Foreign investors are exiting from Indian IT stocks like never before, fearing the recession cloud in developed economies to overshadow the ongoing digital transformation party.

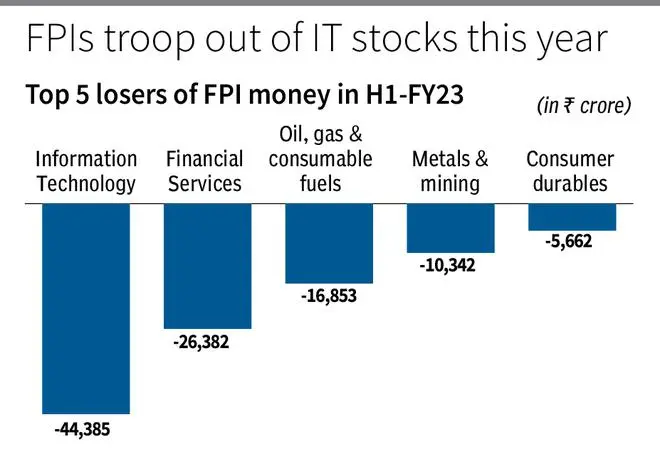

The Information Technology (IT) sector was the highest loser of foreign funds in the first half of the current fiscal. As per the latest depositories data, foreign portfolio investors (FPIs) have pulled out a net investment of ₹44,385 crore from the IT sector between April and September 2022. It was followed by the financial services sector (₹26,382 crore), oil, gas and consumable fuels (₹16,853 crore), metals and mining (₹10,342 crore) and consumer durables (₹5,662 crore).

The outflow from the IT services sector in the first six months of the current fiscal year is nearly 90 per cent of what the foreign investors have pulled out in FY22. FPIs pulled out ₹49,660 crore from the IT services sector in the previous fiscal after investing a net sum of ₹3,028 crore in FY21.

VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said the IT services industry was the best performer in 2021 and one of the poor-performing sectors in 2022.

Higher valuations

“The over optimism about the growth of the sector pushed the valuations into unjustified territory in 2021. Now, there are concerns regarding the near-term growth due to the slowdown/possible recession in the US, and this has pushed the valuations down. FPIs are bearish on the near-term prospects of the IT sector,” Vijayakumar said.

The Indian IT industry had a stellar run over the last two years as the Covid-19 pandemic led to widespread digital transformation across industries. In 2021, the Nifty IT index rallied 59 per cent driven by the strong earnings posted by IT companies, which bagged multi-million-dollar digital transformation deals in the US and Europe.

However, the IT index began to correct over the last few months as the FPIs pulled out massive sums from the sector due to concerns over their steep valuations, high inflation and fears of economic slowdown in developed economies, which may translate into lesser spending on IT transformation.

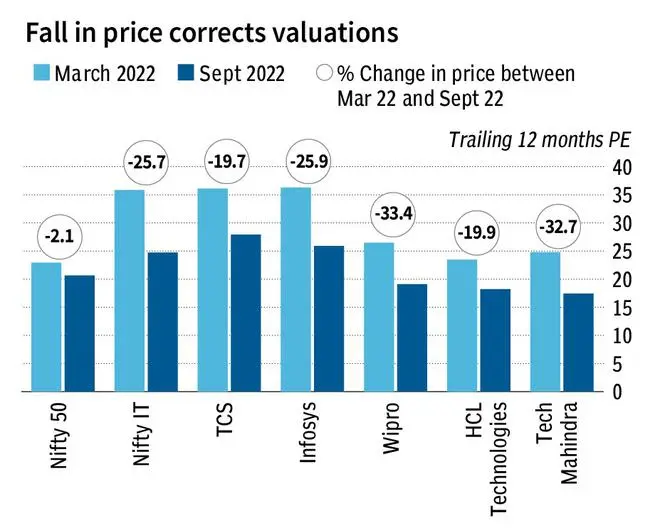

The Nifty IT Index fell by 25.71 per cent between March and September 2022 against the 2.12 per cent fall by the Nifty 50 Index. The stock price of country’s largest IT services exporter, TCS, fell by 19.66 per cent during this period, while the price of other major software companies like Infosys, Wipro, HCL Technologies and Tech Mahindra have all corrected by 19-33 per cent.

Kranthi Bathini, an equity strategist at WealthMills Securities, said it’s not just the Indian IT stocks but even the tech-heavy US Nasdaq Index has fallen by 30 per cent on a year-to-date basis. “FPIs have high exposure to BFSI and IT sectors, so, naturally when FPIs are pulling out money from India in a big way, you see a big exodus in these two sectors. Also, the IT sector outperformed in the last 18 months, which led to skyrocketing valuations of many stocks in India and the US. This is now seeing a correction,” Bathini added.

Price-to-earnings multiples

The sustained FPI sell-offs have also brought down IT stocks’ valuations over the last few months. The 12-month trailing price-to-earnings multiples of the top IT companies compressed from 23-36 times to 17-27 times due to the ongoing correction in the sector.

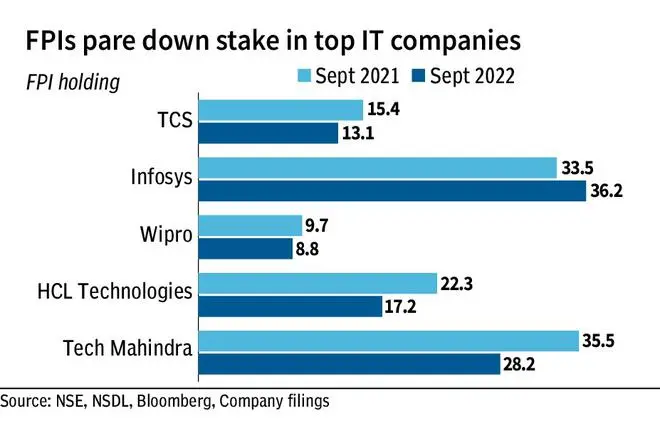

FPI shareholding in major IT companies, except Infosys, has also come down yearly as of September 2022. FPI holdings in TCS as of September 2022 fell to 13.05 per cent (from 15.37 per cent), while that of Infosys went up to 36.20 per cent (33.46 per cent) during this period.

Despite economic uncertainty, the four major IT companies — Infosys, HCL, Wipro and TCS — have reported strong growth in Q2FY23 and a healthy pipeline of new contracts. The overall management commentary was also cautious but not that gloomy, as these companies saw no change in client spending in key geographies despite the volatility and possible economic slowdown across the globe.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.