Data centres have been expanding globally despite economic roadblocks, geopolitical tensions and supply chain disruptions across markets. India too has hopped onto the bandwagon, especially post-Covid. The country now ranks 14 with 151 data centres. However, data centre capacity in the country needs to grow much more, given the multitude of internet users in the country and the copious amounts of data they generate.

A data centre is a dedicated space housing networked computer, storage systems and computing infrastructure used by organisations to store, assemble, process and distribute large amounts of data. The key components of a data centre design include routers, switches, firewalls, storage systems, servers, and application-delivery controllers.

India has more than 880 million internet users, almost twice that of the US and about 12 times higher than that of the UK. However, data centre space per 1 million internet users in India stands significantly low compared to the established markets.

While the US leads by a long way with 5,375 data centres, Germany and the UK rank second and third with 522 and 517 data centres, respectively.

Growth post pandemic

The Indian data centre industry has, however, grown from occupying 2.7 million square feet (msqft) in 2017 to 11 msqft in 2023. According to market research firm Arizton, India’s data centre size stood at 447 MW in 2021. This has now increased to 819 MW. This is according to the CII-Colliers report on the growth of Indian data centres, which was released recently.

MP Vijay Kumar, Executive Director and Group CFO, Sify said digitalisation and technological adoption across sectors has contributed to the demand for data centres in the country in the last few years. “There is a data usage explosion after Covid. The emergence of 5G, which is aiding applications like IoT, machine learning has also contributed to the demand. The pivot to data localisation for reducing the latency has also led to data boom. The e-commerce and OTT sectors too have led to boom in data consumption leading to need for more data centres.”

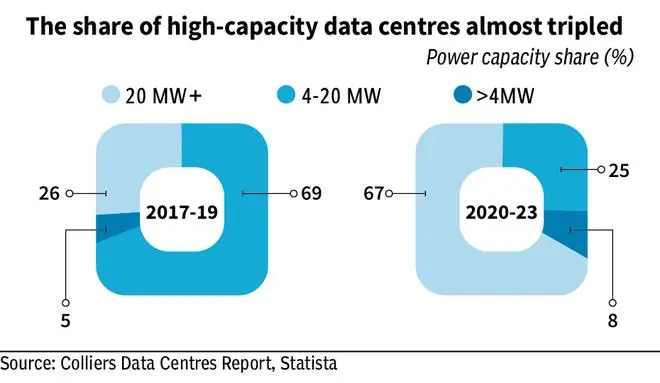

The Colliers report noted that the data centre capacity is likely to double up faster in the next phase of growth, crossing 1,800MW by 2026. There has been a rise, especially, in high-capacity data centres (with capacity over 20 MW) in the post-Covid era. “A major factor behind the development of high-capacity data centres is the demand from hyperscalers (large cloud service providers), which is ultimately being driven by the increased end-customer demand, these include public cloud and SaaS solutions, “ says Vimal Kaw, Colocation Product Head and New Site Selection Lead, NTT Ltd.

Mumbai is on the radar

Mumbai has the highest share of data centre capacity in India at 50 per cent followed by Chennai at 14 per cent and cities like Hyderabad and Pune are poised to grow at a much faster rate in the next few years owing to supporting infrastructure and encouraging regulatory framework.

Factors such as location, proximity to landing stations, fibre connectivity, uninterrupted power supply and high score on disaster proofing are some of the key parameters to decide on a location for setting up data centres.

“In the future, cities like Hyderabad are poised to grow at a much higher pace mainly due to data consumption demand and real estate boom and land availability,” says Vimal Nadar, Senior Director and head of Research, Colliers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.