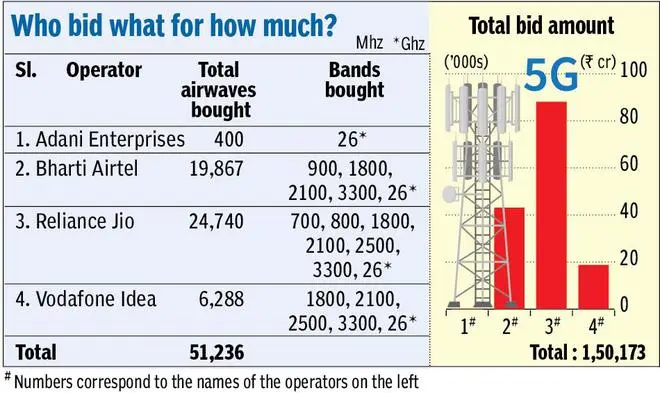

The 2022 spectrum auction concluded on Monday with the government fetching ₹1,50,173 crore from the seven-day long biddings that saw Mukesh Ambani-led Reliance Jio emerging as the highest bidder buying radiowaves worth ₹88,078 crore.

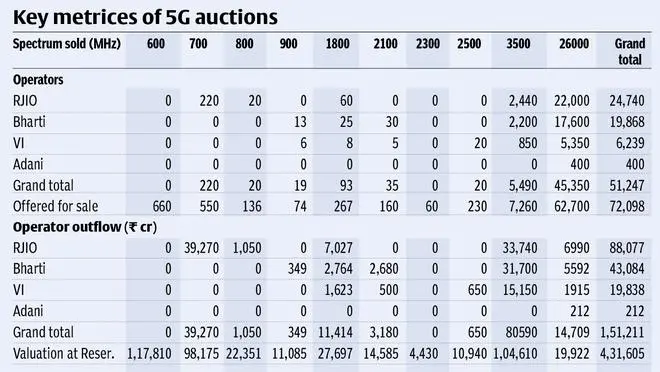

While Reliance Jio bought 24,740 MHz of spectrum in the 700 MHz, 800 MHz, 1800 MHz, 2100 MHz, 2500 MHz, 3300 MHz and 26 GHz bands, Sunil Mittal-owned Bharti Airtel emerged the second highest bidder with 19,867 MHz of spectrum across 900 MHz, 1800 MHz, 2100 MHz, 3300 MHz and 26 GHz bands, worth ₹43,084 crore.

Vodafone Idea bought spectrum worth ₹18,799 crore in 1800 MHz, 2100 MHz, 2500 MHz, 3300 MHz and 26 GHz with a total of 6,288 MHz airwaves and billionaire Gautam Adani — who entered the fray for the first time — bought 400 MHz of spectrum in 26 GHz band worth ₹212 crore across six States, including Andhra Pradesh, Gujarat, Karnataka, Maharashtra (Mumbai), Rajasthan and Tamil Nadu.

A total of 72 GHz (gigahertz) of radiowaves worth at least ₹4.3-lakh crore was put on the block for auction, of which 75 per cent were sold, the government informed. “If you compute the expected annual instalments, it is ₹13,365 crore put altogether to be paid by telecom service providers (TSPs) ... this will be the first instalment. Those who have lesser cost of capital might like to pay more upfront,” Telecom Minister Ashwini Vaishnaw told reporters here.

‘Uncertainty, risks removed’

He said the telecom industry is likely to see an investment of ₹2-3 lakh crore in the next two years as reforms by the government have removed uncertainty and risks, and provided a stable investment regime.

Barring the 1800 MHz band, for which Jio and Airtel engaged in fierce bidding, spectrum in all bands was sold at reserve (base) price, he noted. For instance, ₹39,270 crore in 700 MHz, ₹1,050 crore in 800 MHz, ₹349 crore in 900 MHz, ₹10,376 crore in 1800 MHz, ₹3,180 crore in 2100 MHz, ₹650 crore in 2500 MHz, ₹80,590 crore in 3300 MHz (mid band) and ₹14,709 crore in the 26GHz (millimetre band), were received he said. The mop-up from the 5G spectrum is almost double of ₹77,815 crore worth 4G airwaves sold last year and triple of ₹50,968.37 crore garnered from a 3G auction in 2010.

A new era

Explaining why the 600 MHz band was not sold, Vaishnaw explained there is not much ecosystem for that band right now and it is expected to attract bidders in the next 3-4 years.

According to analysts, the successful conclusion of the spectrum auction heralds a new era for the Indian telecom sector. “This is only the beginning of realising Prime Minister Narendra Modi’s vision of a $450-billion contribution of 5G technology to India’s economy. In the next 6-8 months, consumers will start experiencing 5G services firsthand — high-speed mobile broadband downloading content in seconds and seamlessly connecting through HD video calls. Access to immersive content will be a key proposition for consumers through virtual and augmented reality headsets/glasses,” Prashant Singhal, EY Global TMT Emerging Markets Leader said.

‘Deliberate strategy’

Gopal Vittal, Managing Director and CEO, Bharti Airtel, said the spectrum acquisition at the latest auction has been a part of a deliberate strategy to buy the best assets at a substantially lower relative cost compared to its competition. “This will allow us to raise the bar on innovation and address the emerging needs of every discerning customer who demands the best experience in India. We are confident that we will be able to deliver the best 5G experience in India in terms of coverage, speeds and latency. This will allow us to change a lot of established paradigms for both our B2C and B2B customers,” he said.

Similarly, Akash M Ambani, Chairman, Reliance Jio Infocomm, said India will become a leading economic power in the world by adopting the power of breakthrough technologies. “This was the vision and conviction that gave birth to Jio. The speed, scale and societal impact of Jio’s 4G rollout is unmatched anywhere in the world. Now, with a bigger ambition and stronger resolve, Jio is set to lead India’s march into the 5G era,” he added.

“We have successfully acquired mid band 5G spectrum (3300 MHz band) in our 17 priority circles and mmWave 5G spectrum (26 GHz band) in 16 circles, which will enable us to offer a superior 5G experience to our customers as well as strengthen our enterprise offerings and provide new opportunities for business growth in the emerging 5G era. We will continue to collaborate with enterprise customers and partners in prioritising and developing 5G use cases for real-world deployments,” Vodafone-Idea said in a statement.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.