The world of commodity derivatives in India has traversed nearly two decades, and yet it has struggled to attain the same level of prominence as its counterpart, equity derivatives. This market segment has been marred by controversies, regulatory uncertainties, and government concerns regarding its impact on inflation. These impediments have stymied its growth, leaving it lagging behind international commodity markets.

Key issues included constraints on participation by investment funds and the absence of appropriate hedging instruments, which, in turn, discouraged businesses from leveraging this platform. Consequently, the market predominantly relied on individual speculators and traders, often lacking a comprehensive understanding of the intricate dynamics at play and underestimating the inherent risks embedded in commodity contracts.

The new beginning

The landscape underwent a transformative shift in 2015, following the merger of the Forward Markets Commission (FMC) with the Securities and Exchange Board of India (SEBI). This momentous event bestowed SEBI with the authority to both regulate and nurture the commodity market. This change ushered in a new era marked by the introduction of new participants, including domestic asset managers, overseas corporates, farmer associations and, most recently, foreign portfolio investors (FPIs). It also paved the way for the introduction of commodity indices and, more notably, the approval of commodity option contracts.

However, the initial reception of options in the market was lukewarm. They made their debut in the world of gold, which, though an immensely valuable commodity, presented challenges due to its substantial contract size (typically exceeding ₹50 lakh), low implied volatility (attributable to gold’s reputation as a stable asset with limited price fluctuations), and a trading cycle that occurred bi-monthly. These factors collectively led to high option prices, rendering them expensive for buyers, while simultaneously offering modest returns for writers. Moreover, gold options were structured as deliverable contracts, meaning they could devolve into futures contracts upon expiry, potentially leading to physical delivery—a feature that failed to resonate with market participants.

In May 2018, MCX introduced option contracts for crude oil, an asset known for its inherent volatility. Unlike gold options, crude oil options are cash-settled, eliminating the threat of physical delivery. With monthly expirations and a growing interest among speculative traders, this development set the stage for retail traders to explore and engage, albeit at a measured pace.

The Plunge

The world was thrust into uncharted territory with the onset of the COVID-19 pandemic in early 2020, resulting in a truly black-swan event. Financial markets had to grapple with the sudden and substantial disruptions in demand, especially in the case of crude oil, whose demand plummeted. Commodities stand apart from financial assets due to the intrinsic cost of carry, equivalent to the cost of storing the physical commodity for a specific time period—commonly referred to as “Badla” This inherent feature makes commodities ideal candidates for “cash-carry” arbitrage. Energy commodities, in particular, possess unique storage requirements, such as storage tanks for crude oil or high-pressure tanks for natural gas, which, unfortunately, cannot be expanded at short notice.

As the pandemic brought consumption of crude oil to a grinding halt, inventories began to accumulate. The process of shutting down production took time, and by April 2020, crude oil inventories had surpassed available storage space. The cost of storing a barrel of crude oil exceeded the price of the commodity itself, leading to an unprecedented scenario where the price of crude oil briefly dipped into negative territory.

Traders were desperate to offload their crude oil holdings, and this predicament also had a profound impact on trading in crude oil futures and options. Margin requirements for crude oil futures skyrocketed to an astonishing 300 per cent of the contract value. While these margin requirements have since been reduced over time, they remain elevated compared to the pre-COVID levels, hovering around 38 per cent.

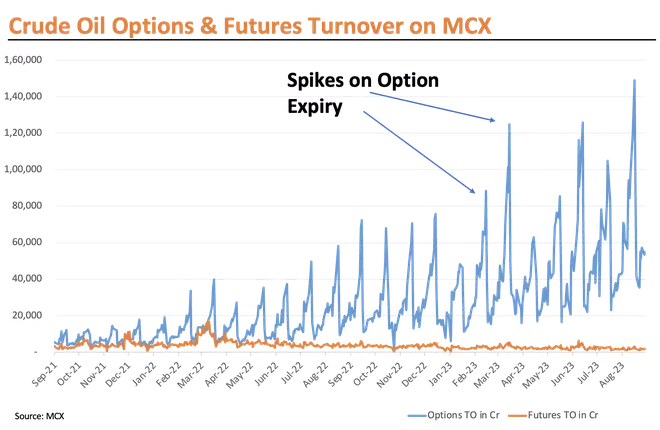

Fast forward to 2022, and the market witnessed the introduction of option contracts for natural gas, alongside crude oil options. Both these contracts began to attract the attention of option writers and algorithmic traders, primarily due to the tantalising return on capital employed (ROCE) offered by theta decay strategies. Over the past 14 months, trading volumes in Crude Oil options on MCX have surged dramatically. Natural gas, silver, and gold mini options are also making headway, emerging as additional avenues for traders and option writers to deploy their capital effectively.

Dynamics of writing option strategies in crude oil

Crude Oil options now lead the surge in trading volumes on MCX and are drawing significant interest from large proprietary trading desks, algorithmic trading firms, and High Net Worth Individuals (HNIs) keen to capitalise on higher premiums.

These crude oil options have a contract size of 100 barrels, with an exposure of approximately 7.5 lakhs. They feature monthly expirations scheduled around the 16th to 17th of each month. Currently, crude oil options exhibit implied volatility ranging from 40 per cent to 50 per cent, resulting in premiums of around ₹230-250 per barrel for both Call and Put options at the beginning of the month, yielding around ₹45,000 - 50,000 premium for an At-The-Money (ATM) short straddle per lot, which translates to roughly eight - nine per cent yield on margin (investment). Even when selecting options around 10 per cent out of the money (OTM), which is approximately ₹700-800 from the current price, generating ₹12,000-15,000 premium which is around 2.0 -2.5 per cent on capital.

- Also Read: Crude oil gets a boost from US GDP data

The decay of theta for At-The-Money ATM options generally hovers around ₹20 per day per side, representing approximately 0.25 per cent to 0.5 per cent of the option premium, depending on prevailing volatilities. This theta decay tends to be more pronounced in the final weeks of the contract cycle.

As these options devolve into futures contracts, the exchange imposes a “Devolvement Margin” on option buyers holding in-the-month options. This margin begins two days before the options’ expiration date, starting at 25 per cent of the futures margin. On the day before the options’ expiration date, it increases to 50 per cent of the futures margin. This substantial incremental capital requirement during these two days prompts those holding in-the-money (ITM) options to close their positions, leading to the highest traded volumes occurring one day prior to expiration as these margins are levied on an End-of-Day (EoD) basis.

While trading volumes continue to climb, these contracts are still in the process of maturing, offering occasional mispricing opportunities. Nevertheless, as the contracts become more established, such opportunities may become scarcer. Despite this, crude oil, with its inherent high volatility compared to the Bank Nifty, holds the promise of consistently delivering higher premiums. Additionally, there is hope that MCX may introduce a weekly expiry contract in the near future, further enhancing the allure of crude oil options for option writers and traders alike.

The author is Director and Head - Commodity and Currency - Motilal Oswal Financial Services Ltd

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.