Financial performances of Central Public Sector Enterprises (CPSEs) have improved, aiding Finance Minister Nirmala Sitharaman in charting a detailed roadmap for the implementation of PSE policy and strategic disinvestment.

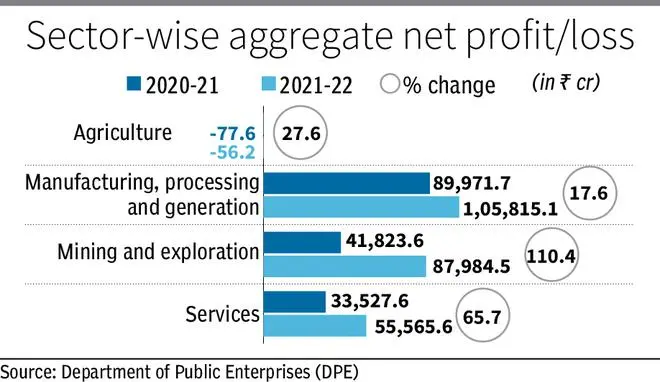

According to the annual report on the performance of CPSEs, 188 of the 248 operating units reported total net profit of ₹2.64-lakh crore and 59 reported net loss aggregating to ₹0.15-lakh crore. Food Corporation of India (FCI) has reported no profit or loss.

A total of 22 CPSEs returned to profit from loss in FY22. These reported a total profit of ₹7,201.42 crore in the fiscal compared with a total loss of ₹8,098.83 crore in FY21. Eight of the 22 reported profit of more than ₹100 crore.

Dismal FY23

However, FY23 has not been good from the strategic disinvestment point of view. On one hand, the government had to annul the strategic disinvestment proposals of BPCL and Visvesvaraya Iron and Steel Plant (a unit of SAIL), and on the other, it disqualified successful bids received for Central Electronics Limited and also put on hold the strategic disinvestment of Pawan Hans on account of legal battle.

Privatisation of IDBI Bank is expected to take place in the next fiscal only. Additionally, there is no timeline for Shipping Corporation and CONCOR, besides others.

The government, on its part has maintained that profitability/loss is not among the relevant criteria for privatisation/strategic disinvestment. The policy is based on the economic principle that the government should discontinue in sectors where competitive markets have come of age and economic potential of such entities may be better discovered in the hands of a strategic investor. Still, officials think better financial position will help fetch higher value and also attract more bidders.

Now, with the impressive performance on the fiscal front by CPSEs, government may go aggressive on strategic disinvestment in FY24 and onwards, and fulfil the objective as defined in the new PSE policy. As on March 31, 2022, there were 389 CPSEs, out of which 248 are operational. As many as 62 CPSEs are listed on the stock exchange.

Know the policy

The new policy, detailed in the FY22 Budget, aims to minimise the presence of CPSEs, including financial institutions, and create a new investment space for the private sector. It says post disinvestment, economic growth of CPSEs/ financial institutions will be through infusion of private capital, technology and best management practices. Under the policy, various sectors will be classified as strategic and non-strategic sectors.

The first group of strategic sectors include atomic energy, space and defence, and the second has transport and telecommunications. The third one has power, petroleum, coal and other minerals while the fourth one has banking, insurance and financial services. In strategic sectors, there will be bare minimum presence of the public sector enterprises. The remaining CPSEs in the strategic sector will be privatised or merged or subsidiarised with other CPSEs or closed. In non-strategic sectors, CPSEs will be privatised, otherwise will be closed.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.