Even as India’s sovereign bonds make it to the global leagues and have seen a steady rise in foreign flows, the rising FPI interest has not aided a material fall in yields or improved FPI debt utilisation levels.

Indian bonds are set to be included on JP Morgan’s GBI Emerging Markets (EM) bond index starting June, while Bloomberg has announced incorporation of Indian bonds in its EM index from January 2025.

Analysts estimate the move to bring inflows of around $30-35 billion into India’s sovereign debt market, and expect it would prompt foreign funds to buy Indian G-secs resulting in fall in yields and lower cost of borrowing for the government.

- Also Read: Indian Government Securities inclusion in Bloomberg EM Index to attract $3-4 bn foreign investments

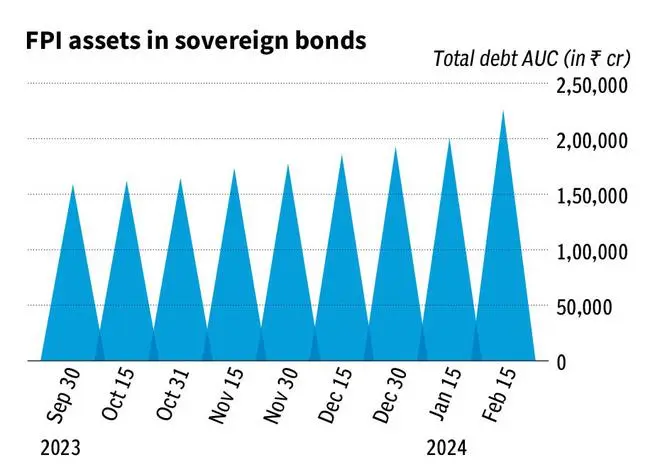

Since JP Morgan’s announcement in September 2023, foreign investors have bought close to ₹79,941 crore ($9.6 billion) of fully accessible (FAR) government bonds. However, given the staggered manner of inclusion and the fundamental challenges in Indian government securities, the yields in the bond markets have not hardened much.

As of March 8, the 10-year Indian government bond yield stood at 7.03 per cent remaining flat in the last few sessions. There has been a slight decline of 18 basis points since September 2023, but this could also be due to declining inflation, lower government borrowing budgeted for FY25 and the possible end of RBI’s rate hike cycle.

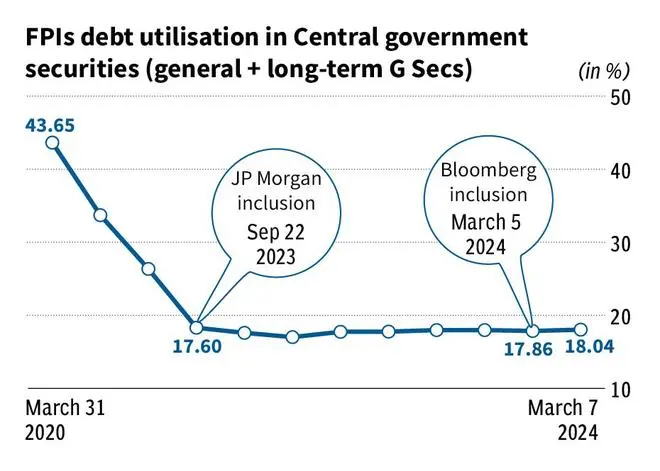

FPI utilisation of the limit in government securities also remains almost unchanged since September 2023. They have utilised 18.04 per cent of the available limit as on March 7, 2024, which is lower than 18.3 per cent limit used in March 2023 and much lower than the utilisation of 43.6 per cent in March 2020.

While inflows are coming into Indian G-secs, the large fiscal deficit is resulting in simultaneous increase in supply of fresh paper. The additional inflows have therefore not been able to move the needle, until now.

Madan Sabnavis, chief economist, Bank of Baroda, said that while there are indications of rising foreign interest in government securities in the last two months, there are challenges. “While passive buyers such as global funds and ETFs are buying into the market, for non-index funds, the bond market, unlike equity, has issues of liquidity and will see lower participation,” he adds.

The Indian government bond market is dominated by institutional investors like banks, mutual funds, insurance companies and other financial institutions, and foreign ownership is just around 2 per cent. The total sovereign funds under custody with foreign investors stands at ₹2,30,733 crore ($27 billion) as of February 29 compared to ₹1,58,765 crore ($19 billion) as of September 30.

“The build-up of foreign exchange reserves due to the inflows will help RBI have greater control over the exchange rate and in funding the Current Account Deficit. As India becomes attractive for fixed income investors globally, Indian sovereign bonds may see more interest from such global as well as India specific funds/indices and Indian corporate bonds may likely follow suit,” Jiju Vidyadharan, senior director of Funds and Fixed Income, CRISIL Market Intelligence and Analytics, said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.