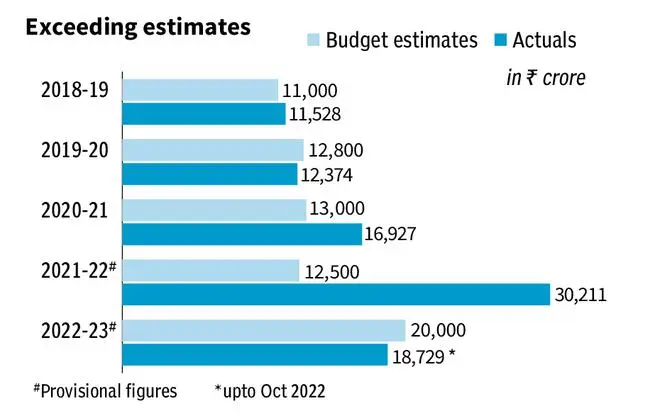

For a third year in a row, Centre’s revenue from the Security Transaction Tax (STT) is likely to exceed its budget estimates by a wide margin. Thanks to the robust turnover in the stock market, STT collections in the first seven months have already touched 94 per cent of the full year target.

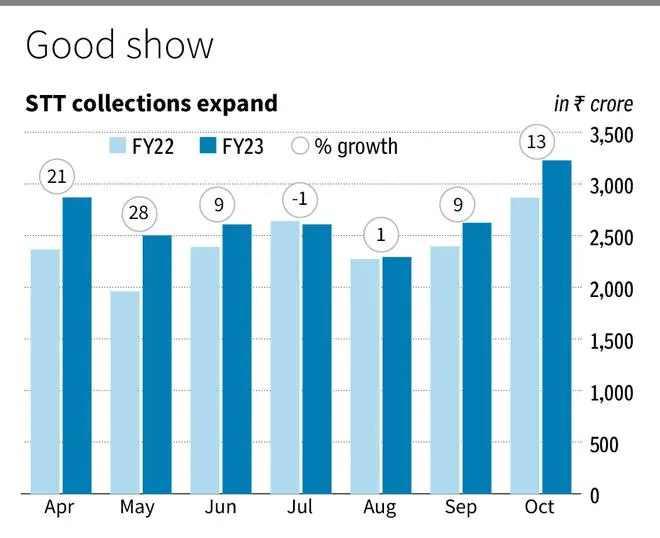

As per provisional figures, the Centre has collected ₹18,729 crore in STT between April and October, registering an 11 per cent growth over th eprevious fiscal’s ₹16,889 crore.

Not the first time

For FY23, the Centre budgeted ₹20,000 crore in STT and with the current run rate, it is likely to overachieve the target. But this is not the first time it has happened.

In FY21, the Centre had budgeted ₹13,000 crore in STT while the actual realisation jumped over 130 per cent to ₹16,927 crore. In FY22, the Centre budgeted ₹12,500 crore and later revised it to ₹20,000 crore in the 2022 Budget.

As per provisional figures, Centre’s actual STT collections in FY22 stands at ₹30,211 crore.

STT is a direct tax levied on purchase and sale of securities listed on stock exchanges. The tax is charged on equity, derivatives, units of equity-oriented mutual funds, unlisted shares sold under an offer for sale to the public included in initial public offering (IPO). The rate varies from 0.025 per cent to 0.25 per cent depending upon the type of security traded and the nature of the transaction (purchase or sale).

Stock market

Stock market experts attribute the growth in tax collections to the stock market performance and growing retail participation in equity and derivatives markets. “Indian stock market has been buoyant this year, especially, after June from where Nifty rose by around 20 per cent,” said VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

He added that the other dominant feature of the market performance in 2022 is the eclipsing of foreign investors (FIIs) by domestic investors. “Retail investors now account for 52 per cent of the daily trading volume in exchanges.”

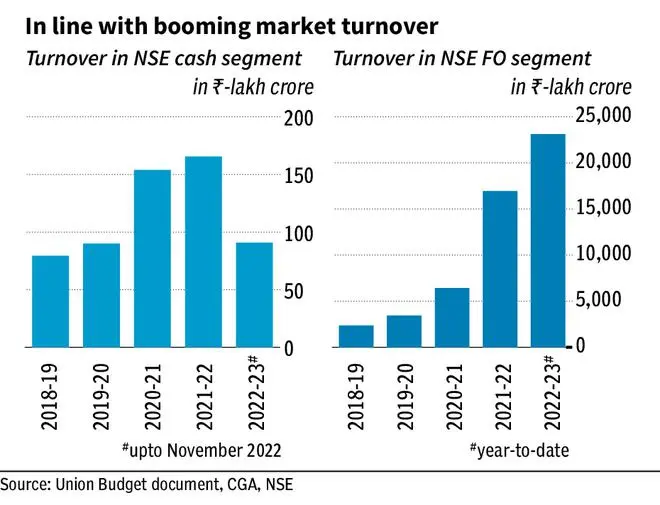

Higher retail participation in the stock market was also evident from the strong growth in turnover of the National Stock Exchange (NSE). Its turnover in the equity cash segment jumped from ₹90-lakh crore in FY20 to ₹166-lakh crore in FY22. The turnover already touched ₹91-lakh crore as of November. Not just the cash segment. A growing number of retail investors are also dabbling in the Futures and Options (F&O) segment. NSE’s turnover in derivatives segment exploded to ₹16,952-lakh crore as of FY22 against ₹3,454-lakh crore in FY20.

Vikas Gupta, CEO and Chief Investment Strategist, OmniScience Capital said FY24 is likely to see no rate hikes and possibly even some rate cuts by the US Fed and the RBI to support growth.

“In this situation, the FPI/FIIs are likely to come back for the long-term India growth story. Many investors, whether retail, family offices or institutional (DII/FII), are using derivatives to hedge or to take positions in anticipation of the FIIs coming back once the December tax-loss harvesting is over,” he added.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.