Dividend receipts from central public sector enterprises (CPSEs) are among the principal sources of revenue for the Centre and the revenue from this source far exceeded the Budget estimates in FY21 and FY22. While the dividend receipts so far in FY23 have been good, a large part relates to the performance in FY22. With the outlook more subdued for commodity producers this fiscal, bounteous dividends may not be on the cards for the rest of the year.

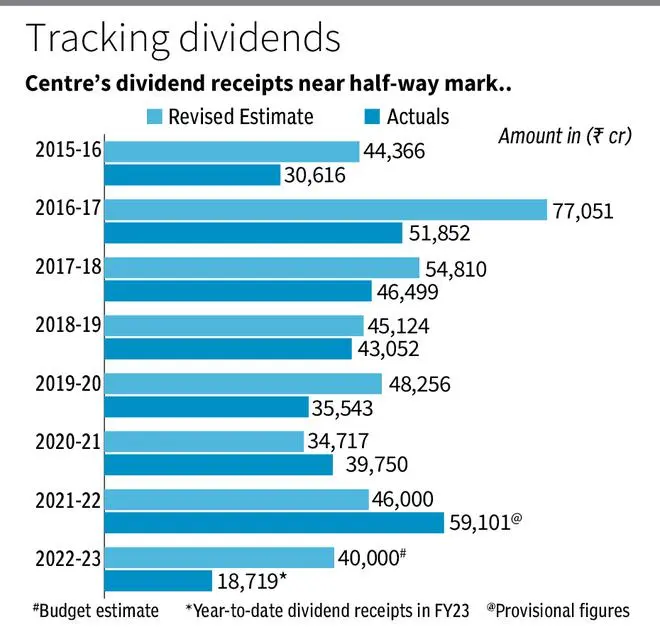

In FY21, the Centre mopped up ₹39,750 crore in dividend receipts from CPSEs against the revised estimate of ₹34,717 crore for the year. In the previous fiscal, the Centre received one of the highest ever dividend receipts of ₹59,101 crore, which was 28 per cent more than its revised estimate of ₹46,000 crore. The spike in dividend receipts in the previous fiscal was led by a sharp rise in price of commodities such as oil and gas, metals and mining, which led to supernatural profits by commodity-based public sector enterprises and oil marketing companies (OMCs).

For the current fiscal, the Centre has budgeted ₹40,000 crore from dividends from CPSEs. On a year-to-date basis, the Centre’s dividend receipts are close to the half-way mark. According to Department of Investment and Public Asset Management (DIPAM) data, the total dividend received from CPSEs stands at ₹18,719 crore or 46 per cent of FY23 budget estimate.

Current norms require every CPSE to pay a dividend of 30 per cent of profit after tax or 5 per cent of the net-worth, whichever is higher. In November 2020, DIPAM issued an advisory regarding ‘consistent dividend policy’ under which CPSEs are asked to pay interim dividend at the end of every quarter instead of bunching them for the year-end.

Mixed bag

Madan Sabnavis, chief economist at the Bank of Baroda, said the dividend picture for FY23 will be mixed. The OMCs are making losses and will not be able to deliver while oil exploration companies have paid windfall tax and will not have much to distribute. The steel industry has seen profits fall and hence will distribute less.”

In July, the Centre introduced a windfall tax, as a special additional excise duty, aimed at absorbing the super profits earned by domestic crude oil producers arising from a spurt in international energy prices. While the move may reduce the dividend payouts of OMCs, it will lead to additional tax revenues from the oil firms.

OMCs’ performance

All the three major state-run OMCs have posted net losses in the latest quarter. Bharat Petroleum posted a net loss of ₹338.49 crore in Q2 FY23 against a net profit of ₹3,149 crore in the same quarter of the previous fiscal while Hindustan Petroleum recorded a net loss of ₹2,172 crore (net profit of ₹1,923 crore) while Indian Oil’s net loss stood at ₹272 crore (net profit of ₹6,360 crore) during the comparable period. On the other hand, PSUs like ONGC, NTPC, Coal India, Power Finance Corporation and many others have posted net profits.

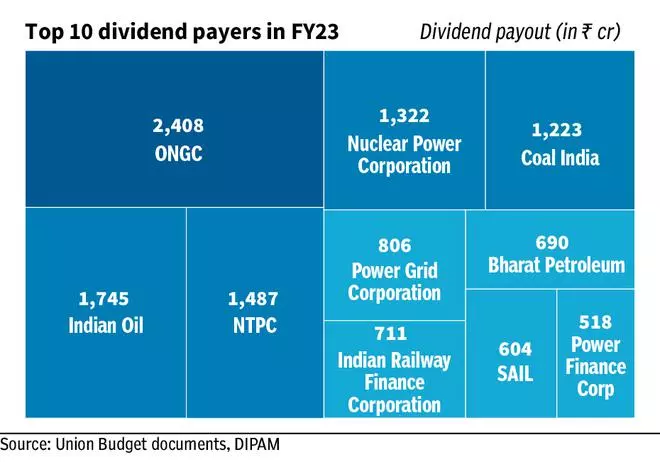

During the current fiscal, the Centre received ₹2,408 crore from ONGC and ₹1,745 crore from Indian Oil being the final dividend tranches for FY22. NTPC (₹1,487 crore), Nuclear Power Corporation (₹1,322 crore) and Coal India (₹1,223 crore) were the other major dividend payers in the current fiscal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.