The Indian economy is intrinsically better positioned than many parts of the world to head into a challenging year ahead, according to an article in the Reserve Bank of India’s latest monthly bulletin.

This is mainly due to the country’s demonstrated resilience and its reliance on domestic drivers, per the article “State of the Economy.” This assessment is based on the National Statistical Organisation’s (NSO) end-February data.

Second advance estimate

In this regard, the article, put together by senior RBI officials, referred to the NSO’s second advance estimate (SAE) of national income, which placed real GDP growth at 7 per cent for 2022–23—the same as in the first AE.

The SAE of national income indicates that the recovery from the pandemic was stronger than earlier believed (with a steady gathering of momentum since the second quarter of the current financial year), led by private consumption and supported by a rebound in government consumption during 2021–22, they added.

During Q3 (October–December) 2022–2033, India’s GDP growth slowed to 4.4 per cent from 6.3 per cent in the preceding quarter.

“The Q3 data carry valuable information content for the rest of the year. Private consumption may edge down further, going by high-frequency indicators, including and perhaps mainly due to elevated inflation,” per the article.

Private investments

The authors stressed that investment must be regenerated from private sources alongside the public sector push to consolidate and improve the quality of spending so as to provide a congenial habitat for the private effort.

“The Q4 (January-March) data release will nevertheless need to be read with a pinch of salt because unfavourable base effects will be strong.

“Our nowcast of real GDP growth for Q4:2022-23 is placed at 5.3 per cent,” the officials said.

Recession and India

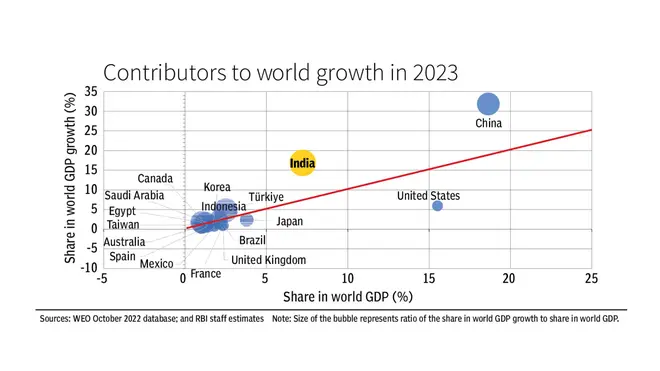

The authors underscored that even as global growth is set to slow down or even enter a recession in 2023, as global financial markets wager, India has emerged from the pandemic years stronger than initially thought, with a steady gathering of momentum since the second quarter of the current financial year.

“Unlike the global economy, India would not slow down—it would maintain the pace of expansion achieved in 2022–23. We remain optimistic about India, whatever the odds,” the official said.

- Also read: Advanced economy central banks should adopt RBI’s playbook in rescuing troubled banks: SBI report

The article said that the consumer price inflation remains high and core inflation continues to defy the distinct softening of input costs.

Over the financial year ahead (2023–24), inflation is expected to range tightly between 5.0 and 5.6 per cent (per the February 2023 Monetary Policy Statement) if India survives an El Nino event adversely affecting the south-west monsoon, given global uncertainties.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.