The government faces the tough task of deciding on domestic gas prices as the date for the biannual exercise for fixing the prices approaches on September 30 . The record high international prices signal a decision towards a record upward revision, whereas concerns about inflationary pressures on the consumers may necessitate a more nuanced approach.

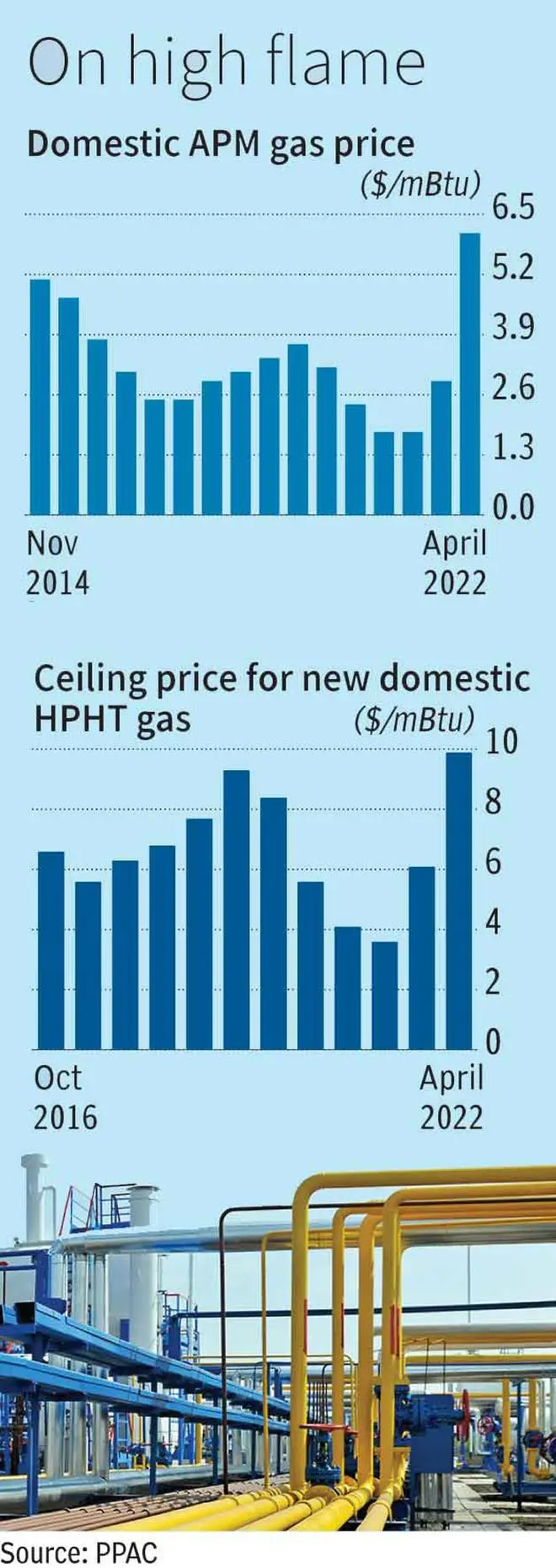

Sources said if the government follows the administered price mechanism (APM), then rates are likely to go up in the range of $9-10 per million British thermal units (mBtu). Similarly, the ceiling price for gas from high pressure high temperature fields (HPHT) will also rise to over $12-12.5 per mBtu. The weakening rupee will also exacerbate the impact.

Already, after the steep hike in April of $6.1 per mBtu (APM gas), CNG prices have been raised several times since October 2021. There could be a chance that even if APM prices hit $9-10 per mBtu, the firms may only raise prices, in a staggered manner, by about ₹3-5 per kg.

However, with inflation already above the comfort level, the government may introduce a new “variable or component” in the pricing to provide some relief. Another alternative could be that it may defer the hike and wait for the final recommendations of the Kirit Parikh committee, which has been asked to set a fair price for end consumers, a government official said.

“In case the government decides to soften the blow with the introduction of a new variable or component to soften the impact, the rate of APM gas may be in the range of $8-8.5 per mBtu. This can be reviewed later when the Parikh committee submits its report, which is also expected to come out soon,” the government source added.

Price impact

Crisil expects sales growth to moderate to 8-10 per cent in FY23. Industrial PNG segment could bear the major brunt, due to price-sensitive customers, with realisations exposed to the volatility in LNG prices. Performance of the CNG segment would remain healthy, given continued competitiveness versus alternates. Customer stickiness to enable the domestic PNG segment to continue its moderate growth.

On margins, Crisil said that after a steep decline in per unit profitability seen in Q3 of FY22, players have been able to reverse their performance with successive price hikes. The price hikes have, however, resulted in players losing on volume sales.

APM is based on gas prices at Henry Hub (US), Alberta Gas Reference (Canada), NBP (UK), and Russia Gas over a year with a lag of one quarter. Generally, a $1 per mBtu increase in gas prices translates to around a ₹4-4.5 per kg rise in CNG prices. At present, CNG prices in Delhi are ₹75.61 per Kg.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.