The net assets of the Indian exchange traded funds and index funds grew by a healthy 43 per cent year-on-year to ₹5.21-lakh crore as of June 2022 from ₹3.65-lakh crore in the same quarter of the previous fiscal. It further grew to ₹5.72-lakh crore as of July 2022.

Industry experts attribute the strong growth to the rising awareness about the passive investment products , historical underperformance of active funds, investors looking for diversification; and availability of a wider range of investment themes under passive investment products now.

A passive investment strategy does not require active fund management as these funds simply track an underlying benchmark. With the reduction is information asymmetry globally, active funds have been struggling to beat their benchmarks, strengthening the case for passive funds. These include index funds, gold ETFs, other ETFs and international ETFs.

“Biggest reason for growth of ETF and index fund assets is awareness. Due to the exponential rise of retail demat accounts in the pandemic, ETF demand has also grown in the same proportion,” said Pratik Oswal, Head of Passive funds, Motilal Oswal Asset Management Company Ltd.

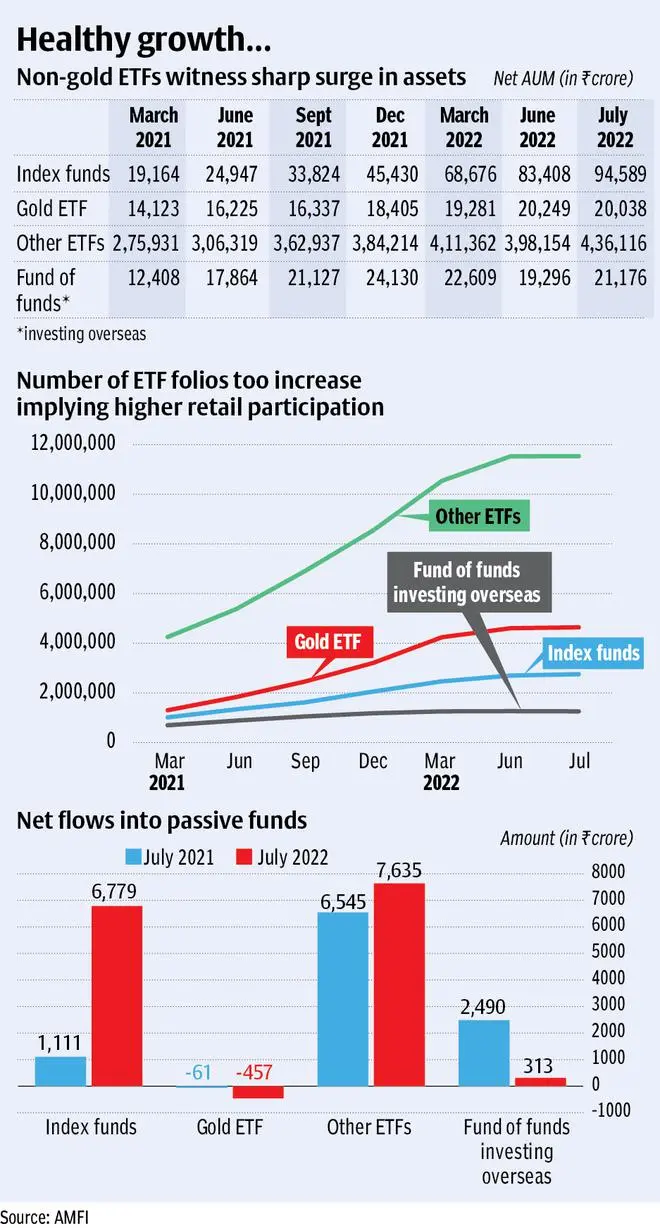

Index funds witnessed the sharpest increase in net assets y-o-y to ₹83,408 crore as of June 2022 from ₹24,947 crore during the same quarter previous fiscal. It was followed by ‘other ETFs’ whose assets grew to ₹4.36-lakh crore as of July 2022 from ₹3.06-lakh crore in June 2021. Assets of gold ETFs and international ETFs grew by 25 per cent and 8 per cent, respectively, during this period.

“Rising interest in passive investing is aiding the growth of ETFs in general. The highlight, however, is the rise in Debt ETFs in recent times. Target Maturity Debt Funds, as a category, has grown the fastest in the last one year and have significant contribution to the growth of ETFs,” said Radhika Gupta, MD & CEO, Edelweiss AMC

Spike in retail participation

The number of folios (mutual fund accounts) also recorded a significant jump implying higher retail participation. For instance the number of folios under Other ETFs nearly doubled from 53.81 lakh in June 2021 to 1.15 crore folios as of July 2022.

Edelweiss’ Gupta attributes the spike in new folio addition to incremental contribution from the EPFO as well as growing participation from retail and high networth individuals (HNI) investors. “The rise of Debt ETFs, mainly BHARAT Bond ETFs, has also aided this growth over the last one year. Debt ETF is the newest category, and the target maturity structure specifically, is appealing to a lot of HNI and institutional investors due to its simplicity, transparency, and visibility of returns it provides.”

Anand Varadarajan, Business Head - Banking, Alternate Products and Product Strategy, Tata Mutual Fund,said,

“With the digital proliferation, execution of these products (index funds and ETFs) have been made easier, which is why many do-it-yourself (DIY) investors are preferring this. Also, some investors find it easier to buy the indices rather than choosing individual stocks or active funds, so some part of allocation is going towards simple passive investing.”

Other ETFs

Among the four schemes, Other ETFs received the highest net inflow of ₹93,010 crore between July 2021 and 2022 followed by Index Funds (₹55,701 crore), International ETFs (₹8,179 crore) and Gold ETFs (₹3,011 crore).

“The biggest contributors to ETFs are the pension or retirement funds. Approximately 80-85 per cent of the ETF AUM that gets added every month is due to these funds,” Motilal Oswal AMC’s Pratik said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.