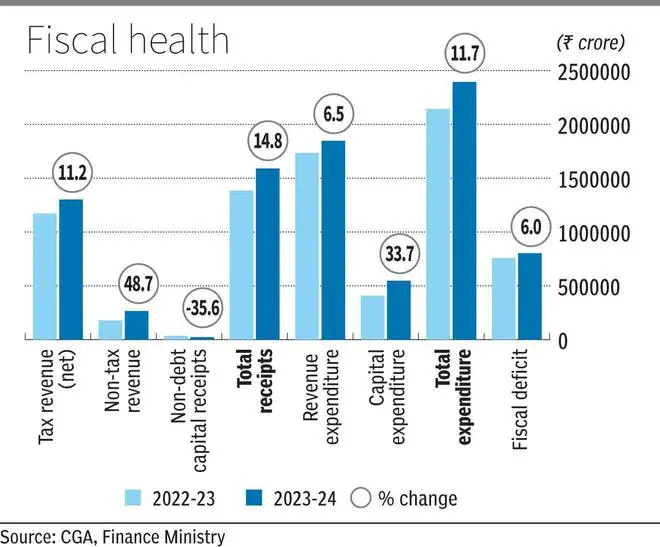

Sustained growth in tax collections helped the Centre limit fiscal deficit (difference between income and expenditure) during April-October period to 45 per cent of the budget estimate for FY24. The period under consideration also showed strong growth in capital expenditure.

With this, the expectation is that the Centre will be able to contain the deficit within the budget estimate of ₹17.87-lakh crore i.e. 5.9 per cent of GDP or perhaps even lower than that. Revised number of the full-year deficit will be out on February 1, when Finance Minister Nirmala Sitharaman presents the interim budget.

Finance Secretary T V Somnathan said that there is nothing as of now to change the budget estimate of 5.9 per cent. “I’m confident as of today with the information I have today that we will adhere to a fiscal targets. And the announcement on the PM Garib Kalyan Yojana does not by itself mean anything for our fiscal consolidation but we are still committed to that path. And that decision does not throw us off the fertilizer,” he said.

Further he added that crude remains at levels that the government had expected it. Also, though the budget is not directly affected by crude until if there are major movements and no major movements have happened. “They’ve happened within a narrow range perfectly within what is normal and on fertilizer. We will give you the numbers and we present the budget on February first but we will not be very far from our budget estimates,” he said.

The period under consideration recorded good growth in direct tax collections led by income tax which surged by around 31 per cent. Corporate Income Tax rose by around 17.5 per cent. Though GST collection, too, is rising and average monthly collection is now more than ₹1.50-lakh crore, other indirect taxes such as customs and central excise are lagging. While customs duty saw less than 1 per cent growth, union excise collection went down by nearly 10 per cent. Revenue from the customs has been affected by lower global trade ,while reduction in rate on petrol and diesel last year is still impacting excise duty.

Capital expenditure saw a healthy growth of 33 per cent in seven months period, while revenue expenditure saw 6.5 per cent rise. However on y-o-y basis, capex declined by 15 per cent and thus, the lower fiscal deficit. With the model code of conduct is likely to be imposed in the ensuing quarter, the capex target may be missed.

Commenting on the numbers, Aditi Nayar, Chief Economist with ICRA, said: “Our baseline expectation is that direct taxes will surpass the FY24 BE by ₹0.85-lakh crore, a portion of which will be absorbed by lower-than-budgeted union excise duty collections, leaving a gross upside of around ₹0.5-lakh crore. Setting aside the additional devolution to the States, we estimate that net tax revenues will exceed the FY24 BE by a modest ₹0.3-lakh crore. However, this will be offset by a similar shortfall in disinvestment proceeds.”

After considering the additional economic cost towards the extension of free foodgrains under the NFSA for January-March 2024, the higher subsidy on LPG, the nutrient based subsidy rates on P&K fertilisers for the ongoing rabi season, and the additional amount likely to be required for MGNREGS, Nayar estimated spending to exceed the FY24 BE by ₹0.8-1 lakh crore but there is very little risk of fiscal deficit being breached.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.