The Centre and States together are launching two months special drive from Tuesday against GST fraudsters. Experts say every GST assessee needs not panic on such a move.

“A Special All-India Drive may be launched by all Central and State tax administrations from May 16, 2023, to July 15, 2023, to detect suspicious/fake GSTINs and to conduct requisite verification and further remedial action to weed out these fake billers from the GST ecosystem and to safeguard Government revenue,” Central Board of Indirect Taxes & Customs (CBIC) said in an instruction to all of its field formation.

As of date, there are 1.39 crore registered taxpayers, which is more than double of assesses registered during the pre-GST or Central Excise-VAT regime.

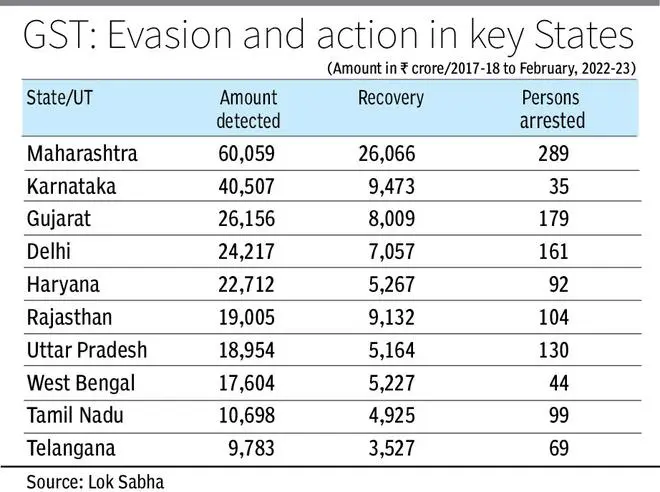

However, the worrying part is mounting evasion. Last month, officials conceded that GST evasion detection by tax officers almost doubled YoY to over ₹1.01 lakh crore in FY23, out of which a recovery of ₹21,000 crore was made by the officers of the Directorate General of GST Intelligence (DGGI).

Also read: GST evasion worth around ₹23,000 crore being investigated: Finmin

In FY22, DGGI, the investigative agency under the Goods and Services Tax (GST) regime, detected evasion of over ₹54,000 crore and made a tax recovery of over ₹21,000 crore.

The total number of Goods and Services Tax (GST) evasion cases has gone up this fiscal with about 14,000 cases detected in FY23, up from 12,574 cases in FY22 and 12,596 cases in FY21.

In the drive, based on detailed data analytics and risk parameters, GSTN will identify fraudulent GSTINs for State and Central Tax authorities. Details of such identified suspicious GSTINs, jurisdiction-wise, will be shared with the concerned State/Central Tax administration for initiating a verification drive and conducting necessary action subsequently.

If, after detailed verification, it is found that the taxpayer is non-existent and fictitious, then the action will be initiated for suspension and cancellation of the registration of the said taxpayer.

Further, the matter may also be examined for blocking of input tax credit in Electronic Credit Ledger. Additionally, effort will also be taken to identify the recipients to whom the input tax credit has been passed by such non-existing taxpayer.

Also read: To counter digital savvy evaders, GST to set up 5 forensic laboratories

“Action may also be taken to identify the masterminds/beneficiaries behind such fake GSTIN for further action, where ever required, and also for recovery of Government dues and/or provisional attachment of property/bank accounts,” the instruction added.

A National Coordination Committee headed by Member [GST], CBIC, including Principal Chief Commissioners/Chief Commissioners Delhi and Bhopal CGST Zones and Chief Commissioners/Commissioners of State Tax of Gujarat, West Bengal, and Telangana will monitor the progress of this special drive.

Pawan Arora, Senior Partner, Athena Law Associates, says genuine taxpayers are not required to panic from this drive as the verification is unlikely to be carried out in the case of such taxpayers.

“Genuine taxpayers are only required to ensure that all the GST compliances as required to be maintained in the normal course of businesslike maintenance of books of accounts and records at registered premises, affixing of signboards, etc, in order to avoid any unnecessary hassle during the GSTIN verification, if any,” He advised.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.