India’s crude oil imports are expected to grow from October level during the remaining two months of the calendar year in line with the ongoing festival and marriage season, which also witnesses an uptick in industrial, construction and farm activities.

Analysts and trade sources said that domestic oil marketing companies (OMCs) have increased refinery runs for the remainder of 2023 to meet the growing demand for auto fuels, bitumen, fuel oil and other refined petroleum products.

A top official with a public sector OMC explained, “Traditionally, consumption rises during October-March in line with the festival and marriage season as well as industrial and construction activity. Besides, agricultural activity for Rabi season also picks up. This coupled with some exports will push demand.”

- Also Read: Global trends to dictate movement in markets this week amid lack of domestic triggers: Analysts

Energy intelligence firms Kpler and Vortexa also expect crude imports by the world’s third largest energy consumer to grow in November and December this year.

Similarly, OPEC in its latest monthly oil market report for November said, “India’s crude imports fell further to an average of 4.3 million barrels per day (mb/d) in September, the lowest in a year, although are expected to recover with the start of Q4 2023.”

Rising imports

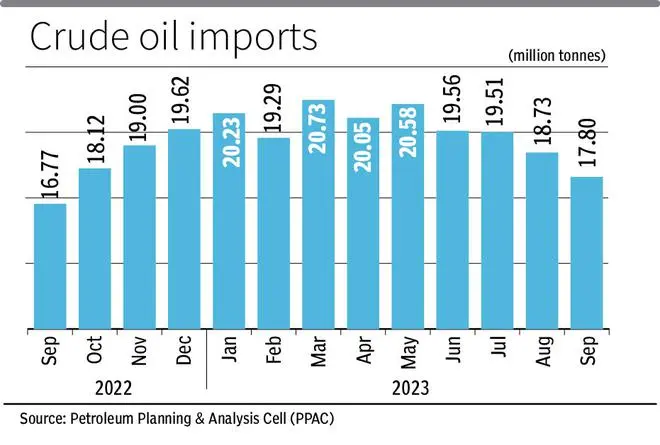

Kpler’s Lead Analyst (Dirty Products and Refining) Andon Pavlov said considering that maintenance season is now starting to wane and seasonally demand at home starts to pick up, following the monsoon season and as visible in the latest Petroleum Planning and Analysis Cell (PPAC) data, refinery runs are also going to increase gradually over November and December, pushing import requirements higher as well.

India imported 4.66 mb/d of crude in October, which is almost flat compared to September, Kpler data show.

“In our books, we see (refinery) runs standing at 5.3 Mb/d and 5.45 Mb/d in November and December, respectively, some 500,000 barrels per day (b/d) and 130,000 b/d higher Y-o-Y over said months, (respectively), mainly due to a baseline effect from last year,” he told businessline.

However, Pavlov said, considering that discount on Russian imports has diminished somewhat over the past months and in light of seasonal tightening of the Russian crude balance towards the end of year, as refinery runs seasonally increase, it seems like the share of Russian crude is going to remain in check at best.

- Also Read: Crude Check: Support holds ground

Discount on Russian crude to India continues to be lower at around $4-5 per barrel in May-August 2023 against $6-10 earlier.

Vortexa’s chief analyst for Asia Pacific, Serena Huang said, ”I expect India’s crude imports to continue rising through to December, with demand supported domestically by the festive season and exports.”

Rising consumption

India’s oil demand outlook in Q4 2023 should continue to benefit from strong annual GDP growth in 2023, combined with robust manufacturing activity and a proposal by the government to increase capital spending on construction, OPEC said.

Besides, the post-monsoon harvesting season and construction activity are also expected to support oil demand growth. In addition, the forward-looking indicators show strong manufacturing and services PMIs, suggesting prospects for healthy oil demand in the near term, it added.

“In Q4 2023, oil demand is projected to grow by 243,000 b/d, Y-oY. Distillates are expected to be the driver of oil demand growth, supported by harvesting, construction and manufacturing activity. Additionally, traditional festivities are expected to support mobility and boost gasoline demand, while increasing air travel is expected to support jet/kerosene demand,” OPEC projected.

Similarly, S&P Global Commodity Insights said, “Overall, India’s oil demand is expected to grow by 258,000 b/d in 2023, revised higher by 9,000 b/d from last update on strong diesel sales. Middle distillates, gasoil, and kerosene/jet fuel combined will account for more than 50 per cent of the growth, with gasoline and naphtha together to contribute 27 per cent of the growth.”

The demand for petrol and diesel rose to a four-month high in October, while jet fuel sales surged to their highest in the current financial year and calendar year as rising industrial and construction activity coupled with the onset of the festival season boosted sales.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.