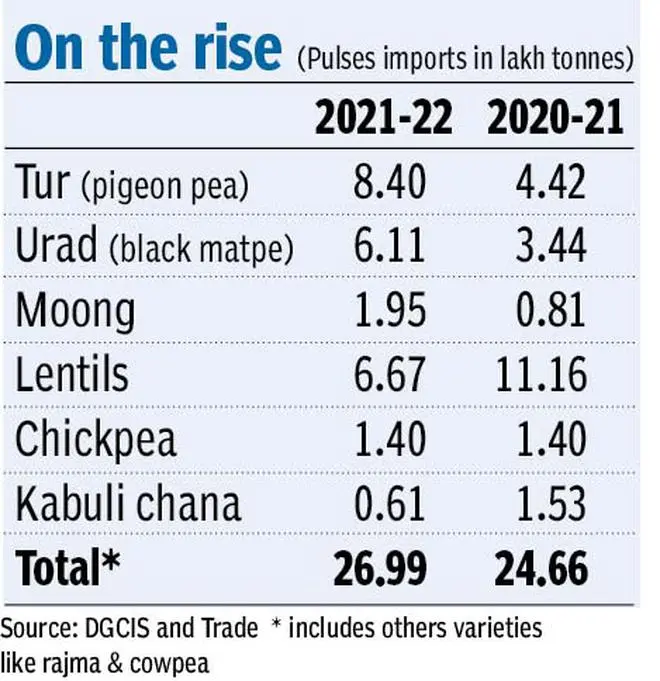

India’s pulses imports rose 9.44 per cent to about 26.99 lakh tonnes (lt) during the financial year 2021-22 over 24.66 lt in 2020-21 on lower domestic output and the Government’s decision to keep imports open to ensure adequate supplies.

As per the DGCIS data, the imports rose by around 39 per cent in value terms to ₹16,627 crore (about $2.22 billion) during 2021-22 over ₹11,937 crore ($1.61 billion) the previous year.

The trade expects total pulses imports to remain around the levels of 25-26 lt in the current financial year with the import window being kept open till March next year.

Crop damage fears

During 2021-22, imports of tur, urad and moong registered a sharp increase. Tur imports stood at around 8.4 lt (4.42 lt), while urad imports jumped to 6.11 lt (3.44 lt). Imports of moong beans more than doubled to 1.95 lt (0.81 lt), while imports of lentils (masur) declined.

“It is a marginal increase as more imports were allowed for tur, urad and moong. Our imports will be in the range of 25-26 lakh tonnes for the current year,” said Bimal Kothari, Chairman, Indian Pulses and Grains Association, the apex trade body. The Government’s decision to allow imports during May-June last year on apprehensions of crop damage, resulted in higher inflow of the pulses ensuring adequate supplies.

Kothari said pulses prices are under control and most of the pulses are ruling around or below the minimum support price levels. “Prices of pulses is no longer an issue for the Government, unlike edible oils, where there’s a concern,” he said.

Trend to sustain

Rahul Chauhan of IGrain India expects the trend in pulses imports to be sustained this financial year as the Government has kept the imports open. Imports of pulses like masur will depend on how the crop shapes up in Canada, where the sowing is almost complete. The strengthening of the dollar may impact the import parity, he said.

B Krishnamurthy, Managing Director, Four P International, said the imports of urad would have gone down during March-June due to the currency issue in Myanmar and the domestic rates at par on higher supplies. With the decline in the rupee against the dollar, there’s not much of an incentive for the medium to smaller players to import compared to the large companies, he said.

Higher MSP

Further, Krishnamurthy said there’s some speculation that pulses growers are likely to shift to alternative crops such as corn, cotton, sugarcane and soyabean, which are attractive. “We need to watch the situation. With the increase in MSP, the overall pulses production is likely to be retained, provided the rain gods are smiling,” he said.

The Centre has increased the MSP for tur and urad by ₹300 per quintal each to ₹6,600 for the current kharif season, while the support price for moong has been hiked to ₹7,755 from ₹7,275 last season.

The Government has set the kharif pulses production target of 10.55 million tonnes against previous year’s 8.25 million tonnes (third advance estimates)

With the onset of monsoon, the sowing of pulses like moong and tur has begun in States such as Karnataka. The modal price (rates at which most trades take place) of tur are ranging between ₹5,700 and ₹6,100 in various markets of Maharashtra and Karnataka, much below the MSP levels. Prices of moong are ruling around ₹6,000 per quintal levels, below the support price, while urad prices are hovering around ₹6,000-6,200 levels in Madhya Pradesh, lower than MSP.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.