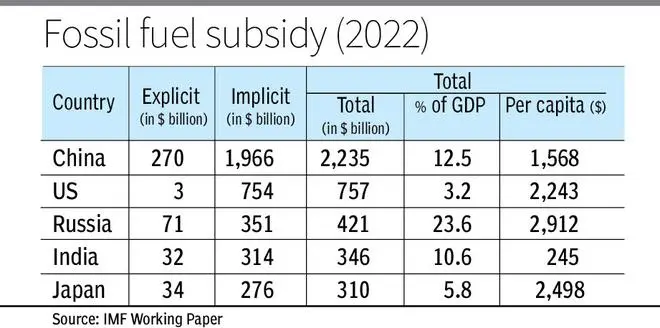

India ranks fourth among the top five nations in fossil fuel subsidies with around $350 billion (over ₹28-lakh crore), a working paper of International Monetary Fund (IMF) has said.

The paper, released on Wednesday, has listed China at the top, followed by the US and Russia. The European Union and Japan share the fifth spot. “Globally, total fossil fuel subsidies amounted to $7 trillion in 2022, equivalent to nearly 7.1 per cent of global GDP. Explicit subsidies account for 18 per cent of the total fossil fuel while implicit subsidies account for 82 per cent,” the paper said.

Here total subsidy means sum of explicit subsidies (undercharging for the supply costs of fossil fuels) and implicit subsidies (undercharging for environmental costs and forgone consumption tax revenues). The full gap between efficient prices (the sum of supply, environmental, and other costs) and retail prices multiplied by consumption equals the total fossil fuel subsidy.

In India, explicit or direct subsidy is given for domestic LPG under a scheme called ‘Ujjawala’ while some transport subsidy is also give to take various types of fuel to remote locations. The paper said sum of both implicit and explicit subsidy in India is estimated at $346 billion which is over 10 per cent of the GDP (gross domestic product).

- Also read: EU imported six times more fossil fuel from Russia than India since February 2022: EAM Jaishankar

Underpricing

Talking about the global bill, the paper said that underpricing for local air pollution and global warming account for nearly 60 percent of global fossil fuel subsidies and underpricing for supply costs and transportation externalities (such as congestion) explain another 35 per cent (the remainder is accounted for by forgone consumption tax revenue). By fuel product, undercharging for oil products accounts for nearly half the subsidy, coal another 30 per cent, and natural gas nearly 20 per cent (under-pricing for electricity accounts for the remainder).

Providing a blueprint to lower subsidy, the paper said fully reforming fossil fuel prices by removing explicit fuel subsidies and imposing corrective taxes such as a carbon tax would reduce global carbon dioxide (CO2) emissions by 43 percent below ‘business as usual’ levels in 2030 (34 per cent below 2019 levels). This would be in line with keeping global warming to ‘well below’ 2 degree Celsius and towards 1.5 degree Celsius.

Price reform

Full fuel price reform would also raise substantial revenues, worth about 3.6 per cent of global GDP. “These revenues could be used to cut more burdensome taxes such as on those labourr, help with debt sustainability, or fund productive investments, the paper said.

Further, fuel price reform would avert about 1.6 million pre-mature deaths per year from local air pollution by 2030. Reforming fossil fuel subsidies is in countries’ own interest, even when excluding climate benefits. For the average country, reforming fuel subsidies to the extent that they reduce CO2 by about 25 per cent below baseline levels in 2030 would raise net welfare (due to local environmental benefits and removing price distortions), before even counting global climate benefits.

“Globally, full price reform would generate net welfare benefits of about 3.6 per cent of GDP,” the paper said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.