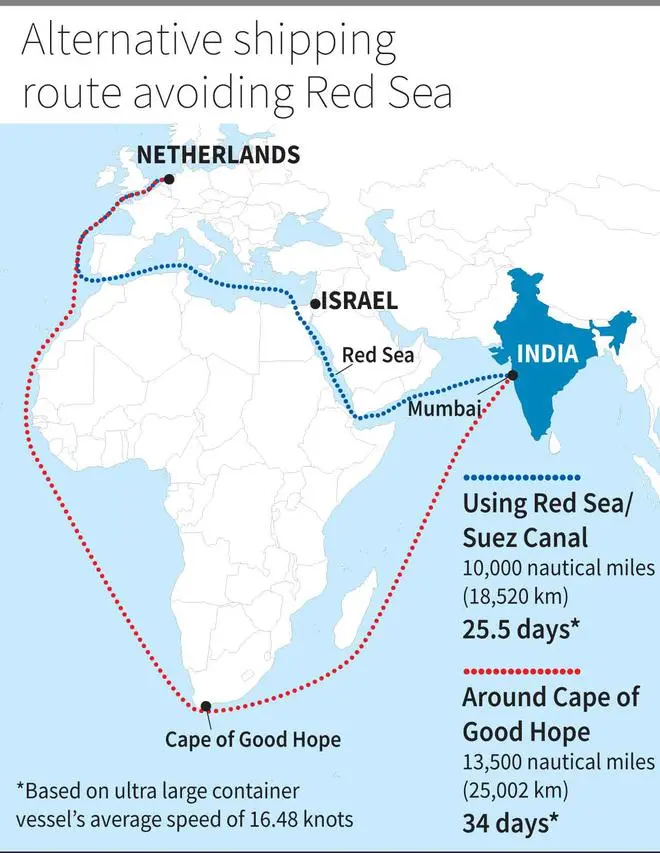

Global trade, which is heavily dependent on container shipping, is in troubled waters due to the fallout of the recent attacks by Iranian-backed Houthi militants on ships passing through the Red Sea/Gulf of Aden. The container ships are now being diverted via the Cape of Good Hope at the southern tip of Africa, resulting in a sharp rise in both transit time and freight cost. These ships burn a million dollars worth of fuel per trip more than they would if they went via the Suez Canal.

The Suez Canal, a tiny strip of water that connects the Red Sea and the Meditteranean Sea, is a vital trade route. Some 19,000 ships— or one every half an hour — pass through the 193-km-long, man-made canal every year.

Interference in commercial shipping won’t be tolerated: Expert

The circuitous route, which adds about 6,000 nautical miles to a typical voyage from Asia to Europe, doubles the travel time to more than a fortnight. As ships spend more time sailing, their turnaround time is curtailed, and more of them are needed to be put into service. J Krishnan of S Natesa Iyer Logistics LLP, one of Chennai’s oldest custom house agents, reckons that a million TEUs (twenty foot equivalent) of additional shipping capacity would be needed.

Sources say that freight charges will double to more than $2,000 per TEU as shipping lines introduce a plethora of charges to defray the additional costs. These levies include various surcharges, including transit disruption surcharges and contingency charges ranging between $200 per twenty-foot equivalent unit and $1,500 per TEU for various destinations.

Double blow

Coming on the heels of a drought-induced disruption in container vessel movement through the Panama Canal, the Red Sea crisis is a double blow for global trade. The Panama Canal is another vital link for ships from Asia heading to the Eastern Coast of the United States and Europe.

India’s exports using the Red Sea include engineering goods, textiles, and tea, and its imports are electronics and minerals through the Red Sea and the Suez Canal.

The issue started when ships belonging to Mediterranean Shipping Company and Maersk were attacked by the Houthi militants, who are hitting out in order to avenge (what they see as) Israel’s excesses on Hamas. Soon, both lines announced diversion via Cape of Good Hope. Other shipping lines, including CMA CGM Group and Hapag Lloyd, followed suit. The Indian trade uses all these shipping lines to send their consignments.

Ramesh Rajah, President, Coffee Exporters Association of India, said Europe accounts for over 65 per cent of India’s coffee exports. In the short term, insurance rates may increase. Freight charges may go up, which will have an impact on costs.

Prakash Kalbavi, former President of the Mangaluru-based Karnataka Cashew Manufacturers’ Association, says for cargo to Europe and the US, there will be 15-20 additional days besides adding ocean freight and the travel of 3,200 additional nautical miles.

Indian export pricing to Europe will evolve and adjust to the importing country’s inflation. Close to 1 million tonne of wheat supply have come to a halt in the last one week. In this dynamic geopolitical situation, India is likely to emerge as an important player in strengthening the food security of the Middle East and North Africa region (MENA),” said S Chandrasekaran, a foreign trade policy expert.

(with inputs from AJ Vinayak, G Vishwanath Kulkarni and Prabhudatta Mishra)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.