In August, E-way bill generation reached an unprecedented 9.34 crore, as reported by GSTN.

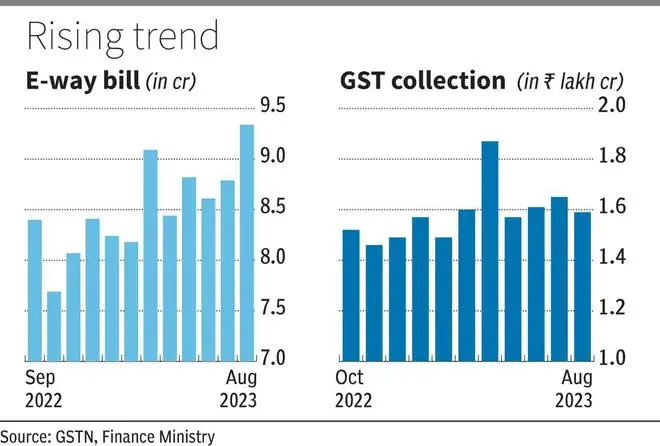

E-way bill generation touched an all-time high in August at 9.34 crore, data from GSTN (IT backbone of the indirect tax system) showed. The previous high was 9.09 crore in March this year.

Though GSTN has not mentioned reasons for record generation, companies are dispatching higher volumes to meet festive demands. Also, the rising number of registered taxpayers and better compliance lead to higher generations. At the same time, recovery in consumption demand also contributes to more movement of goods, resulting in more e-way Bill.

An e-way bill is an electronic document generated on a portal, evidencing the movement of goods and indicating whether tax has been paid. As per Rule 138 of the CGST Rules, 2017, every registered person who causes the movement of goods (which may not necessarily be on account of supply) of consignment value of more than ₹50,000 is required to generate an e-way bill. This is required for movements between the two States and within a State. However, a State or UT, with the legislature, can decide the threshold for the value of goods to be applicable for movement within its boundary.

There could be some impact on revenue collection because of more and more e-way bills, but evidence indicates that a higher generation of e-way bills would lead to higher collection. For example, data from GSTN shows e-way bill generation crossed an all-time high of 9 crore in March, resulting in an all-time collection in April at ₹1.87 lakh crore. In April, the generation came down to 8.44 crore; subsequent collection in May was ₹1.57 lakh crore. Similarly, on a month-on-month basis, e-way bill generation rose to 8.79 crore in July, but collection in August came down to Rs 1.59 lakh crore. It is also possible that the movement of goods might have occurred in the same month of consumption or even a month before that, which is why e-way bill generation may have an impact on collection spreading over two months.

Sandeep Sehgal, Partner-Tax, AKM Global, a tax and consulting firm, stated that the increase in e-way bill generation indeed points to buoyant GST collections, as evident from the past few months. The festival season will improvethe economic condition by boosting higher economic activity and transactions. Gautam Mahanti, Business Head with IRIS Business Services z,feels This increase in e-way bills also means the government might collect a lot of money in taxes (GST) in September.

“The fact that this happened at the same time as a report about factories making more things (PMI data) suggests that businesses are getting ready for the festive season, like Ganesh Chaturthi, Dussehra and Diwali and continues till Christmas . Factors contributing to this surge include increased compliance obligations and the build-up of festive stock .Additionally, a reduction in the sales threshold for reporting wholesale transactions and improved goods shipment have played a role in this economic uptick,” he said

However, both Sehgal and Mahanti have some words of caution. “It is important to note that while increased e-way bill generation is a positive sign, the overall economic conditions depend on various factors beyond this, such as consumer spending, investment, and government policies,” Sehgal said. Adding to that, Mahanti listed challenges like rising prices and high interest rates.

Published on September 12, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.