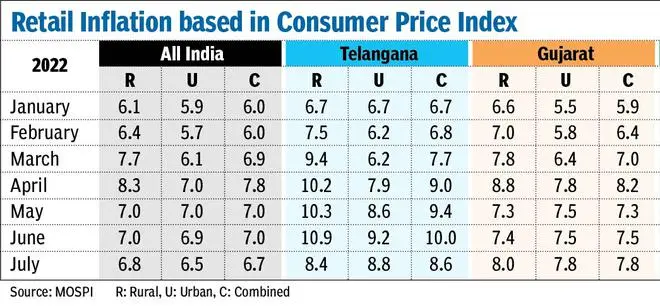

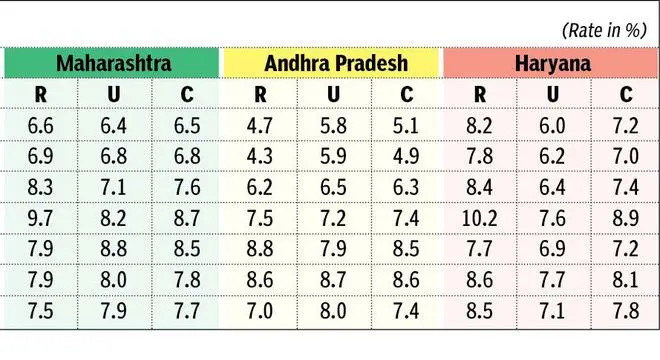

Amidst headline retail inflation coming down to a 5 month low in July, 11 States, including big states such as Maharashtra and Gujarat, have recorded higher growth rates than the national number. Another important factor is rural inflation continues to be higher than urban in many of the 22 States and Union Territories, for which inflation number is released every month.

Telangana continues to lead with the highest rate of overall retail inflation based on the Consumer Price Index (CPI) for the third month, while Delhi recorded the lowest rate for the second month. All India CPI recorded 6.71 per cent in July, which is the lowest in five months. However, experts feel rupee depreciation and uneven monsoon are likely to put pressure prices. At the same time, uneven monsoon and higher input prices also affect rural inflation.

Data from National Statistical Office shows that 11 States and Union Territories showed retail inflation in the range of 8.58 to 6.89 per cent in July. Apart from Telangana, these States/UT include Andhra Pradesh, Assam, Gujarat, Haryana, Jammu & Kashmir, Madhya Pradesh, Maharashtra, Telangana, Uttar Pradesh, Uttar Pradesh, West Bengal and Rajasthan. However, one positive development is that number of States/UTs with retail inflation above the upper band of targeted inflation (2-6 per cent) has come down.

Higher rural inflation

A research report by SBI says there were 21 States and UT with retail inflation above 6 per cent, but now the number is 15. Meanwhile, the worrying factor is higher inflation in rural areas. Data shows as many as 13 States and UTs have higher retail inflation in rural areas than in urban areas. West Bengal leads the race with rural inflation at 9.34 per cent, the highest number across two sectors in all the States and UT.

Now the concern is that the erratic movement of monsoon may impact food prices which in turn have some impact on rural and overall inflation. A report by QuantEco Research, authored by Yuvika Singhal, Vivek Kumar and Shubhada Rao, maintains retail inflation estimate at 6.5 per cent for Fiscal 2022-23 (FY23) for many reasons. One says “Uneven distribution of rainfall with significant shortfall in states such as Uttar Pradesh, Bihar, Jharkhand has led to lower acreage sown under paddy in the ongoing Kharif season down by close to 13 per cent compared to a year ago (as of 5th Aug-22). While Rice stocks with the Government remain sufficient so far, a sizeable shortfall in rice production could trigger price pressures given price of close substitute i.e., wheat and wheat derivatives has already seen a run-up in domestic prices since the outbreak of the Ukraine-Russia war (ban on wheat exports notwithstanding).”

Dharmakirti Joshi, Chief Economist with CRISIL Ltd feels the gradual moderation in inflation suggests there remains some pressure across major categories despite the recent fall in global prices and benefits from the government’s tax cuts on certain items. “Food inflation faces risks from lower rice sowing, tight wheat supplies, and elevated input costs,” he said.

Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank, expects the coming few readings to be a tad above 7 per cent, with inflation likely to hover above RBIs upper threshold limit of 6 per cent until January 2023. “We expect Repo rate at 6% by end of 2022 followed by a pause and a shift to neutral policy stance.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.