The Indian diagnostics industry is projected to reach $25 billion by FY28, up from $13 billion in FY23, backed by attractive margins and growth potential.

“This market is expected to have CAGR (compound annual growth rate) of 14 per cent in the next five years, fuelled by factors such as the rising prevalence of chronic diseases, growth in geriatric population, demand for preventive tests, and higher penetration of government insurance schemes,” Aryaman Tandon, Managing Partner and Co-founder of Praxis Global Alliance, told businessline, based on the firm’s research report.

Moreover, there is a shortfall of about 3 million beds to achieve the target of three beds per 1,000 people by CY25, suggesting substantial room for expansion in the diagnostics sector.

Of the two main segments of the sector, pathology involves diagnosis of diseases through the examination of tissues, cells, and body fluids, while radiology involves use of medical imaging techniques to diagnose and treat diseases and injuries.

Also read

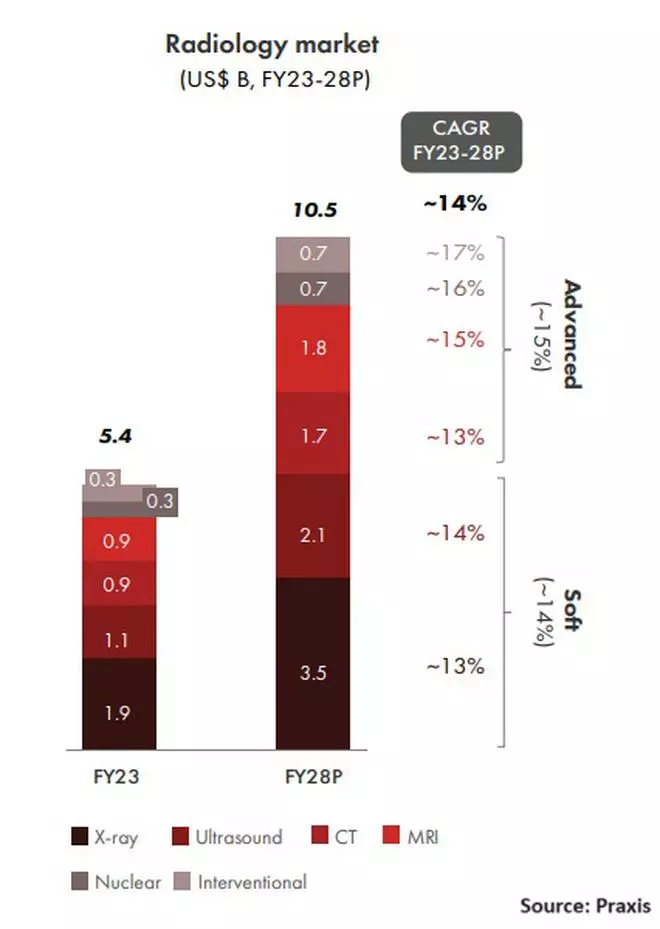

Radiology is split into soft (x-ray and ultrasound); and advanced radiology (CT-scan, MRI, nuclear imaging, and interventional radiology).

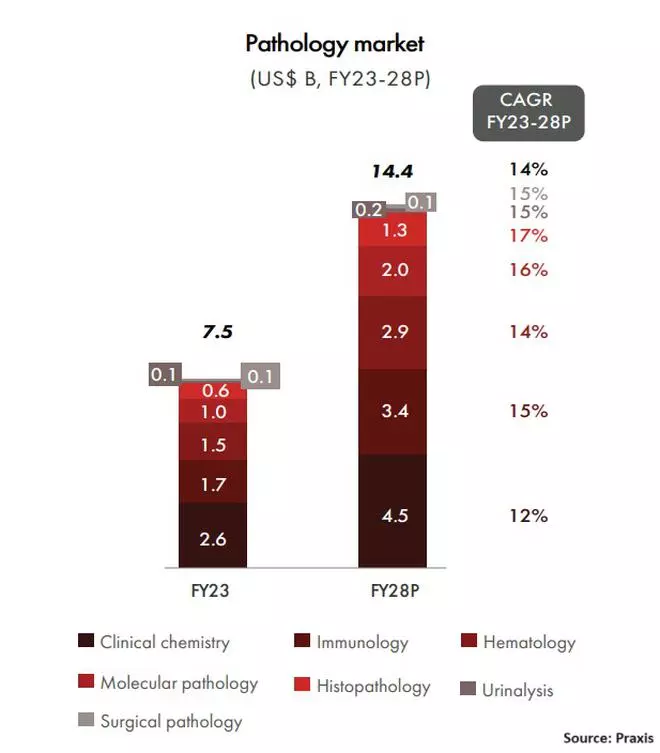

The pathology market size is about $7.5 billion, or 58 per cent of the diagnostics market. Radiology accounts for the rest, with soft radiology commanding 55 per cent share compared to advanced radiology.

The domestic diagnostics industry is fragmented, with standalone centres at 46 per cent, private hospital labs at 28 per cent, and national chains at 6 per cent.

The pathology market is projected to reach $14.4 billion by FY28. Of the estimated 1.32 lakh pathology labs, 60-plus per cent are standalone.

Growing disease complexity, technological advancements, and the tier 2 and tier 3 markets are the key drivers of growth for the radiology market, which is projected to reach $11 billion by FY28.

The Indian radiology market includes standalone laboratories, regional chains, national chains, small and medium private hospitals, large private hospitals, and government hospitals and institutions. Of the estimated 55,000 radiology labs, over 80 per cent are standalone.

“India’s pathology and radiology test prices are lower compared to developed countries, suggesting potential for future price realisation improvement,” said Tandon.

“The diagnostics industry is at the cusp of a transformation, driven by emerging opportunities. While the fragmented nature of the industry presents challenges in terms of capabilities and scalability, it also offers opportunities for consolidation and the emergence of new business models, he added.