India-targeted Mergers & Acquisitions (M&A) deal activity hit a 16-month high of $22.5 billion in August 2023, substantially higher than the deal value of $ 7.9 billion reported in same month last year, showed latest data from Refinitiv, an LSEG business.

M&A deal was also substantially higher than the deal value of $5.9 billion recorded in July 2023.

However, the number of M&A deals for the month under review declined to 90 as against 152 in August last year, the Refinitiv data showed.

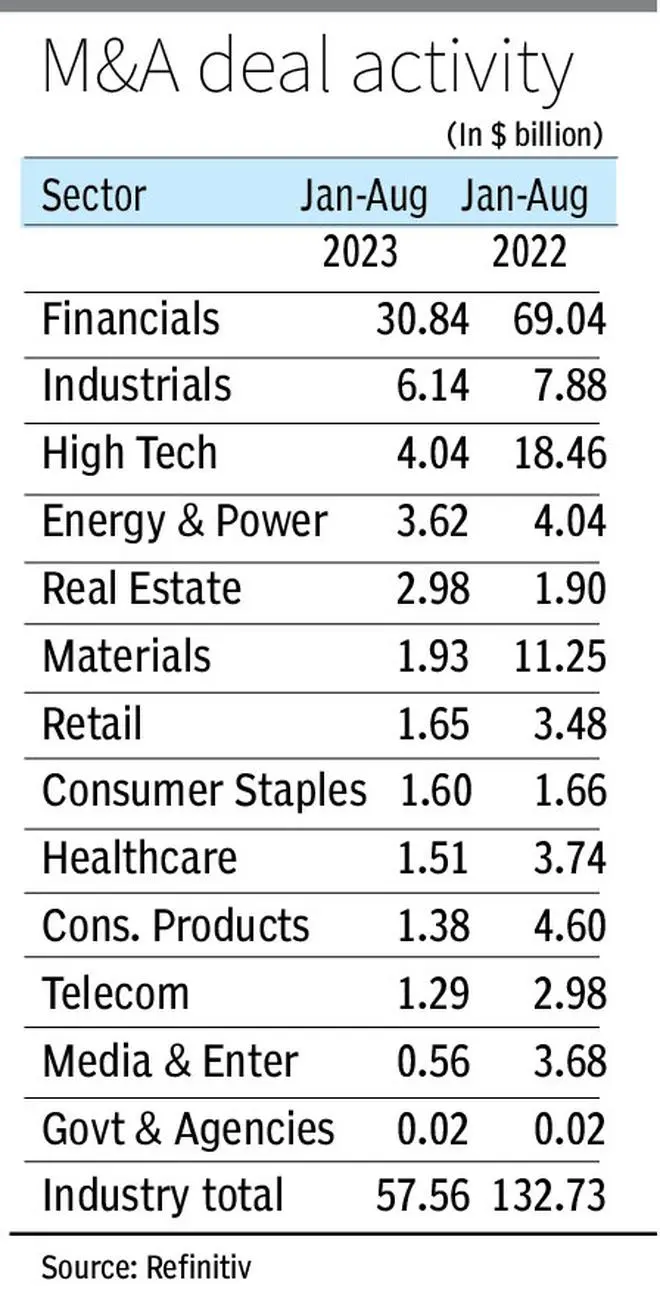

On an aggregate basis from January-August 2023, the India-involved M&A deal value stood at $ 55.6 billion, down 57 per cent over deal value of $ 132.74 billion in same period last year.

The number of deals for this eight month period stood at 1,527, nearly the same level of 1532 deals recorded in same period last year.

PE-backed M&As

In August this year, private equity-backed M&As (Indian target) stood at $540 million, lower than $1,715 million in same month last year. It was, however, higher than $ 397 million recorded in July 2023.

While M&A activity may not have been driven by mega deals this year, a healthier level of mid-market transactions dominated the market.

Sector wise, the financial sector continued to see lion’s share of deal activity at 54 per cent involving deal value of $30.84 billion in January-August 2023. In the same period last year, financials accounted for 52 per cent with India-target M&A deal activity of $69.4 billion.

The other leading sectors that saw robust M&A activity include Industrials ($61.41 billion); High Technology ($40.42 billion); Energy & Power ($36.20 billion) and Real Estate ($29.76 billion).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.