The US 10-year treasury yield moving close to 5 per cent has created an upheaval in financial markets. Indian 10-year g-sec yield has also edged around 25 basis points higher over the past month. But the pressure on Indian g-secs appears much lower compared to other assets such as equity.

This is borne out by foreign portfolio investor activity in Indian government bonds. While they have pulled out almost Rs 25,000 crore from Indian equities since September this year, they have been net purchasers of Indian debt securities in nine out of ten months this calendar; the only exception being March. They have net purchased Rs 6,300 crore of Indian debt in October so far.

The reason could be that, despite the narrowing spread between Indian and US government bond yields over the past year, the contraction is less in comparison with many other countries. Also, unlike South Africa, Brazil and Mexico, India has not hiked policy rates to protect capital flows. This bodes well for growth in India.

Narrowing spread

The trouble in bond markets began with the US Federal Reserve hiking the federal funds rate by 525 basis points since early 2022. This, coupled with the Fed’s recent resolve to keep rates higher well into 2024, has resulted in a sharp surge in US treasury yield, taking it close to the 5 per cent mark.

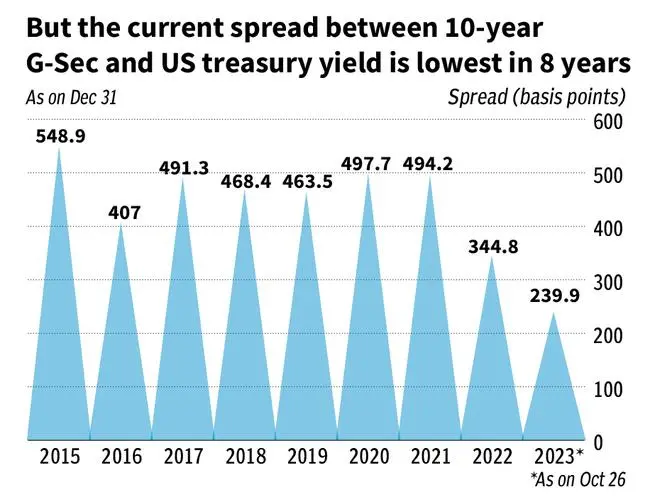

If we consider the Indian g-sec yield since 2015, it has largely been moving in a 100-basis points range at 6.5-7.5 per cent. The year-to-date change in the 10-year bond yield is, in fact, just 3.9 basis points. This stability is largely due to the ability of domestic investors to absorb the increased supply of paper.

Also read

The spread between the 10-year government bond yields in India and the US is currently the lowest since 2015, at 240 basis points.

Relative comfort

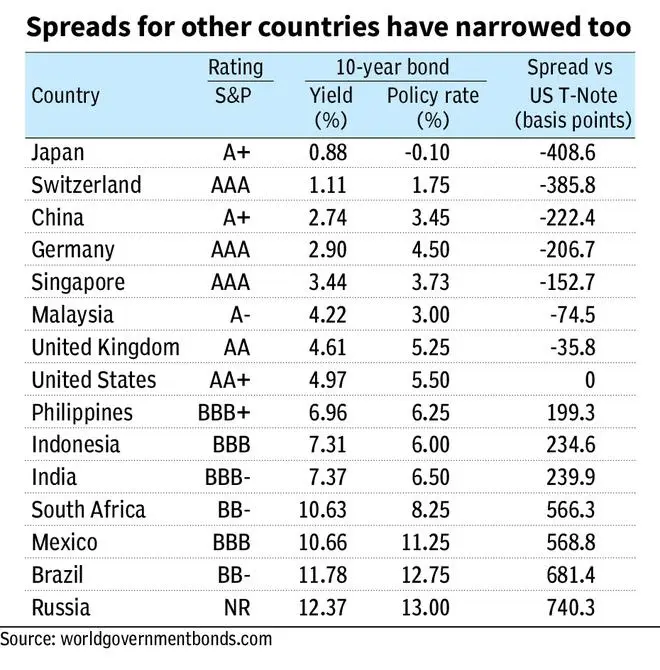

A look at the government bond yield spread of other countries against US treasury yields shows that India is not too badly placed. Countries such as Japan, Switzerland and China — which have kept their policy rates low — have negative spread vis-a-vis US treasury bonds since the yields on their government bonds have remained subdued.

Some emerging economies such as Malaysia, South Korea, Thailand and Spain, too, have negative spreads against US treasury securities. Countries such as Indonesia, Hungary and Philippines have spreads similar to India, having raised policy rates to the same extent.

Hiking rates to expand spreads

Many countries such as Brazil, South Africa, Mexico and Russia have been aggressively hiking their policy rates to double-digits. This has made the spread of their government bond yields over US treasury very attractive relative to India.

But given that India is continuing to attract foreign investors into debt, it appears that FPIs are not too concerned about the reducing spread between Indian and US government securities. The superior growth prospects and a resilient domestic economy seem to outweigh the differential in bond yields.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.