In India, an Automatic Teller Machine (ATM) is a millennial. It debuted in 1987 and as the years passed, its popularity grew. Zoomer children weren’t shocked when they saw their parents use it, a machine a few feet taller than them, to dispense money every time they needed it. But as the generation enters adulthood and starts making their own money, they may find fewer of these machines.

Data from the Reserve Bank of India shows that since 2017, the number of ATMs in the country has been growing at a snail’s pace.

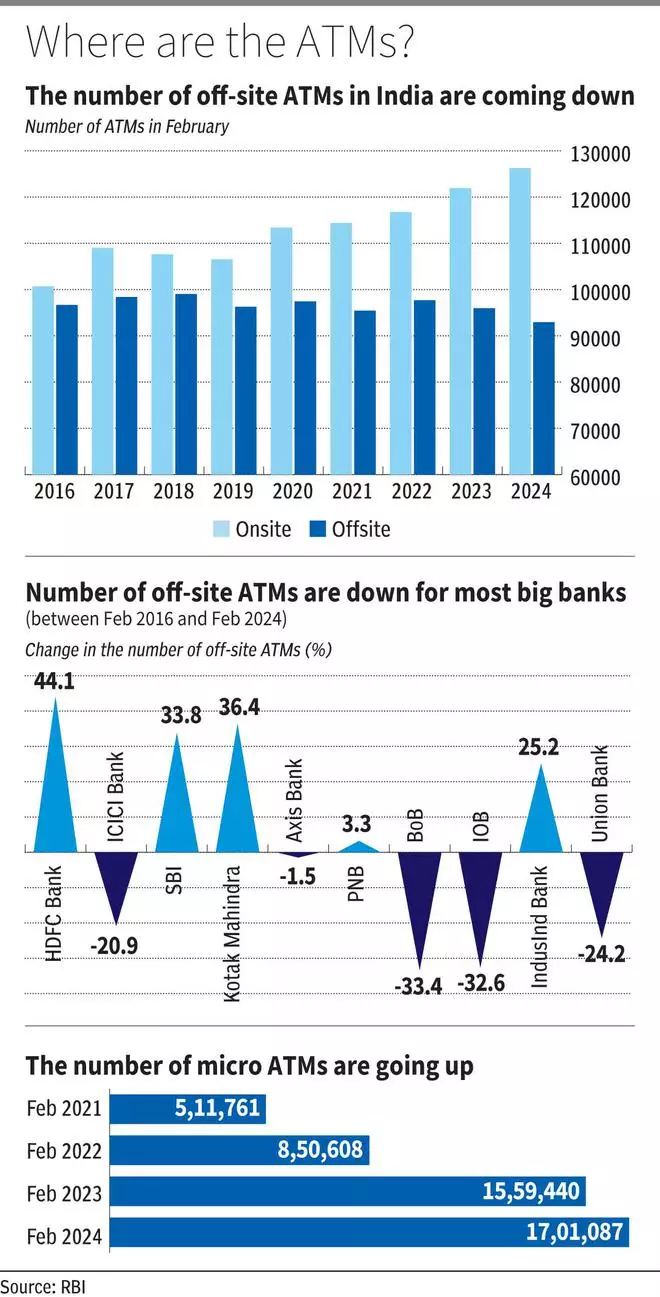

There are 2.19 lakh ATMs deployed by Indian banks, as of February 2024. This is just an 11 per cent increase from February 2016. At that time, there were 1.97 lakh ATMs, both on-site (within the bank’s premises) and off-site (outside the bank’s premises).

A closer look at the split shows that the number of off-site ATMs has been coming down since 2022. In February 2024, there were 92,000 off-site ATMs in the country. The number was 95,000 in February 2023 and 92,000 in February 2022. Among the 10 big banks in India, Axis Bank, ICICI Bank, Union Bank, Indian Overseas Bank and Bank of Baroda have seen a drop in the number of off-site ATMs.

Tiny big factors

According to the RBI, a bank must offer its savings bank account holders a minimum number of free transactions at ATMs. In the metros, the limit is a minimum of three transactions, if the customer is not using the ATM of a bank, where they have an account. After this, each transaction may attract a small fee.

According to an expert involved in cash management systems, the growth in the number of ATMs has been slowing down in the country since the RBI put a cap on the number of cash transactions via ATMs and allowed interoperability. “Since then, banks have lost the interest to put up more ATMs. There is also not much scope for innovation here,” he said, adding that the rise in UPI transactions has nothing to do with it.

He also said that the plateauing in the number of ATMs may correlate with the growing number of micro-ATMs in the country. He adds that micro-ATMs are usually low maintenance, compared to a regular ATM. Between February 2021 and February 2024, the number of micro-ATMs in India more than tripled. Micro ATMs, as the name suggests, are small ATMs or card-swipe machines that are portable and handheld. They also facilitate cardless money disbursal, using the Aadhaar-enabled payment system (AePS) at remote locations.

At the same time, the founder of a digital banking service provider says that banks are shutting down off-site ATMs owing to the high rental and maintenance costs. “The value of money withdrawn from ATMs in India is only going up. There is still a section of people who rely on cash and are yet to graduate to UPI,” he added.