Cotton arrivals in India have begun to increase to a three-year high across agricultural produce marketing committee (APMC) yards in the growing regions in March. This is in view of the natural fibre prices stabilising between ₹60,000 and ₹62,000 a candy (356 kg) and the quality of the arrivals being good, said traders and industry leaders.

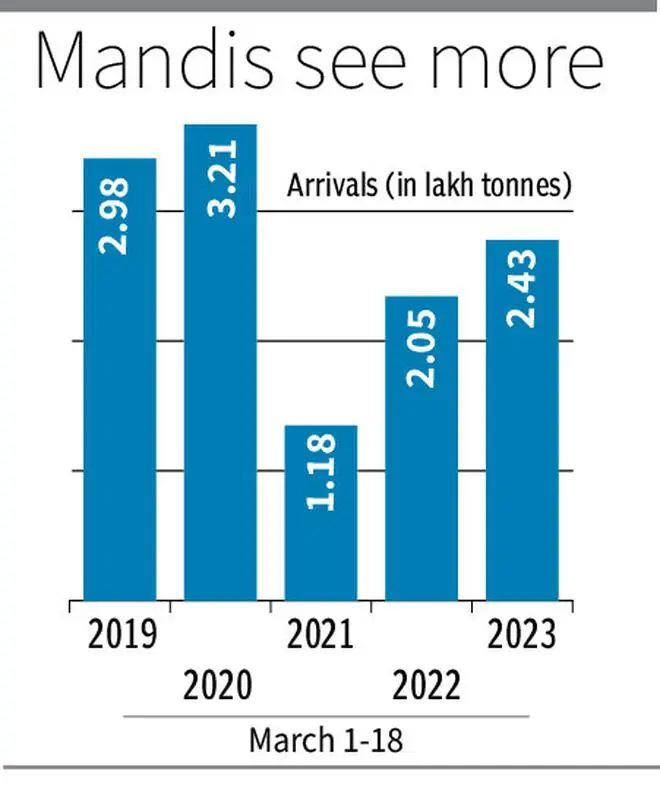

Increasing arrivals have left the market confused over the exact production of cotton this season (October 2022-September 2023). According to data from Agmarknet, a unit of the Agriculture Ministry, cotton arrivals between March 1 and 18 are at a three-year high at 2.43 lakh tonnes(lt).

Peculiar situation

“We are witnessing a steady increase in arrivals across all markets,” said Prabhu Dhamodharan, Convenor, Indian Texpreneurs Federation (ITF).

“Arrivals are good and their quality is excellent. We are facing a peculiar situation this season as farmers held back their produce and now seem to be ready to sell,” said Ramanuj Das Boob, a sourcing agent for multinationals from Raichur, Karnataka.

“Arrivals have shown improvement over the last 15 days. However, all-India arrivals (October-March 20) are 30 per cent less compared with the last season due to the holding of stocks by the farmers,” said Sanjay Gupta, MD and CEO, NCML.

“Arrivals have increased as prices have stabilised in the region of ₹60,000 a candy. But for rains, arrivals are between 1.6 lakh bales (170 kg each) and 1.8 lakh bales,” said Anand Popat, a Rajkot-based trader in cotton, yarn and cotton waste.

Inflows gather pace

Agmarknet data showed that cotton arrivals picked up last week at 77,498 tonnes compared with 49,573 tonnes a year ago and 30,334 tonnes in 2022.

Last week, the Cotton Association of India (CAI) lowered its cotton crop estimated for the current season to 313 lakh bales against 307.05 lakh bales last season. In its second advance estimate, the Centre lowered its crop forecast to 337.23 lakh bales (311.18 lakh bales last season) and the USDA has pegged it at 313.76 lakh bales.

Currently, prices of Shankar-6 grade ginned (processed) cotton, the benchmark for exports, are ruling at ₹61,750 a candy in Gujarat. Kapas (raw cotton) are quoting at ₹7,900 a quintal against the minimum support price of ₹6,080.

In the global market, cotton futures for delivery in May on InterContinental Exchange (ICE), New York, are ruling at 77.90 US cents a pound (₹50,900 a candy). On MCX, cotton for delivery in April closed at ₹61,160 a candy.

Stagnant demand

“Over the last couple of weeks, cotton prices have stabilised. We expect this to continue at least till April 10,” said Das Boob.

“Demand has stagnated due to global macroeconomic factors such as rising interest rates, an unstable financial environment and fears of recession. Cotton prices are trading on the lower side of ₹60,000-62,000,” said Gupta.

“Spinning mills have begun building inventories, though slowly since prices have stabilised, But lower yarn demand is almost impacting their purchases,” said Popat.

“Mills are still not confident about going for higher inventories due to the muted global demand signals for textile and apparel products. We are seeing only pockets of recoveries from a few countries due to their exhaustion of inventories,” said Dhamodharan.

Cautious purchase

Gupta said owing to lower seed and oilcake prices, ginners were facing problems of disparity. “Yarn sale is not promising but demand for finer quality yarn is allowing mills to run at good capacities. Arrivals are expected to increase in the forthcoming weeks as and when the farmers liquidate part of their stocks putting additional pressure on the prices,” he said.

A majority of markets and buyers are still cautious in buying. Chinese pent up demand trend is also not playing out as expected, said the ITF Convenor.

Cottonseed prices were not supporting growers, said Das Boob, wondering if 130 lakh bales could arrive in the market over the next 4-5 months going by the production forecasts.

ITF’s Dhamodharan said the current cotton season is expected to be much longer and “the continuing weak demand signals may keep a constant check on cotton prices”.

“Though the area under cotton was higher, the yield is reported to have dropped,” the Raichur-based sourcing agent said.

If prices drop below ₹59,000, arrivals could decline, said Popat.

Slack exports

On the other hand, export demand is lukewarm. “Export purchases are small. This season’s our exports will be lower,” said Das Boob.

“The volume of Bangladesh’s purchase has been less. We don’t see much export demand coming,” said Popat.

CAI has pegged exports at 30 lakh bales this season against 43 lakh bales last season.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.