working days left for the winter session to end) be able to bring amendments to the Direct Taxes Code Bill.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.