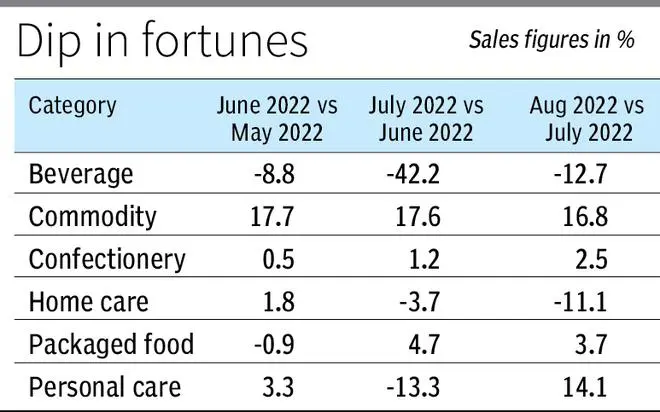

Even as the fast-moving consumer (FMCG) goods have witnessed a surge in demand during the festive season, beverages and homecare product segments have seen a decline in consumption.

Products that have witnessed growth in sales over the last three months include packaged food, personal care, confectionery and commodities.

As per a data sourced by BusinessLine from Bizom, a retail intelligence platform that tracks consumer product sales from 7.5 million outlets, beverages witnessed a 12.7 per cent drop in sales in August while homecare products have witnessed 11.1 per cent dip in sales.

Beverage products saw a 42.2 per cent drop in sales in July m-o-m as compared to 8.8 per cent drop in June. Homecare products witnessed a 3.7 percent drop in sales in July and 1.8 per cent growth in sales in June. “The inflation has impacted big-ticket consumer products which were heavy on the pocket while in the beverage industry, where the juices and aerated drinks start at ₹10 has seen a rise in consumptions,” said Mitkaran Singh Ghai, Co-founder, Groovy Juice (Enhaz Beverages).

Commodity good sales up

Commodity goods have witnessed an increase in sales by 16.8 per cent in August on m-o-m basis as compared to 17.6 per cent in July and 17.7 per cent in June while confectionary products saw increase in sales by 2.5 per cent in August as compared to 1.2 per cent in July and 0.5 per cent in June.

The packaged food products also saw an increase in sales by 3.7 per cent in August as compared to 4.7 per cent in July and -0.9 per cent in June. “We did see the impact of price inflation earlier on discretionary products and that has eased off a little by capitalising on greater social interactions. Beverage sales lost fizzle with the onset of monsoons this year,” said Akshay D’Souza, Chief of Growth & Insights, Bizom.

The decline in sales has primarily been due to price inflation and consumers preferring to spend on essential products while companies are expecting sales to increase during the festive season.

“We have seen signs of a pick up in demand, but the market is still slow. There is an increased demand for smaller packs. While Q2 is up, it has not panned out the way we expected., we do see an increase in demand with the upcoming festive season.,” said Neeraj Khatri, Chief Executive, Consumer Care, India and SAARC Business, Wipro Consumer Care & Lighting.

Confectionaries down

Further, the demand of confectionary products could witness a dip during the festive season as per experts. “Confectionary products will see pressure as the increase in Indian mithais in the festive season when consumption surges,” added D’Souza.

“The premium chocolate gifting market grew at around 35 per cent in 2021 and this year it is expected to grow by almost two times. This has been accelerated with a marked shift in the e-commerce sales volume growing at 5x of category growth,” saidGeetika Mehta, Managing Director, Hershey India

Consumers spending on essential products during the festive season also have witnessed a growth as compared to non-essential products that have witnessed a marginal growth.

Consumers stocking less

“The consumption of homecare products have not declined but consumers are stocking less to neutralise cost inflation. Spending on essentials has increased by 45 per cent for the families but spending on non-essentials is cautious and only 7 per cent plan to increase their spending. 20 per cent of the consumers plan to shop more this festive season as compared to last year,” said Pradeep Gupta, Chairman & Managing Director, Axis My India, a consumer data intelligence company.

After witnessing negative sales in July, personal care products saw a surge in sales in August with 14.1 per cent growth compared with 13.3 per cent drop in July and 3.3 per cent growth in June.

“With retail inflation continuing to impact consumers, we have taken the hit of inflation and have retained maximum retail prices of our bestsellers. We have achieved a triple-digit growth as compared to pre-Covid growth level, witnessing a significant growth for our core categories—Sebium (Acne prone skin) and Atoderm (Dry Skin),” said Sanjay Sahu, Managing Director, NAOS Skin Care India Private Limited (Bioderma).

Product costing and affordability will impact the sales even during the festive season, “Brands are moving to minis to tackle this situation. Also traditionally we have seen that minis have worked the best in the Indian consumer market,” Harini Sivakumar, CEO & Founder, EarthRhythm

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.