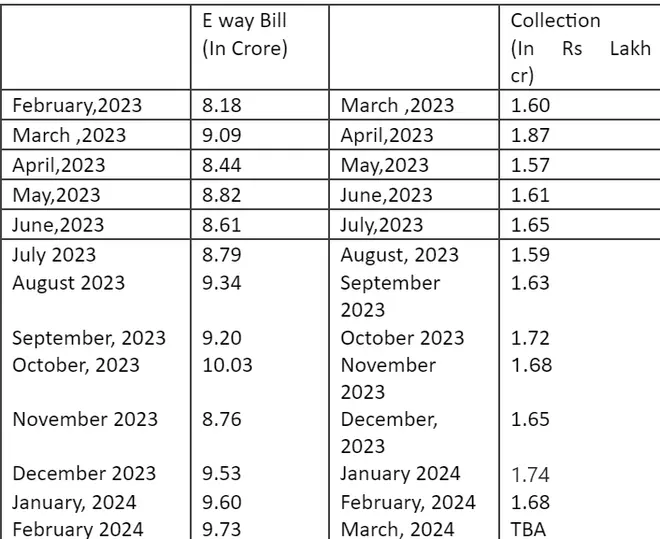

E-way bill generation surged to 9.73 crores in February. This is the highest in four months and also the new second-all all-time-high generation. This is expected to have a positive impact on GST collection in March. February figures are also important as the month had only 29 days.

The Finance Ministry will come out with the collection of data for March on April 1.

An e-way bill is an electronic document generated on a portal, evidencing the movement of goods and indicating whether tax has been paid or not. As per Rule 138 of the CGST Rules, 2017, every registered person, who causes the movement of goods (which may not necessarily be on account of supply) of consignment value of more than ₹50,000 (can be lower for intra-state movement) is required to generate an e-way bill.

During last three months (December, January and February), e way bill generation has been more than 9.5 crore. Also, month of October saw all time high generation of over 10 crore. One basic reason of this rise is better compliance. Although, this is not the main reason behind collection of over Rs 1.66 lakh crore, but experts feel this is one important reason behind higher collection and trend is expected to continue further.

Now the big question is what does the high generation means? Vivek Jalan, Partner, Tax Connect Advisory said: ”E-way bill is a deterrent to evaders of GST, by tracking movement of goods and supply thereof. In the last six years of GST, most of the cases going to High Court are due to certain non-compliances in E-Waybill regulations, some genuine suppression and some inadvertent mistakes.”

Ankur Gupta, Practice Leader at SW India feels the surge in E-Way bill indicates several significant trends in India’s economic landscape. Firstly, it reflects a notable increase in consumption across various sectors, with heightened economic activity driving the need for transportation and logistics services. This rise in e-way bills is particularly evident in industries such as FMCG and electronics, where year-end supplies and increased demand contribute to the surge. “We might witness the highest e-way bill generation in Mar-24 breaking the Oct-23 figure due to year-end supplies across industries especially FMCG and electronic sectors,” he said.

- Also read: DGGI’s crackdown: ₹18000 crore worth of GST evasion exposed, 1700 fake ITC cases unearthed

While some experts feel that higher generation of E-way bill will have impact on GST collection, some opine that this could have multiplier effect. Jalan said that now taxpayers have streamlined their E-Waybill Compliances to a large extent. The large e-waybill generation maybe a reflection of such streamlining .Further, “large E-Waybill generation also does reflect on the high GST Collections in March 2024,” he said.

According to Gupta the impact of surge in e way bill is expected to manifest at the macroeconomic level, with increased production, job creation, and overall economic growth. “As Bharat continues to enhance its contribution to the global supply chain and expand its manufacturing capabilities, the positive effects on economic indicators are likely to become more pronounced in the coming months, further reinforcing the narrative of Bharat’s growth story,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.