The Unified Payments Interface is the clear leader in digital payments but credit cards are still finding takers.

In fact, despite the growing adoption of UPI and alternatives like Buy Now Pay Later, most banks are upbeat about their credit card portfolios and believe that the segment will continue to grow. This is evident in their fourth quarter earnings commentaries as well as the recent acquisition of Citi’s consumer banking franchise in India by Axis Bank.

A recent report by Kotak Institutional Equities said that the share of cards (credit and debit) in private final consumption expenditure has grown from less than 4 per cent in 2013 to about 12 per cent in 2021. The share of UPI in PFCE too is at a similar 12 per cent.

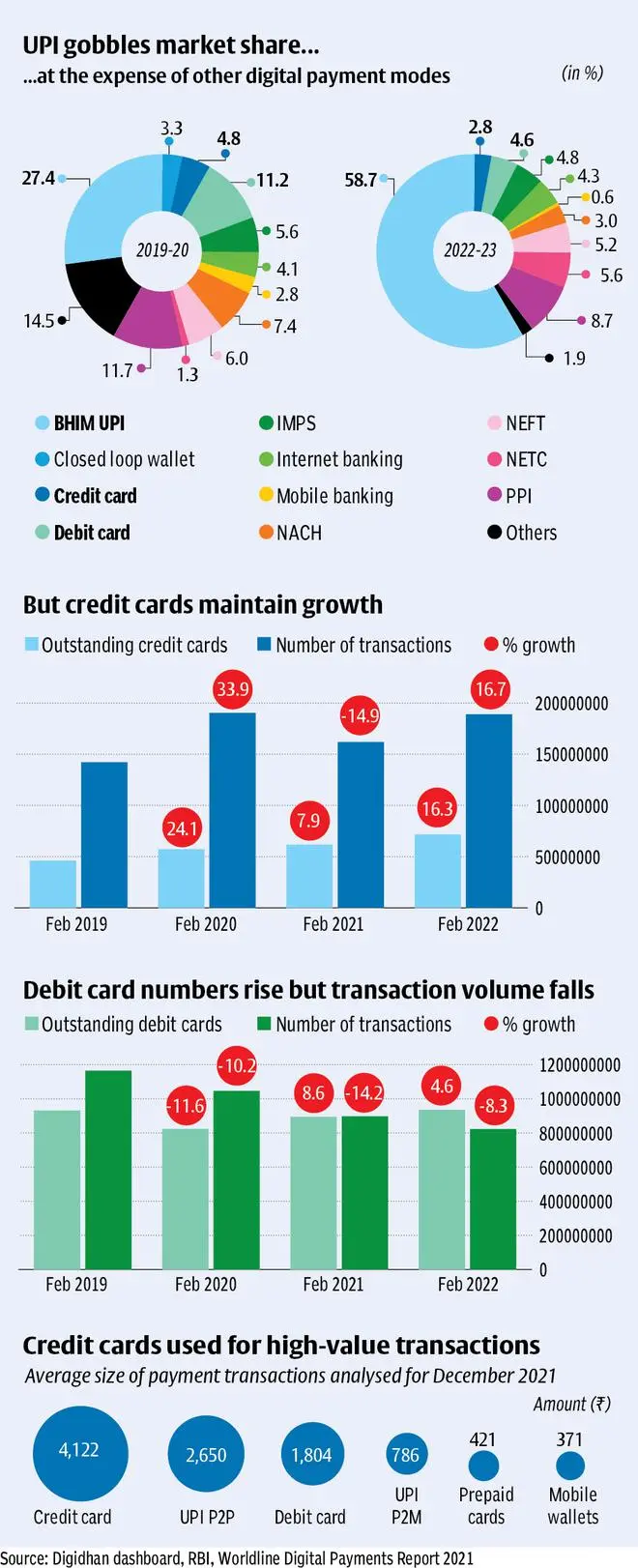

Official data reveals that UPI has seen huge acceptance and made up for 52.5 per cent of all payments made through digital modes in 2021-22. It grew further to near the ₹10 lakh crore mark in April with transactions valued at ₹9.83 lakh crore last month.

Credit cards make up for a small chunk of digital payments but issuances and spends are on the rise.

In absolute terms, the value of transactions from credit cards increased by nearly 26 per cent to ₹222.2 crore in 2021-22, from ₹176.47 crore in 2020-21. However, in percentage terms, it was lower at 2.56 per cent of all digital payments in 2021-22 from 3.18 per cent in 2020-21.

According to data with the Reserve Bank of India, credit card issuances have increased 16.3 per cent year on year to ₹7.71 crore by February end 2022.

“Both digital payments such as UPI and credit cards are seeing an increase in usage and customers given the huge under penetration of financial services and credit. The pie is growing and so both these segments are growing,” noted a banker, adding that credit cards are the preferred mode for payment for larger ticket size spends.

The average transaction size on credit cards too increased to ₹4,122 in 2021 from ₹3,653 in 2020, said the Worldline India Annual Digital Payments Report 2021.

The report however, said that UPI P2M transactions had significantly eaten into the share of card and other payment modes. “UPI emerged as the most preferred payment mode among consumers with a P2M market share volume of 56 per cent while its share of the value of transactions was 41 per cent,” it said.

Debit cards

A greater impact however, seems to be on debit cards where data indicates that spends are on the decline even though they continue to have a large base.

The total number of debit cards rose 4.6 per cent to 93.5 crore by February end 2022 from 89.4 crore a year ago. However, spends fell to ₹396.89 crore in the fiscal 2021-22 from ₹411.49 crore in the previous fiscal. It is pertinent to note that debit cards still held a larger share in the digital payments pie at 4.57 per cent in 2021-22 compared to credit cards.

The average ticket size of debit cards in year 2021 was ₹1,804 against ₹2,568 in 2020. Though the average ticket size and transaction value of credit cards are higher than debit cards, the latter remain the preferred mode of payment among consumers thanks to its huge outstanding base, the Worldline report noted.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.