It’s a rainy day in Mumbai as one battles the thick traffic in Powai to the Colgate-Palmolive India HQ. Calm follows after the tumult outside when one enters the enormous foyer of the imposing building; open upwards to the high ceiling, all the floors with workspaces are in tiers around. The atmosphere is festive with booths all round displaying Colgate’s multifarious and popular brands. It’s ‘Brand Days’ at the office, which offers an immersive experience and insight for media, analysts and select customers into what makes Colgate’s brands tick.

There are stalls displaying its most popular brand, Colgate Strong Teeth — its flagship and largest brand — relaunched last May; the oral care star, Total; Max Fresh; Colgate Whitening; toothbrushes, and many others, including for the unsung brand which contributes to the second half of its name, Palmolive, displaying a range of hand and body washes.

Scientists flashing wide smiles — Colgate, of course — in white coats from Colgate India’s R&D centre, are on hand at each display stall to take us through brand stories and efficacy. Total, for instance, they say is a complete oral care toothpaste — with 125 patents globally — which prevents cavities and sensitivity. The scientists use small white HAP (hydroxyapatite) discs to prove the efficacy of the Colgate brands — whether for bacterial removal or whitening, by dipping them in solutions. For the whitening toothpaste, the discs glow whiter as compared to a regular toothpaste.

Happy days

Brand Days is being held just a few days before Colgate’s MD and CEO, Prabha Narasimhan, completes a year in office on September 1. It was also cause for some celebration because the quarter ended June 30, 2023, saw a significant increase in revenue and net profit after a couple of sluggish quarters; the company’s revenue from operations saw a 10.8 per cent growth compared to the same quarter last year while net profits surged 30 per cent and the company saw a 12.3 per cent growth in domestic net sales (compared to 5.4 per cent growth in Q4 FY 22-23 and 2.7 per cent for the whole of last FY), driven by an approximate 8 per cent price increase. Gross margins have gone up to 68 per cent (highest ever in the past 10 years) with a moderation in inflation.

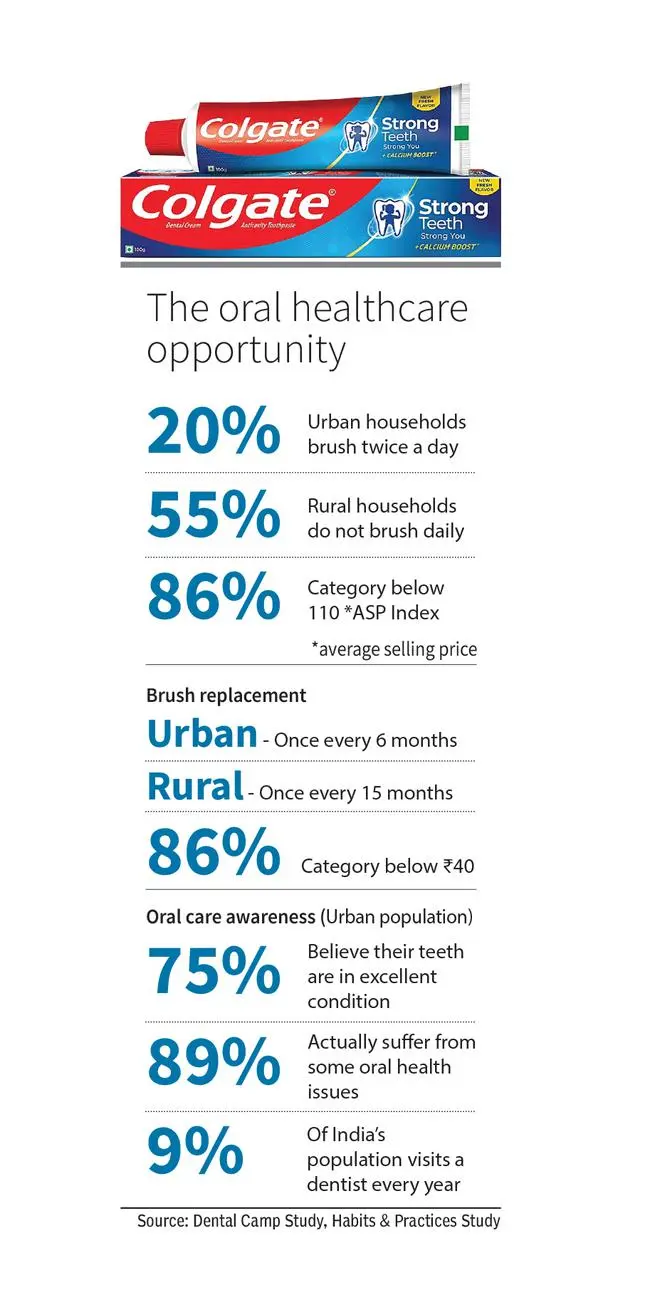

Ask Narasimhan what were the ingredients of a turnaround in this last quarter, she points to three factors. One of which is that it’s coming off a weak base. The macro environment is also picking up with green shoots sprouting in the rural economy. And, the quarter saw the relaunch of its blockbuster brand Colgate Strong Teeth (CST). “The relaunch was well supported and well distributed, that helped, as well as the continuing momentum on Max Fresh,” she adds. Two-thirds of Indian households use CST, says the toothpaste major, which works out to around a billion; CST is growing in double digits while the availability is at 90 per cent of category value stores.

Narasimhan explains that the company has identified few triggers for growing consumption. “We have some answers which you will see sooner than later; some of it is still work in progress. As we find this, we will do above-the-line (promotions) as well as drive behaviour change on the ground.”

Meanwhile, the challenge for Palmolive is different in the category of body and hand wash. “The category by itself is tiny with very low penetration. The way we operate in the category has to be fundamentally different to the way we operate in the oral care category,” she avers.

Growth levers

Colgate-Palmolive has other levers for growth as well. One, is the premiumisation plank it has embarked on with brands like Max Fresh and Colgate Whitening. On display during Brand Days were some examples of how the brand is responding to consumer needs. Apart from whitening paste, the brand has also launched a whitening pen which one can smear on teeth overnight to remove stains and whiten them.

And, as Narasimhan points out, the company is not averse to inorganic growth. “We have high intent on inorganic growth — you will notice from our balance sheet that we are a debt-free company; so the concern is finding the right target that fits with our strategic intent. We have a strategic intent that is larger than oral care,” she emphasises.

However, it’s hard to put a time frame for any acquisitions. “What’s in our control, you’ll see more of it — like our biggest brand relaunch; but it’s hard to put a time frame on what’s not in our control. The intent to diversify remains a very strong part of our strategic plan and therefore we will surely take the opportunities that presents itself,” she says.

Colgate-Palmolive India might also dip into its international portfolio to bring in more brands to the table here. “We will bring in the best of that range as suitable for this country. That’s an easy one. Apart from that, we also have other brands outside India that could be relevant here. Colgate-Palmolive globally plays in many more categories than we have here. So we are doing an assessment of our global portfolio to find what could be relevant for us in India . Globally we have hair, homecare, pet care. We have many of those categories and anything that Colgate does globally is certainly within the consideration set for India,” elaborates Narasimhan. Colgate’s cautious but aggressive intent is evident.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.