As the Reserve Bank of India (RBI) announces its monetary policy on Friday, the focus will be on the measures taken to support the rupee, which is down 8.9 per cent this year.

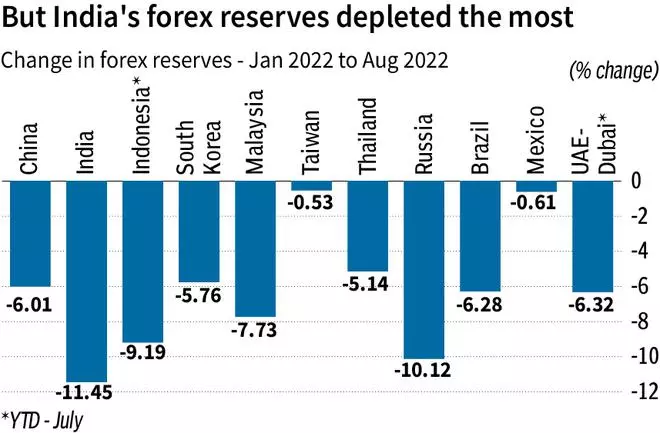

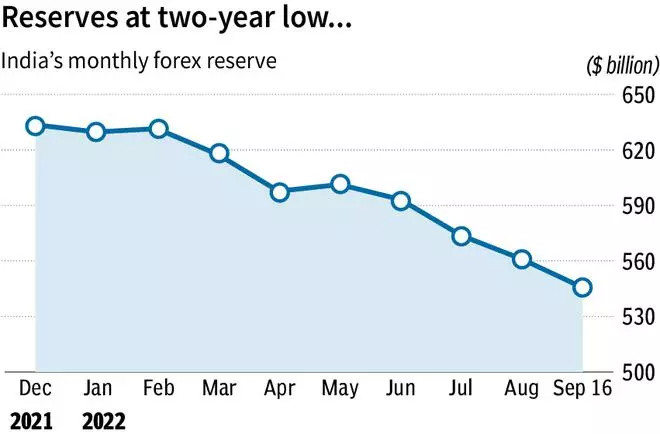

The central bank has been fighting hard to stop the rupee from sliding over the past few months. As the RBI sold dollars, India’s forex reserves have contracted sharply; the reduction in reserves is the highest in India compared to other emerging economies.

Since the beginning of 2022, India’s foreign exchange has fallen 13.88 per cent from $633.6 billion to $545.6 billion as on September 16. But other emerging economies were also in a similar boat as a stronger dollar caused a sharp fall in their currencies. Behind India, Russia’s reserves witnessed a fall of more than 10 per cent as of August, followed by Indonesia with 9.19 per cent reduction as of July. Taiwan’s forex reserves have declined the least; down 0.53 per cent.

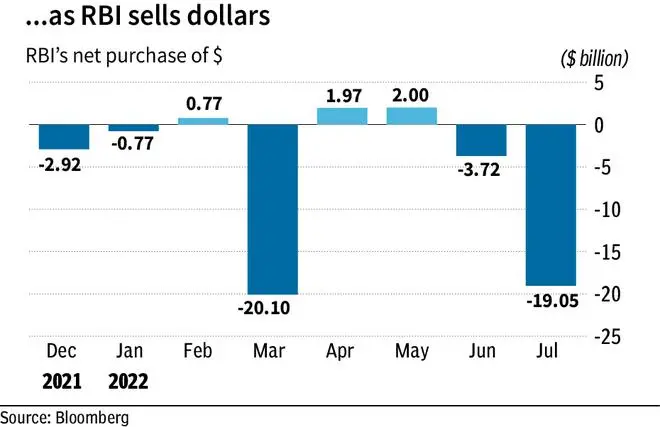

The RBI net sold $38.9 billion between January and July as it tried to stop the rupee’s fall. The highest net selling was in March at $20.1 billion, followed by $19.04 billion in July.

Falling currencies

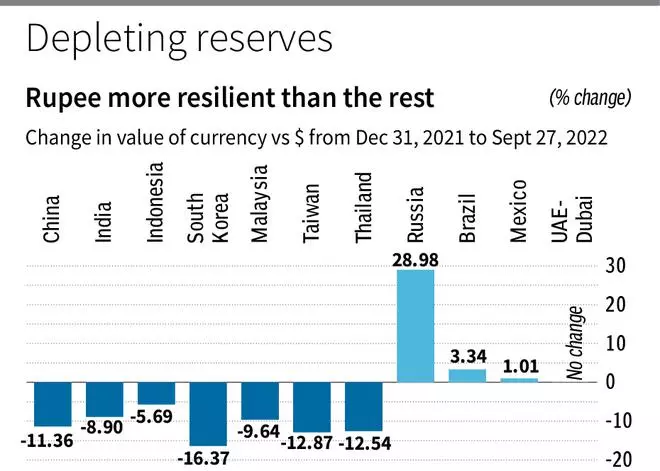

All the currencies of emerging markets have been under pressure since the beginning of the year. Besides, Federal Reserve’s actions, strengthening of the dollar, high crude oil prices, geopolitical and economic uncertainties have also roiled EM currencies. Most of them lost ground against the dollar, with the exception of Russia, Brazil and Mexico whose currencies gained due to soaring commodity prices. The Russian ruble has appreciated the most in value by 28.9 per cent since January.

The South Korean won has declined the most this year, down 16.37 per cent, followed by Thailand and Taiwan at around 12.5 per cent. The Chinese yuan, too, has depreciated by 11.36 per cent.

The Indian rupee was among the most resilient until September 14, with YTD loss of 6.9 per cent. But the recent FOMC announcement of aggressive rate hikes in the future resulted in a sharp decline over the last 10 days, making the rupee lose around 9 per cent this year. Given this decline in forex reserves, the RBI will have to look at deploying other tools to support the currency in the monetary policy.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.