Last week, Hitachi Payment Services launched the country’s first UPI-based ATM at the Global Fintech Fest in Mumbai. These white-label UPI-ATMs, launched in partnership with the National Payments Corporation of India, allow customers to withdraw cash without a debit or credit card.

Sharing a viral video on the functioning of the new UPI-ATM machine on X (formerly Twitter), industrialist Anand Mahindra wrote, the speed at which India is digitising financial services is simply dazzling, adding “Alarm bell for credit card companies?”

While the credit card industry may not have to lose sleep over the latest innovation, UPI ATMs do pose an existential threat to their poorer cousin, debit cards.

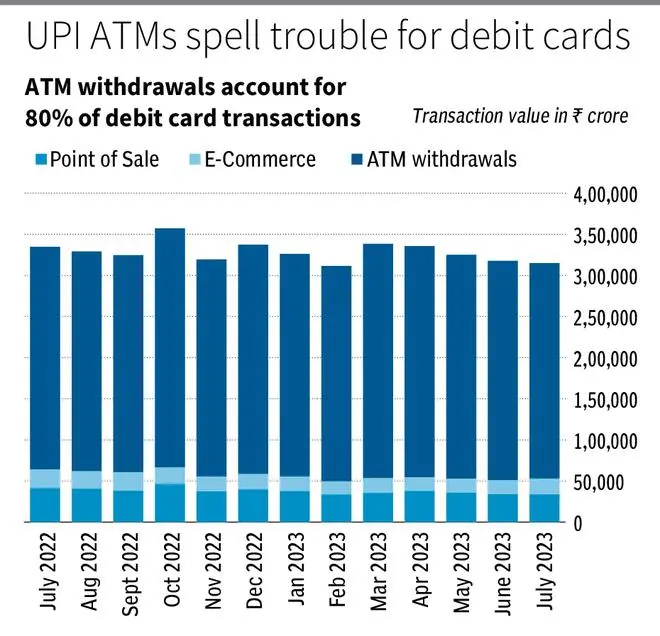

That’s because ATM withdrawals are the currently the major use case for debit cards. In July, ATM withdrawals accounted for over 80 per cent of the ₹3.15-lakh crore of debit card transactions, followed by transactions done through point-of-sale at merchant locations (11 per cent) and e-commerce (6 per cent).

“Debit cards are predominantly used for cash withdrawal at ATMs, aside usage at POS and online commerce. I foresee the volume of ATM withdrawals using debit cards surely getting impacted with the introduction of UPI ATMs,” said Ajay Rajan, Head - Digital & Transaction Banking, YES Bank.

No immediate threat

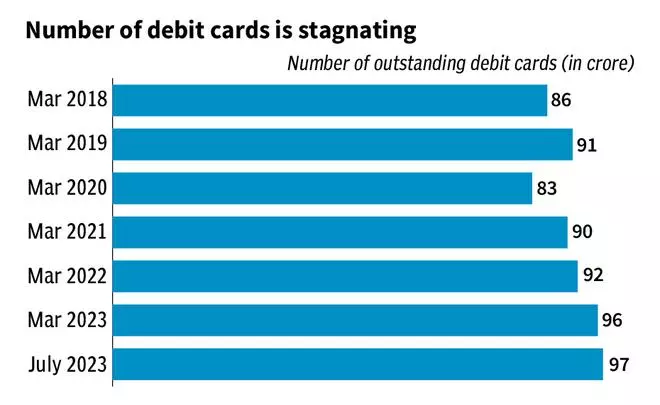

Rajan, however, added that there won’t be any immediate threat to debit card issuance since most banks would prefer giving customers that optionality, while also preferring to install hybrid ATMs, offering both debit cards and UPI-enabled cash withdrawal facility to their customers, including for international card acceptance.

Ever since the launch, several banks have announced that they would deploy UPI-only ATMs to their network. Bank of Baroda said it will go live with over 6,000 ATMs. According to Rajan, YES Bank has already launched this feature on a few ATMs and is working on upgrading its remaining network to enable UPI cash withdrawals. “It also remains to be seen how UPI-only ATMs are priced compared to hybrid ATMs, for banks to make that decision,” Rajan added.

Added option

Rishi Dhariwal, Group Head- Liability, AU Small Finance Bank, sees UPI ATMs as an opportunity for banks to offer additional withdrawal options to customers.

Dhariwal said, while cash withdrawal has been one of the reasons for consumers to use debit cards, it also provides consumers with multiple transaction avenues. “We also offer premium debit cards to our customers which have reward programs, lounge access and offers across marquee brands making debit cards a compelling product. Many banks have also enabled EMI on debit card programs which allows easy consumer finance to customers,” he said.

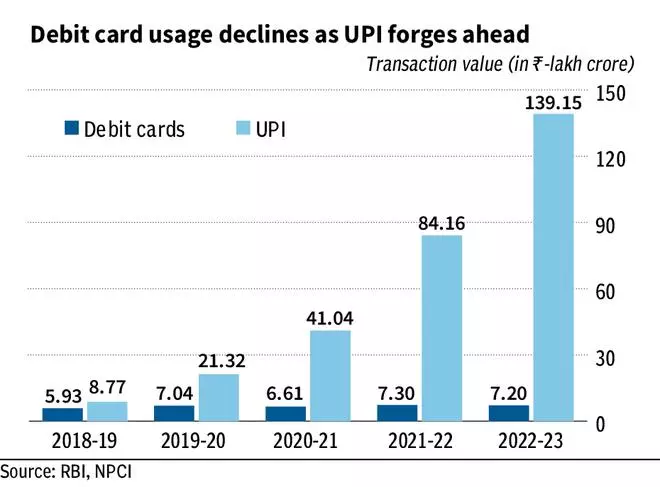

In the last few years, debit cards have been ceding their space to UPI based payment options. While the total transaction value of debit cards went up from ₹5.93-lakh crore in 2018-19 to ₹7.20-lakh crore in 2022-23, the total value of transactions under UPI jumped over 15 times to ₹139.15-lakh crore from ₹8.77-lakh crore during this period.

Higher withdrawal limits

Manjunath Rao, President, Managed Services, CMS Info Systems said, while it is encouraging to see the convergence of the digital and physical world with UPI-enabled ATMs, the Interoperable Cardless Cash Withdrawal (ICCW) enabled ATMs, that allow cash withdrawal from any bank ATM through any UPI application, will be available as a transaction feature for the respective bank’s customers only, at the moment.

Rao also pointed out that an ICCW-enabled ATM feature can dispense up to ₹10,000/- through UPI per transaction, compared to a debit card with a much higher cash withdrawal limit. “Customers wanting to withdraw higher amounts and other transactions at the ATM will still have the utility of debit cards.’

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.