Mexican multiplex chain Cinépolis says lack of quality real estate space is coming in the way of its expansion plans. The company, which has set a target of 400 screens by 2017, says it will have to take the inorganic route for it to grow at the pace it had planned.

The company had previously acquired Essel-owned Fun Cinemas, making it the third largest multiplex operator in the country. The company has earmarked ₹500 crore for expansions and acquisitions. Cinepolis, which started operations in 2009 from Amritsar, has 215 operational screens.

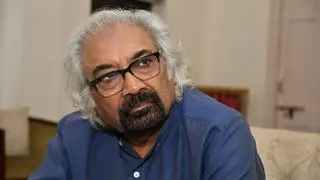

In an interview with BusinessLine , Cinépolis India MD Javier Sotomayor said the company considers its investment in India “valuable”. In India, the company has selected about 60 cities to expand its footprint. Excerpts:

How is the India investment plan progressing?

We consider our investment in India quite valuable. Our shareholders are extremely happy with our growth. We are inching close to becoming the number one player with about 215 screens.

How many new screens do you plan to add?

We have set a target of 400 screens by 2017. These will be in both tier 1 and 2 cities. However, there is a slowdown in the real estate sector, which is impacting our expansions plans. We are not sure if we will be able take that figure through organic growth alone.

The Indian market can easily accommodate around 10,000 multiplex screens, as against about 2,000 screens.

What would it entail in terms of investment?

We plan to invest any where in the neighbourhood of ₹500 crore. It will be largely through internal accruals. We are the second largest company in the world in terms of footfall. India currently accounts of 10 per cent of our total business.

When you look at acquisitions, is there a typical size you have in mind?

We are constantly looking at acquisitions. However, acquisitions will have to make a strategic sense. In India, it will be difficult to find a company that has about 100 screens. It is not that we don’t want to, but there isn’t much opportunity. We will have to look at niche or regional players.

Is your focus on increasing ticketing revenue, or the F&B revenue?

People come to the cinema to watch a movie but food plays a major role. While I can’t share the actual ratio between F&B and ticketing, all I can say is that we are the highest in the industry. F&B will be a core area as it contributes to the whole experience.

Multiplexes are tying up with real estate players to set up screens. Do you also have a similar strategy?

All our screens are in malls and that is our preferred strategy. Even in tier 1 and 2 cities, we have found good quality shopping developments.

Have you completed the acquisition of Fun Cinemas and has it been re-branded?

The acquisition has been completed. It happened 15 months back and the period of integration is over. Now, we are completely working on re-branding the entity. Do you also have sub-segmentation of brands like your competitors have done?

We do have Cinepolis VIP, a luxury brand. Here, it is present in select cities. We will expand these when we expand our mega-plexes.

Could you give us some indication about your revenues?

I can’t comment on revenue as we are privately held. But I can tell you that globally, we sold 216 million tickets, of which 25 million was in India.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.